Advancements in exosome research have largely stemmed from innovations in production techniques. Traditional 2D cell culture methods are being replaced by more efficient alternatives such as hollow fiber bioreactors, which significantly boost exosome yield. Furthermore, the development of engineered exosomes tailored for specific therapeutic purposes is advancing rapidly, particularly in fields like cancer therapy and regenerative medicine. These engineered exosomes offer targeted delivery capabilities and reduced immunogenicity, underscoring their potential in next-generation therapeutic solutions.

The increasing volume of scientific publications and patents underscores the growing interest and progress in exosome research, especially regarding their applications in drug delivery and diagnostics. This surge is supported by considerable funding from entities like the National Institutes of Health, reflecting the promising outlook for exosome-based therapies. Additionally, exosomes are gaining recognition for their diagnostic capabilities, where they are utilized to detect and monitor diseases thanks to the stability and specificity of their cargo. This positions exosomes as a versatile tool in cellular therapy, poised to transform diagnostic and therapeutic approaches in healthcare.

Get Sample PDF Report: https://market.us/report/exosomes-market/request-sample/

Key Takeaway

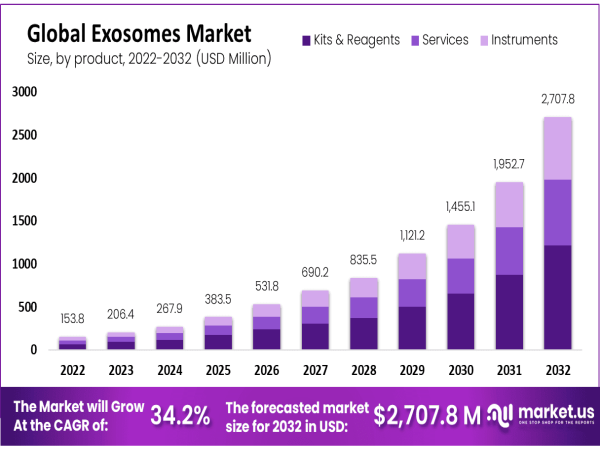

• In 2022, the Kits & Reagents segment led in revenue, capturing a market share of 44.82%.

• The downstream workflow category dominated, contributing 58.46% to the global revenue in 2022.

• Cancer was the most significant revenue generator among segments, securing a 31.88% share in 2022.

• Pharmaceutical and biotechnology companies were the top contributors, holding a 49.42% market share in 2022.

• North America was the leading region, with the highest revenue share of 55.49% in 2022.

• Europe is expected to experience substantial growth, with a strong projected CAGR from 2023 to 2032.

Segmentation Analysis

In 2022, the Exosomes Market was predominantly driven by the kits & reagents segment, capturing a substantial 44.82% revenue share. This segment benefits from the continuous release of innovative products, like Clara Biotech's ExoRelease Starter Kit, introduced in May 2022 for efficient exosome isolation. These advancements facilitate the exploration of new biomarkers and enhance exosome-based diagnostic and therapeutic applications, setting the stage for significant growth in the coming years.

The services segment within the Exosomes Market is projected to expand swiftly over the forecast period. The complex and meticulous process of exosome isolation has spurred the development of specialized services, such as those offered by AMSBIO, which includes exosome quantification and miRNA sequencing. This breadth of services caters to diverse research needs, driving the growth of this segment.

The downstream analysis segment led the Exosomes Market in 2022 with a revenue share of 58.46%. This segment involves sophisticated techniques for exosome detection and analysis, employing methods like mass spectrometry and RNA sequencing. Innovations such as the System Biosciences Exo-ELISA Ultra Method, which quantifies exosomes in just four hours, underscore the segment’s capacity for high efficiency and are expected to contribute to its continued dominance.

Among the applications, the cancer segment held the highest revenue share at 31.88% in 2022, reflecting the significant potential of exosomes in cancer diagnosis, prognosis, and treatment. The role of exosomes in transporting therapeutic molecules and acting as biomarkers is gaining traction. Meanwhile, pharmaceutical and biotechnology companies, as the leading end-users, accounted for 49.42% of the market share, driven by heightened demand for exosome-based therapeutic solutions and extensive collaborative efforts to upscale production.

Based on Product

• Kits & Reagents

• Instruments

• Services

Based on Workflow

• Isolation Methods

○ Ultracentrifugation

○ Immunocapture on Beads

○ Precipitation

○ Filtration

○ Other Isolation Methods

• Downstream Analysis

○ Cell Surface Marker Analysis Using Flow Cytometry

○ Protein Analysis Using Blotting & ELISA

○ RNA Analysis with NGS & PCR

○ Proteomic Analysis Using Mass Spectroscopy

○ Other Downstream Analysis

Based on Application

• Cancer

• Neurodegenerative Diseases

• Cardiovascular Diseases

• Infectious Diseases

• Other Applications

Based on End-User

• Pharmaceutical & Biotechnology Companies

• Hospitals & Diagnostics Centers

• Academic & Research institutes

• Other End-Users

Regional Analysis

North America remains the dominant force in the global exosomes market, capturing a significant revenue share of 55.49% in 2022. This leadership position is primarily attributed to robust government funding aimed at discovering new biomarkers. Additionally, the region sees a high incidence of chronic diseases such as cancer and cardiovascular disorders, further fueling market growth.

The exosomes market in North America is also benefiting from extensive research and development activities. These efforts are focused on innovating new drugs, diagnostic methods, and treatment options, which are expected to sustain market growth during the forecast period.

Turning to Europe, this region is poised for rapid expansion within the exosomes market. Growth is driven by increased collaboration between government bodies and private sectors, enhancing the region's development prospects.

Specifically, the German Society for Extracellular Vesicles exemplifies such initiatives. This network of exosome experts promotes interdisciplinary research and supports emerging scholars in the field. Activities like these are vital in fostering the long-term potential of Europe's exosomes market.

Buy Directly: https://market.us/purchase-report/?report_id=100981

Market Players Analysis

The cell and exosome therapy sector is experiencing significant growth, fueled by strategic collaborations among industry leaders. A notable example is the partnership between FUJIFILM Diosynth Biotechnologies and RoosterBio, initiated in October 2022. This alliance aims to enhance the GMP-compliant manufacturing capabilities for exosome and cell therapies, addressing the rising demand for advanced therapeutic solutions.

Key players in the market, such as Danaher Corp., Hologic Inc., and Fujifilm Holdings Corp., are pivotal in driving technological advancements and expansion. Their efforts are complemented by specialized companies like Lonza and Miltenyi Biotec, which focus on biotechnology innovations and cellular therapy enhancements.

Additional significant contributors include Bio-Techne Corp., QIAGEN, and Thermo Fisher Scientific, Inc. These companies are renowned for their roles in developing and supplying necessary technologies and products that support the growth of cell therapies. Their contributions are critical for advancing research and clinical applications.

Emerging companies like Abcam plc and RoosterBio, Inc. also play vital roles in the market dynamics. Alongside these key players, other market participants are continuously innovating and collaborating to meet the evolving needs of the biotechnology and pharmaceutical industries, ensuring a competitive and vibrant market landscape.

The Primary Entities Identified In This Report Are:

• Danaher Corp.

• Hologic Inc.

• Fujifilm Holdings Corp.

• Lonza

• Miltenyi Biotec

• Bio-Techne Corp.

• QIAGEN

• Thermo Fisher Scientific Inc.

• Abcam plc

• RoosterBio Inc.

• Other Market Players

*We offer customized market research reports tailored to meet your specific business needs and requirements.

Lawrence John

Prudour

+91 91308 55334

[email protected]

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()