Summary

- Brent crude is hovering around US$60 per barrel after one year, amid production cut by OPEC+ and rising demand.

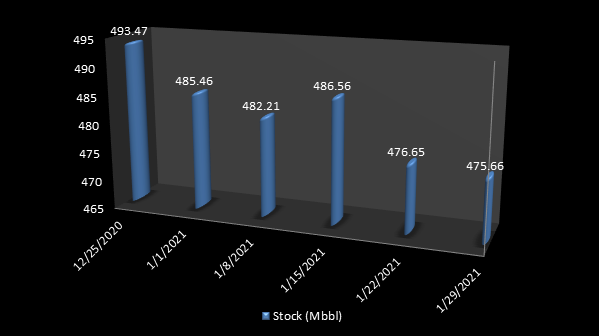

- US stockpile has been on the wane since December 2020, giving positive signals for crude oil price rise to continue in the coming weeks.

The latest Energy Information Administration (EIA) report with crude oil stockpile data has sparked celebrations across the oil industry. The trend in the weekly inventory data has highlighted a drawdown in the levels. Connecting the dots between the US stockpile and the price of crude oil is no rocket science.

The price of benchmark crude brent is hovering around US$60/bbl.

U.S Weekly stockpile data (Data Source: EIA)

The oil industry was in turmoil before the beginning of the pandemic. The race between Saudi Arabia and Russia to capture a bigger market share during 2019-20 flooded the market with crude oil. Many OPEC countries ran out of space to store the extra crude produced in order to maintain their market position amid the clash of the two major oil producers.

As the entire industry was waiting for a truce between Saudi Arabia and Russia, it was hit hard by the pandemic-induced measures.

Recently, there were speculations that the CEOs of two major oil companies- ExxonMobil and Chevron discussed a possible merger to cope up with the low-price regime of crude oil. However, the talks were in the preliminary phase could not reach the conclusive stage.

Copyright © 2021 Kalkine Media Pty Ltd.

The news of a possible merger between two oil giants goes on to prove the popular adage – “desperate time needs desperate measures”. Significantly, these two companies are among the top producers of crude oil with assets in several countries. ExxonMobil reported first-ever annual loss in 2020, reaching US$22.4 billion for the period.

More on the news: Will tough times force oil majors ExxonMobil and Chevron into a merger?

ExxonMobil registered a loss of US$20.1 billion for the December 2020 quarter. The Company reported exploration expenditure of US$21.4 billion for the year 2020, US$9.8 billion lower than the year 2019.

Another global oil & gas major Shell reported a loss of US$4.01 billion for Q4 of 2020 and an annual loss of US$21.68 billion. Its expenditure on exploration for the year 2020 stood at US$1.747 billion, US$0.607 billion lower when compared to the previous year.

The decline in exploration expenditure by major oil & gas companies indicates a strategy change. In the era of lower crude oil prices, the companies are focussing more on their existing projects rather than going for new uncertain projects. They are reducing their exposure on a number of projects and trying to maximise production from the existing ones.

OPEC+ group Ups The Ante to Boost Crude Prices

In the first week of January, Saudi Arabia surprised the world by announcing a production cut of one million barrels of oil per day through the next meeting of the cartel. The member countries, including Saudi Arabia had already achieved their target of production cut of 10 million barrels of oil per day since the COVID-19 situation turned into a pandemic.

Copyright © 2021 Kalkine Media Pty Ltd.

Iraq also recently announced a production cut of 25,000 bbl/day, depending on the government of Kurdistan following the same suit. Iraq did not abide by production cut decision earlier, citing its dismal economic condition and huge dependency on crude oil.

Read More: After Saudi Arabia, Iraq pitches in with Crude Oil production cut

Joe Biden’s Push for Green Energy

One of the first executive orders of Joe Biden as the US President was to include the world’s largest economy in the Paris Climate Agreement. He has blocked or scrapped several oil & gas projects. There is a possibility that we can witness zero fracking in the US and no new oil & gas projects in Alaska.

If fracking is banned or limited, it will impact shale oil production, and the US will again depend on huge crude imports.

Any decision on fracking will significantly affect the crude oil demand and push the prices accordingly.

.jpg)