US Markets: The three major stock averages of the United States started on the positive footing on Thursday, with the Dow Industrials gaining more than 1% in the wee hours of trading, Nasdaq Composite and broader share barometer S&P 500 adding moderately. Within the opening deals, the technology heavy Nasdaq Composite slipped into the negative territory as heavyweight tech shares cracked following the persisting weakness in the equity environment due to the Omicron variant of Covid-19 (SARS-CoV-2) virus.

Dow Jones managed to recover most of Wednesday’s losses, pared gains as the trading progressed after shares of the market capitalisation leader Apple crashed a little more than 4%. According to the Bloomberg news report, the demand for Apple’s iPhone 13 has been apparently slowing. The stock tumbled as much as 4.23% to an intraday bottom of $157.80 from the previous closing price of $164.77 apiece.

Global Markets see a steady movement

The emergence of Omicron variant in the United States has categorically unnerved the market participants as the concerned healthcare authorities and vaccine makers continue to contemplate the expanse of prospective damage due to the higher transmissibility of mutated strain.

Wall Street investors have partly factored in the uncertainty due to renewed Covid worries, any major disruption in domestic, or international travel, reintroduction of stern border control measures, reimposition of pandemic restrictions or mini lockdown to contain the spread of virus can explicitly disturb the market sentiments as the persisting challenges in the critical business functions has already dampened the expectations of higher-than-anticipated Q4 and full year earnings.

Major blue-chip corporations are set to reveal the present quarter number alongside the full year trading from the second week of January. Investors are trying to ascertain the prospective losses due to the arrival of the Omicron variant as vaccine makers are yet to report the level of effectiveness of existing vaccines on the individuals who have contracted the fresh strain.

The Dow Jones Industrial Average rose 458.48 points, or 1.35% to 34,480.52, the tech leader Nasdaq Composite added 17.95 points, or 0.12% to 15,272.00, whereas the wider share indicator S&P 500 advanced 40.32 points, or 0.89% to 4,553.36.

US Market News: Amidst the blue-chip components of Dow Industrials, shares of Visa emerged as the lead gainers with the stock appreciating nearly 4%, trying to offset the back-to-back losses in the last four sessions. The stock surged 3.89% to $197.56 from the previous close of $190.16 per share.

Other than Visa, shares of American Express, Salesforce.com, Boeing, JPMorgan Chase, Travelers Companies, Walt Disney, Chevron, Cisco Systems, Verizon, McDonald’s, Goldman Sachs, Coca-Cola, Nike and Walgreens Boots Alliance rose 1-3%, while, on the other hand, Apple led the losses. The stock of Apple was the biggest drag on the market index. Though the 30-stock average gained further as Apple stock diminished the losses. Shares of Merck & Co and UnitedHealth Group declined 0.40% to 0.80%.

UK Markets: UK Shares remained lacklustre on Thursday with the domestic benchmark FTSE 100 oscillating in the negative region throughout the day. The 101-components heavy market index partly recovered the losses in the terminal deals, led by the support from upbeat Wall Street.

The considerable upsurge in the heavyweight shares of Unilever, HSBC Holdings, Royal Dutch Shell, BP, Rio Tinto, BHP Group, Reckitt Benckiser and BT Group supported the index. On the contrary, the moderate-to-larger drops in the blue-chip components of Flutter Entertainment, Scottish Mortgage Investment Trust, Ashtead Group, Barclays, Lloyds Banking Group, London Stock Exchange Group, Prudential, National Grid, Glencore, British American Tobacco, GlaxoSmithKline and AstraZeneca counterbalanced the cumulative positive points, steering the index in red.

The headline FTSE 100 lost 26.09 points, or 0.36% to 7,142.59, as the market index grappled between the range of 7,083.21 and 7,168.68, in the intraday session. The losses on mid-cap heavy index FTSE 250 were larger as the 250-share average declined 186.34 points, or 0.81% to 22,726.39.

FTSE 100 (2 December)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, BP and Glencore

Top 3 sectoral indices: Consumer Services, Fossil Fuels and Personal Care

Bottom 3 sectoral indices: Automotive, Brokerage Services and Gas and Water

Crude oil prices: Brent crude up 1.74% at $70.07/barrel; US WTI crude up 1.86% at $66.79/barrel

Gold prices: An ounce of gold traded at $1,768.05, down 0.91%

Exchange rate: GBP vs USD - 1.3312, up 0.27% | GBP vs EUR - 1.1770, up 0.36%

Bond yields: US 10-Year Treasury yield - 1.446% | UK 10-Year Government Bond yield - 0.7975%

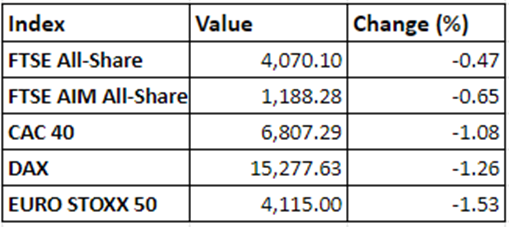

Markets @ 16:20 GMT