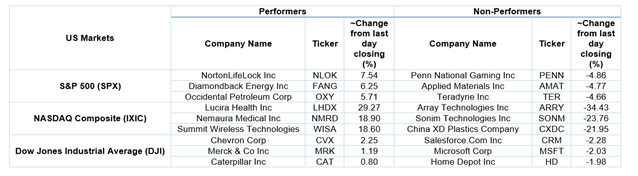

US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 47.98 points or 1.16 per cent lower at 4,104.12, Dow Jones Industrial Average Index dipped by 293.17 points or 0.86 per cent lower at 33,975.99, and the technology benchmark index Nasdaq Composite traded lower at 13,128.36, down by 261.06 points or 1.95 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a red zone after the release of the U.S. inflation data. US CPI surged to 4.2% on an yearly basis and breached 13-year high point. Among the gaining stocks, Biomerica (BMRA) shares jumped by around 12.61% after the Company updated that the COVID-19 antigen rapid test can be performed with a nasal swab. Upstart Holdings (UPST) shares went up by about 7.32% after the Company had reported better-than-expected results for the first quarter. Among the declining stocks, Paysign (PAYS) shares plunged by about 13.21% after the Company had reported weaker first-quarter results. Axonics (AXNX) shares went down by about 3.19% after the Company had priced its public offerings worth USD 150 million.

US Stocks Performance*

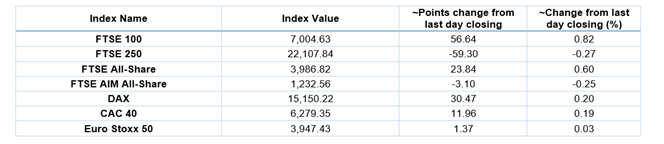

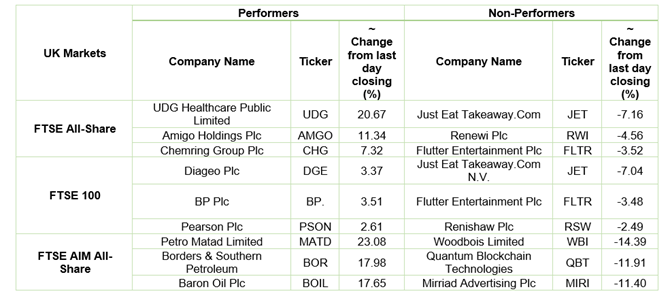

UK Market News: The London markets traded in a green zone as investors mulled the latest UK GDP data. The UK GDP had shown a decline of around 1.50% in the first quarter of 2021 as compared to an increase of 1.3% during the equivalent period of 2020. Moreover, the Office for National Statistics had reported an increase of 1.8% in industrial production during March 2021 on a monthly basis.

UDG Healthcare shares surged by about 20.67% after the Company had agreed to the lucrative takeover bid worth around 2.61 billion pounds from the US private equity giant Clayton, Dubilier & Rice.

FTSE 100 listed Compass Group had shown a substantial drop in the top-line and the bottom-line business during the first half of FY21. However, the Company expected gradual recovery during Q3 FY21. Moreover, the shares went down by around 0.56%.

Drinks maker Diageo shares climbed by around 3.29% after the Company had started a 4.5 billion pounds plan to return capital to the shareholders after witnessing significant recovery during the second half of the financial year.

Landscape products Company Marshalls had expected full-year trading to remain ahead of the previous expectations due to increased demand. Furthermore, the shares jumped by around 1.25%.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 12 May 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); BP Plc (BP.).

Top 3 Sectors traded in green*: Energy (+2.80%), Consumer Non-Cyclicals (+1.73%) and Healthcare (+1.47%).

Top 3 Sectors traded in red*: Technology (-0.39%), Consumer Cyclicals (-0.14%) and Real Estate (-0.05%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $69.53/barrel and $66.28/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,821.65per ounce, down by 0.79% against the prior day closing.

Currency Rates*: GBP to USD: 1.4062; EUR to GBP: 0.8589.

Bond Yields*: US 10-Year Treasury yield: 1.688%; UK 10-Year Government Bond yield: 0.8920%.

*At the time of writing