Highlights

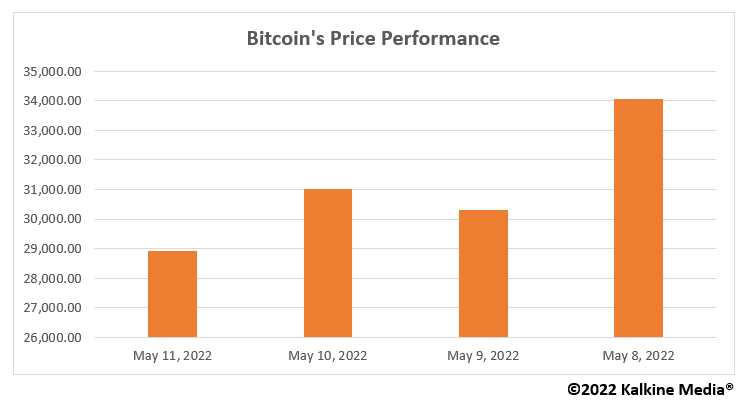

- On Thursday morning, the Bitcoin price was down to US$ 27,152.5 per token as of writing.

- The crypto market cap declined by 18.4 per cent over the previous day at the time of writing.

- Some analysts believe that the market's dip could worsen, but it is too early to predict that the crypto market is dead.

Volatility has always been an issue in the cryptocurrency market. However, it is devastating these days as extreme volatility incurs massive losses to investors worldwide. Each day seems to be the worst for crypto holders, and we don't even know how many more surprises will come in the coming days.

Also Read: Zilliqa (ZIL) crypto soars amid a rising market. Here's why

After staying at US$ 1.42 trillion on May 11, a massive crash came in the crypto market, and the global crypto market cap fell to US$ 1.16 trillion, as per CoinMarketCap data.

The crypto market cap declined by 18.4 per cent over the previous day, and the prices of almost all the major cryptocurrencies dipped to their lowest prices since late 2020.

On Thursday morning, the Bitcoin price was down to US$ 27,152.5 per token at the time of writing and Ethereum (ETH) was down to US$ 1,853.34 apiece.

Is the crypto market dead?

The slump in the cryptocurrency market is worrying and has caused monumental losses to crypto traders worldwide. Some analysts believe that the market's dip could worsen, but it is too early to predict that the crypto market is dead.

This is not the first time we have seen the market decline rapidly. At least there have been four major crashes of Bitcoin in the last 7 to 8 years, and each time the market has bounced back.

Whenever there's a massive dip in the market, it sends investors into a panic mode and critics of the decentralized currency start believing that the crypto market is dead.

Also Read: Bitcoin SV (BSV) crypto records surge in price and volume. What's next?

Due to the dip in the prices of cryptocurrencies, many holders have started selling their assets to limit the damage, and some are yet to pull the trigger.

Seeing the present situation, it appears that people should consider rebalancing their portfolios. Also, coins with the long-term value could be given preference over short-term value cryptocurrencies.

Bottom line

The crypto market had a stellar run over the past few years, but in 2022 it has remained weak. Earlier, due to fears of an outbreak of the omicron variant and later the Ukraine and Russia war contributed to an increase in the market volatility.

Recession fears have increased after the US Federal Reserve hiked interest rates, which appears to have significantly affected the crypto market.

Many people believed that Bitcoin and altcoins could be a hedge against inflation. However, the latest crash suggests otherwise.

Also Read: ANKR crypto price is down and volume is up 18%. What's next for Ankr?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.