GA, UNITED STATES, January 9, 2025 /EINPresswire.com/ -- A U.S.-based research team has unveiled how deep learning models can accurately predict Bitcoin price movements while implementing innovative trading strategies to generate staggering returns. Their study found that a model combining Boruta feature selection and convolutional neural network–long short-term memory (CNN–LSTM) networks achieved an impressive 82.44% prediction accuracy, with a backtested "long-short trading strategy" delivering an annualized return of 6654%. These findings could revolutionize how investors approach the cryptocurrency market.

A study (DOI: 10.1186/s40854-024-00643-1) conducted by researchers from Missouri University of Science and Technology, USA, published in Financial Innovation on August 5, 2024, presents an approach that leverages deep learning and on-chain data to predict Bitcoin price direction. “Our model equips investors with a robust mechanism to navigate the uncertainties and volatility of this highly dynamic market,” the research team remarked.

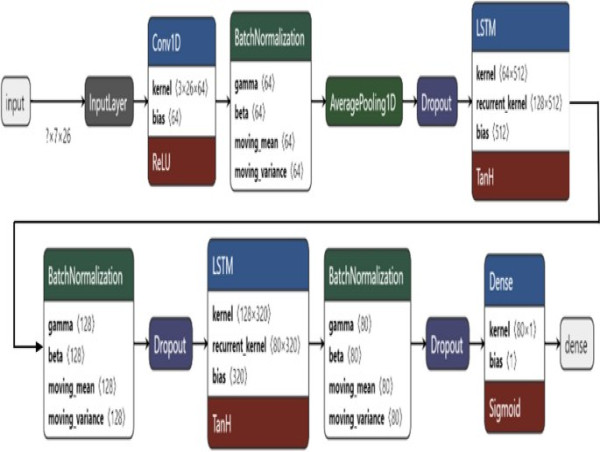

The study began by analyzing 87 on-chain metrics, utilizing advanced algorithms like Boruta to isolate the most influential features, effectively mitigating the risk of "data overload." Following this, the researchers compared the performance of multiple deep learning models, including convolutional neural network–long short-term memory (CNN–LSTM), long- and short-term time-series network (LSTNet), and temporal convolutional network (TCN). Among these, the Boruta-based CNN–LSTM model emerged as the top performer.

The true highlight of this research lies in its practical application. The researchers devised a "long-short trading strategy" that not only capitalizes on bullish trends but also adjusts quickly during bearish periods. This strategy yielded an astonishing annualized return of 6654% in backtests, outperforming traditional methods by a wide margin.

"The integration of on-chain data with cutting-edge machine learning is a game-changer," said David Enke, co-author of the study. "On-chain data not only enhances transparency in the Bitcoin market, but provides additional data points and information that is not often available when modeling the prices of other traded assets."

Despite its promising results, the study acknowledges limitations, including the exclusion of sentiment data and technical indicators. The researchers suggest that future studies expand the model’s scope to include broader data sets and evaluate its performance under varying market conditions.

Whether you're a seasoned investor or new to Bitcoin, this research challenges traditional market perceptions. From accurate predictions to unprecedented returns, it represents both a triumph of technology and an exploration of bold new possibilities in cryptocurrency trading.

DOI

10.1186/s40854-024-00643-1

Original Source URL

https://doi.org/10.1186/s40854-024-00643-1

Lucy Wang

BioDesign Research

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()