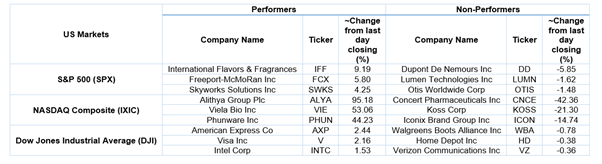

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 22.05 points or 0.59 per cent higher at 3,736.29, Dow Jones Industrial Average Index expanded by 81.59 points or 0.27 per cent higher at 30,064.21, and the technology benchmark index Nasdaq Composite traded higher at 13,201.38, up by 130.69 points or 1.00 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in the green territory due to positive investor sentiments regarding a spike in silver prices. Among the gaining stocks, shares of Viela Bio went up by 52.25% after it had received a lucrative offer from Horizon Therapeutics. Shares of Hecla Mining grew by 27.24% driven by an increase in silver prices. Shares of CureVac NV went up by 9.53% after it would get help from Bayer for its Covid-19 vaccine to boost the manufacturing capacity. Shares of Otis Worldwide Corp went up by 0.54% after it reported earnings and revenue ahead of estimates. Among the declining stocks, shares of Horizon Therapeutics went down by 1.08% after it announced a deal to buy Viela Bio.

US Stocks Performance*

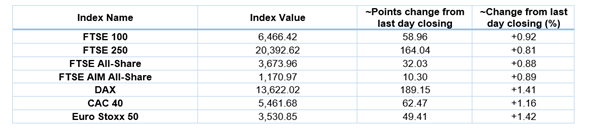

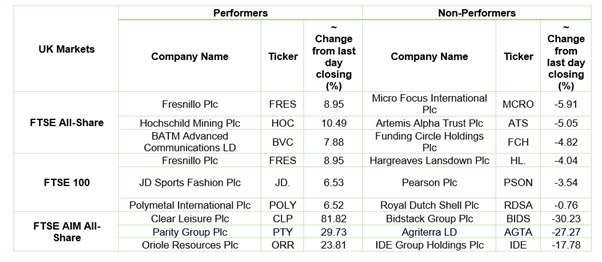

European News: The London and European markets traded in the green territory driven by the surge in silver prices and an encouraging UK Manufacturing PMI data. The IHS Markit UK Manufacturing Purchasing Managers’ Index (PMI) came out to be 54.1 in January 2021 compared to the forecasted figure of 52.9. Among the gaining stocks, Fresnillo shares jumped by 8.95% due to a spike in silver prices. Asos shares jumped by 7.06% after it confirmed the takeover of Topshop and Miss Selfridge. JD Sports Fashion shares jumped by 6.29% after it announced the acquisition of DTLR Villa. Among the decliners, Bidstack Group shares went down by 30.23% after it reported widening of losses. Seeing Machines shares went down by 8.10% although it reported an increase in revenue for the six months ended 31 December 2020. Hargreaves Lansdown shares dropped by 4.98% although it had raised the interim dividend.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 1 February 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Basic Materials (+2.82%), Consumer Cyclicals (+2.07%) and Industrials (+1.71%).

Top Sector traded in red*: Energy (-0.09%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $56.23/barrel and $53.35/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,869.30 per ounce, up by 1.03% against the prior day closing.

Currency Rates*: GBP to USD: 1.3680; EUR to GBP: 0.8823.

Bond Yields*: US 10-Year Treasury yield: 1.064%; UK 10-Year Government Bond yield: 0.321%.

*At the time of writing

.jpg)