Global Markets: Stocks in the United States were trading on a mixed note in the last trading day of this week, with the Dow Jones Industrial Average Index added 11.36 points or 0.04% and quoting at 26,373.61, the S&P 500 index dipped by 2.48 points or 0.08% to 2,922.10, and the Nasdaq Composite index decreased by 33.80 points or 0.42% to 7,939.60 respectively, at the time of writing.

Global News: Even as personal income gained by 0.6 per cent and wages grew by 0.2 per cent, consumer spending increased by 0.6 per cent in July, indicating a strong pace of consumption as households bought a range of goods and services. Core personal consumption was up by 1.6 per cent year on year, and it grew by 0.2 per cent against June. Easing worries about further damage the trade dispute between the largest economies, investors saw some signals that the United States and China will resume trade talks, helping stocks to open broadly higher on Friday, while Treasury yields edged higher.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 22.86 points or 0.32% higher at 7,207.18, the FTSE 250 index snapped 101.13 points or 0.52% higher at 19,393.63, and the FTSE All-Share Index ended 13.65 points or 0.35% higher at 3,953.02 respectively. Another European equity benchmark index STOXX 600 ended at 379.48, up by 2.74 points or 0.73 per cent.

European News: Next week when the British parliament will see a historic showdown initiated by the administration of Prime Minister Boris Johnson, anti-Brexiteers would seek to change the law to stop Britain from withdrawing from the EU without an exit deal or find the majority needed to topple the government. The Lloyds Bank Business Barometer, which signals confidence amongst British businesses and consumers, slid to its lowest level since December 2011 to 1 per cent in August from 13 per cent in July, driven lower by deepening pessimism about the economy. Mortgage lender Nationwide said on Friday that house prices rose in August at the fastest annual pace in three months while prices were flat on a monthly basis, suggesting market appears to have stabilised. As investors reduced some of their short bets against the British currency, the pound was set for its biggest monthly rise in five months as it edged higher versus the euro on Friday.

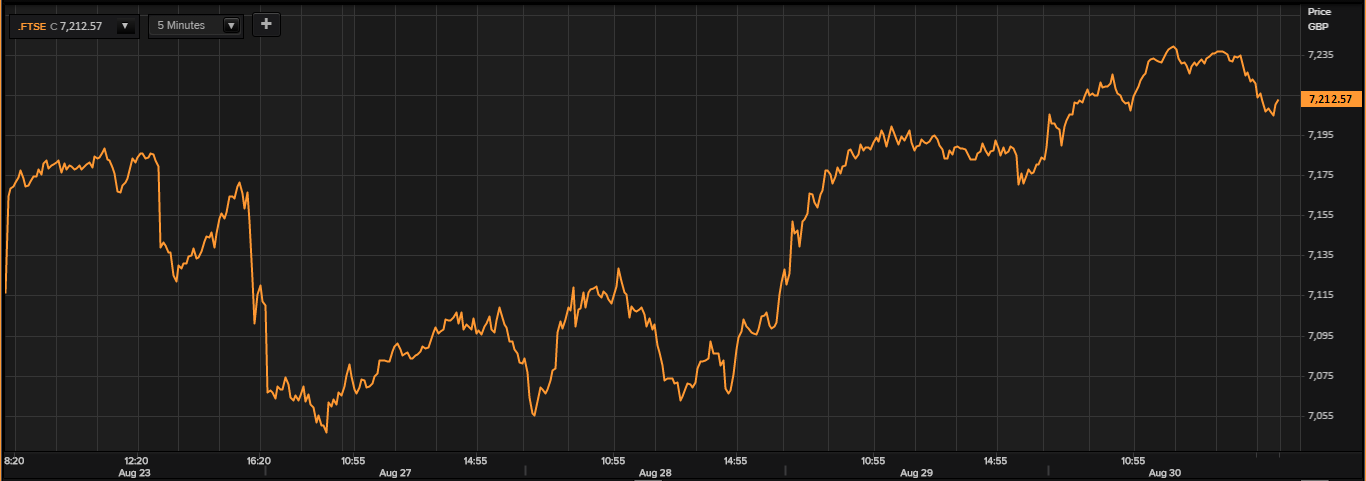

FTSE 100 Index

FTSE 100 Index Chart: 5-days Price Performance (as on August-30-2019), before the market closed. (Source: Thomson Reuters)

Performers*: NMC HEALTH PLC (NMC), MICRO FOCUS INTERNATIONAL PLC (MCRO), and RIO TINTO PLC (RIO) are the top three gainers in todayâs session and up by 6.7%%, 5.97% and 2.51% respectively.

Laggards*: SAINSBURY(J) PLC (SBRY), ROYAL DUTCH SHELL PLC 'B' (RDSB), and ROYAL DUTCH SHELL PLC 'A' (RDSA) are top laggards at the FTSE 100 index and down by 1.70%, 1.16% and 1.02% respectively.

Active by Volume*: LLOYDS BANKING GROUP PLC (LLOY), VODAFONE GROUP PLC(VOD), and HSBC HLDGS PLC (HSBA)

Top Performing Sectors*: Basic Materials (+1.93%), Technology (+1.35%), and Utilities (+1.19%).

Worst Performing Sectors*: Energy (-0.71%), and Healthcare (-0.11%).

Foreign Exchange and Fixed Income

FX Rates (at the time of writing): GBP/USD and EUR/GBP were trading at 1.2197 and 0.9044 respectively.

10-Year Bond Yields (at the time of writing): US 10Y Treasury and UK 10Y Bond yields were exchanging at 1.510% and 0.460% respectively.

*At the time of writing