UK Market News: The UK stock market is trading in the positive territory, with blue-chip index FTSE 100 up by 0.19%, while the mid-cap focused FTSE 250 index up by 0.31% despite an increase in the UK’s energy crisis following a report of two more domestic energy suppliers going bust due to a rise in global energy prices. The UK’s energy sector witnessed the closure of around 25 suppliers since August 2021.

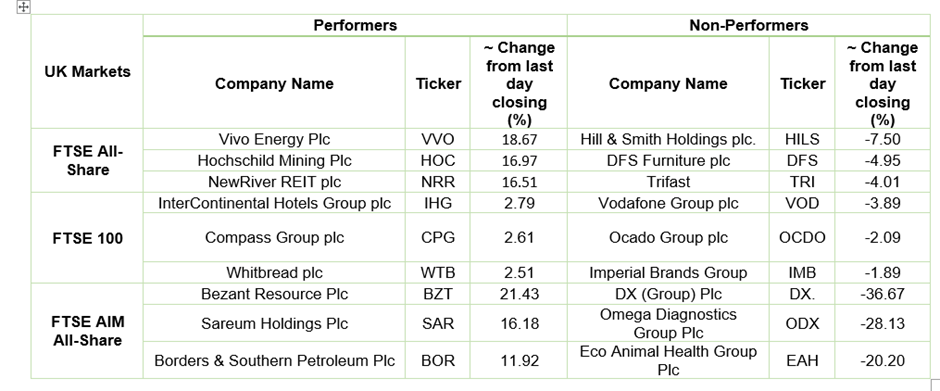

Vivo Energy Plc (LON: VVO): Shares of the oil retailing and marketing company was up by over 20% after it received the acquisition bid from its largest shareholder, the Vitol Group. The group has offered USD 1.85 per share in cash, including an interim and special dividend of USD 0.06.

Must Know Global Cues | ASX poised for Flat Opening

Hill & Smith Holdings Plc (LON: HILS): Shares of the infrastructure products and galvanising service provider was down by over 8% after announcing its business update for four months to 31 October 2021. The stock price was down despite reporting a 4% growth in revenue at £237.1 million.

Omega Diagnostics Group Plc (LON: ODX): Shares of the medical equipment company was down by over 30% after the announcement of its half-yearly result. The company reported an 81% growth in revenue to £5.73 million. However, its statutory loss for the period was £2.75 million.

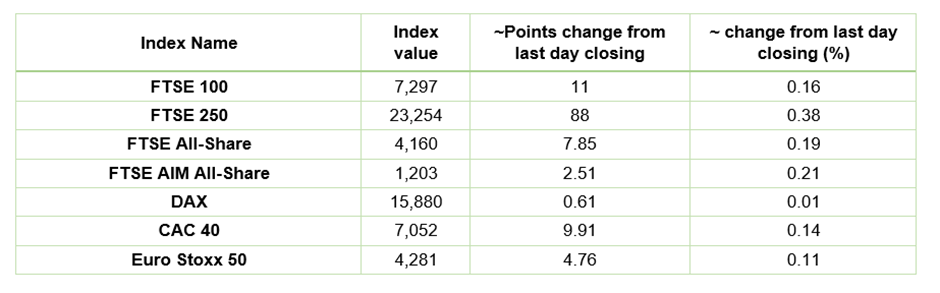

European Indices Performance (at the time of writing):

US Market: US stock market remains closed today on account of Thanksgiving.

FTSE 100 Index One Year Performance (as on 25 November 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Vodafone Plc (VOD), Lloyds Banking Group plc (LLOY), BP Plc (BP.)

Top 3 Sectors traded in green*: Utilities (0.84%), Real Estates (0.61%) and Industrials (0.51%).

Top 3 Sectors traded in red*: Technology (-1.42%), Basic Materials (0.67%), Energy (-0.58%),

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $82.10/barrel and $78.14/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,790 per ounce, up by 0.37% against the prior day closing.

Currency Rates*: GBP to USD: 1.3314; EUR to USD: 1.1219.

Bond Yields*: US 10-Year Treasury yield: 1.643%; UK 10-Year Government Bond yield: 0.9710%.

*At the time of writing