Summary

- Uncertainty surrounding the control of the second wave makes it difficult to predict when the British economy will get back on track: OBR

- Massive public debt of the UK is more sensitive to any interest rate shocks than ever before

- A 3-tier local lockdown system is under consideration for England, announcement likely on 12 October

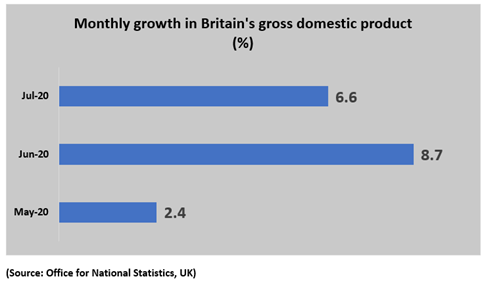

The UK economy had started to recuperate from a recession after contracting during H1 2020, as various industries could reopen after the coronavirus-led lockdown (GDP growth for July 2020: 6.6 per cent). However, the UK treasury officials have warned that this recovery might not be sustainable due to the outbreak of a second wave of Covid-19 cases along with tougher government restrictions in place across different parts of the country.

Charlie Bean, member, UK Office for Budget Responsibility (OBR), said that the rapid bounce back observed post May has stopped with the beginning of September 2020 due to a sharp upsurge in infections.

Bean added that this scenario is expected to put the nation’s economic recovery on a hold for some time at least, due to the precautionary sluggish pace of social and business activities.

He added that it is tough to predict the length and depth of this flattening growth at this point in time. It will mainly be dependent on the effectiveness of tighter restrictions in bring down the Covid-19 infection rate.

Rishi Sunak, Chancellor, UK Treasury has requested the OBR to prepare new estimates for the British economy and public finances. They will be published by the latter half of November 2020.

Bean emphasised that the government’s first priority remained controlling the devastating coronavirus pandemic. Bringing down the rising budget deficit comes only as a second most important goal. However, once the infections are under check, government finances will definitely need to be stabilised, he pointed out.

Why is OBR’s view vital?

OBR provides an independent analysis of the country’s government finances; hence its opinion is critical. The fiscal watchdog was formulated in the year 2010. It generates official projections that are used to formulate Budget and summer/winter statements, without making any policy recommendations. Brexit and government’s oscillating stance towards virus have been making coordination between forecasts and economic policy process increasingly difficult, according to Robert Chote, past chair, OBR.

Ballooning national debt

The national debt of the UK government has risen beyond £2 trillion as the public expenditure continued to swell after March 2020, when the coronavirus pandemic broke out. High spending on one hand and low revenue collections on the other led to a sharp upsurge in the public borrowings of the British government.

Richard Hughes, chair, OBR said that the soaring public debt has made the nation more vulnerable to any changes in the interest rates, despite the ongoing all-time low bank rate of 0.1 per cent. Hughes remarked that in case there is any increase in the rates of interest prevailing in the international bond market, it will push up Britain’s loan interest charges substantially, given the huge size of the national debt.

Covid-19 cases

The number of daily cases is rapidly rising across the nation, especially since the beginning of September 2020. On 7 October, the day’s reported cases were 14162, which had doubled from the earlier week, according to government data. Going further back in time, a month back on 7 September the daily figure was less than one third at 3863 cases. Yet another month back the daily infection number was reported to be 943.

The total number of coronavirus infected cases stood at more than 0.5 million across the country, bringing the total death count to 57,000 plus till now.

Scottish government recently imposed a two-week lockdown along with a £40 million aid to support the region’s businesses. All restaurants and pubs in central Scotland were instructed to be completely shut down beginning 9 October 2020 while these venues would be open across rest of Scotland with a daily closure time of 6 PM in the evening.

Media reports cite that Boris Johnson is under pressure to impose similar tighter restrictions across the entire nation to control the pandemic.

Sources revealed that pubs and restaurants could be closed at high-infection areas in England beginning Monday, 12 October 2020. Overnight stays might also be banned at selected places. A 3-tier system of local lockdowns ( to be named the Local Covid Alert Level) is also under consideration which will be based on the level of prevalent infection rate in that area and would have tightest restrictions in highly infected locations. In all probability, schools shall remain open.

The cases are rising faster across north east and north west regions as compared to the rest of England, as per the latest government statistics.

Finally, no doubt it is a complicated scenario to be tackle by the UK government. Its first priority is to check the rise in infections at any cost. However, it wants to avoid a nation-wide lockdown, given the earlier experience of entering economic recession. Department of health is rightly concerned about the spike in Covid-19 cases and deaths. People with other ailments are also not able to get proper treatment. Such unforeseen circumstances have led to uncertainty with respect to the recovery of the national economic output, as rightly pointed out by the OBR.