Copyright © 2021 Kalkine Media Pty Ltd.

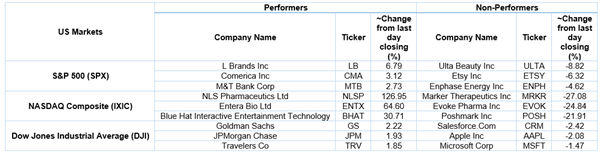

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 18.24 points or 0.46 per cent lower at 3,921.10, Dow Jones Industrial Average Index surged by 111.50 points or 0.34 per cent higher at 32,597.09, and the technology benchmark index Nasdaq Composite traded lower at 13,196.55, down by 202.13 points or 1.51 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in a mixed zone due to ongoing worries regarding rising long-term interest rates. Among the gaining stocks, shares of Novavax jumped by about 11.84% after the drug-maker said its Covid-19 vaccine was 96% effective. Funko shares went up by about 10.73% after the Company delivered robust fourth-quarter results. Among the declining stocks, DocuSign shares dropped by approximately 5.11% despite reporting better-than-expected fourth-quarter results. Tesla shares went down by about 2.74% after a fire in Fremont’s factory in California.

US Stocks Performance*

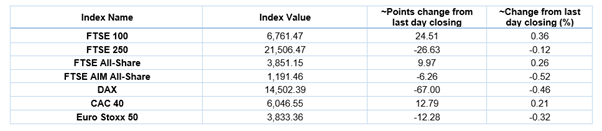

UK Market News: The London markets traded in a mixed zone after the release of the UK’s GDP data. FTSE 100 traded higher by around 0.24%, reflecting positive investor confidence regarding a lesser-than-expected drop in the GDP. The Office for National Statistics (ONS) reported a decline of 2.9% in the UK’s GDP during January 2021 as compared to December 2020. Moreover, ONS also reported the UK’S exports to the European Union plunged by 40.7% during January 2021.

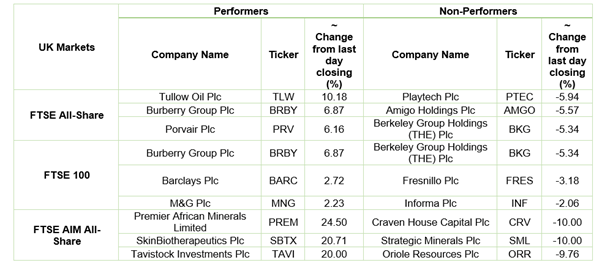

Luxury goods brand Burberry shares jumped by around 6.52% after the Company had lifted its full-year guidance and reported robust trading performance since December 2020. Moreover, the fourth-quarter comparable retail sales would be anticipated to illustrate a year-on-year growth ranging from 28% to 32%.

Housebuilder Berkeley Group had anticipated an annual pre-tax profit similar to the levels achieved during the last year based on robust trading performance for the four months period ended 28 February 2021. However, the shares dropped by around 5.29%.

Sportswear Retailer JD Sports Fashion shares went up by approximately 0.05% after it had agreed to acquire 60% of Poland-based Marketing Investing Group. Moreover, it would facilitate the Company to enter the central and eastern Europe markets.

Shopping centre owner Hammerson had reported a significant annual loss due to reduced rental income and a reduction in the value of its properties caused by the Covid-19 pandemic. Meanwhile, the shares went up by approximately 4.29%.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 12 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Consumer Non-Cyclicals (+0.49%), Financials (+0.39%) and Energy (+0.13%).

Top 3 Sectors traded in red*: Industrials (-0.62%), Real Estate (-0.52%) and Basic Materials (-0.47%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $69.32/barrel and $65.82/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,718.05 per ounce, down by 0.26% against the prior day closing.

Currency Rates*: GBP to USD: 1.3921; EUR to GBP: 0.8585.

Bond Yields*: US 10-Year Treasury yield: 1.630%; UK 10-Year Government Bond yield: 0.826%.

*At the time of writing

.jpg)