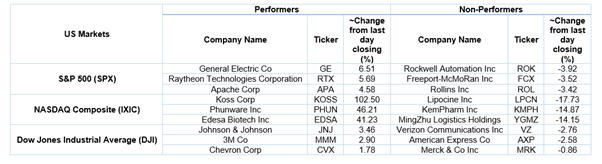

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 2.24 points or 0.06 per cent higher at 3,857.60, Dow Jones Industrial Average Index expanded by 90.38 points or 0.29 per cent higher at 31,050.38, and the technology benchmark index Nasdaq Composite traded lower at 13,630.13, down by 5.86 points or 0.04 per cent against the previous day close (at the time of writing, before the US market close at 10:00 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note driven by the strong investor sentiments regarding the busiest week of earnings season. The US Federal Housing Finance Agency (FHFA) had reported an increase of 1.0% in the Housing Price Index during November 2020 compared to the rise of 1.5% during October 2020. Among the gaining stocks, shares of Apollo Global Management went up by 4.25% after it said that the CEO would step down by 31 July 2021. Shares of Boot Barn Holdings went up by 3.5% after it had reported a 22% increase in the adjusted EPS during its third quarter. ETSY shares jumped about 0.10% after Elon Musk sent a tweet about the company. Among the declining stocks, shares of Crane went down by 4.91% after it had reported disappointing fourth-quarter results. Shares of Kimberly-Clark Corp went down by 1.05% although it had reported fourth-quarter earnings more than the expectations.

US Stocks Performance*

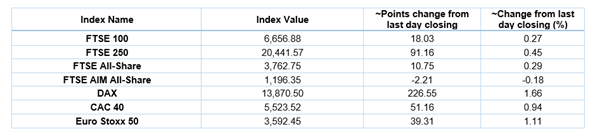

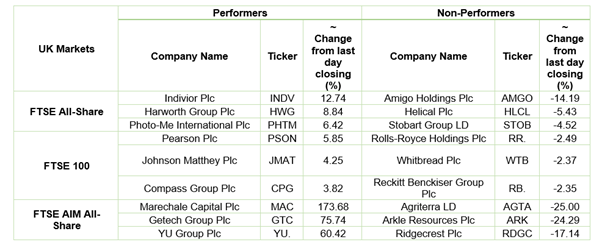

European News: The London and European markets traded in the green territory despite the release of disappointing UK Jobs data. The Office for National Statistics had reported an increase of 5.0% in the unemployment rate for the three months ended in November 2020 compared to an increase of 4.9% for the three months ended in October 2020. Among the gaining stocks, Indivior shares jumped by 12.74% after Reckitt Benckiser said that it had withdrawn a claim against the company. Abingdon Health shares grew by 5.88% after it provided a good trading update. Crest Nicholson Holdings shares went up by 2.29% after it reinstated the dividend payments. Among the decliners, JD Sports Fashion shares dropped by 2.52% after it confirmed of exploring additional funding options. Rolls-Royce Holdings shares went down by 2.41% after it had expected significant large amount of cash burn during the year. Shares of Whitbread had fallen the most on FTSE 100.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 26 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Rolls-Royce Holdings Plc (RR.); Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Financials (+0.77%), Real Estate (+0.76%) and Healthcare (+0.67%).

Top 3 Sectors traded in red*: Utilities (-0.63%), Consumer Non-Cyclicals (-0.55%) and Industrials ( -0.36%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $55.52/barrel and $52.48/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,852.05 per ounce, down by 0.17% against the prior day closing.

Currency Rates*: GBP to USD: 1.3732; EUR to GBP: 0.8856.

Bond Yields*: US 10-Year Treasury yield: 1.041%; UK 10-Year Government Bond yield: 0.264%.

*At the time of writing

.jpg)