ASX nickel stocks rally as underlying commodity clinches 52-week high

Nickel futures prices are edging higher on the London Metal Exchange over firm demand from alloy makers for the underlying commodity, leading to a gush in ASX-listed nickel stocks.

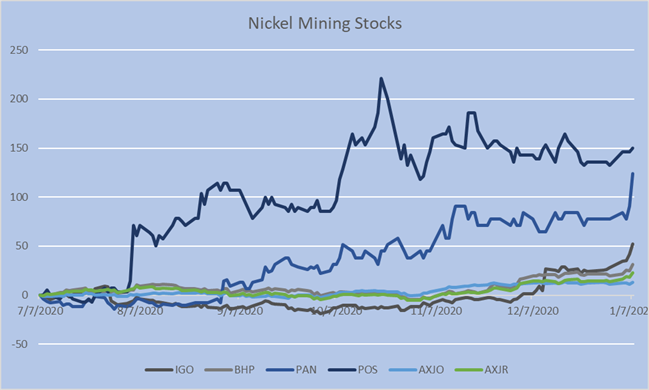

Many listed stocks have performed relatively well over the last six months with total returns far exceeding many major stock indices and the overall resource sector.

Nickel Stocks Outperforming Benchmarks

Nickel Miners Return Against ASX Benchmarks (Data Source: Refinitiv Eikon Thomson Reuters)

Over the last six-month many ASX-listed nickel stocks have performed extremely well against the benchmark ASX 200 and ASX 200 Resources. Stocks such as Poseidon Nickel Limited (ASX:POS), Panoramic Resources Limited (ASX:PAN), have delivered returns as high as 150 and 123.68 per cent, respectively.

Nickel Futures Rallies Over Firm Spot Demand

The futures reached close to its previous top of USD 18,620 per tonne (February 2019) while jolting a 52-week high of USD 17,796 per tonne on 6 January 2020.

Many industry experts anticipate that after witnessing a contraction in consumption over COVID-19 related slowdown on the global front, nickel demand might be strong going forward as economies pick up activity and nickel demand from battery market gets steam.

With nickel prices recovering to multi-period highs, ASX-listed miners are coming out of slumber, leading to a production surge across the continent to lock-in trades and boost the balance sheet and periodic earnings.

Nickel earnings reached $3.8 billion in 2019-20 over high volumes during the period amidst high prices, and as per the estimation of the Department of Industry, Innovation and Science (DIIS), it is poised to mark an increase of ~ 15.78 per cent to stand at $4.4 billion in 2021-2022.

Furthermore, the higher earnings are anticipated to be primarily driven by higher volumes in line with the increase in demand with production across the continent forecasted to increase from 161,000 tonnes (2019-2020) to 213,000 tonnes in 2021-2022.

ASX-listed Nickel Mining Stocks and Operations

Over the surge in nickel prices, many operations would now be coming out of hibernation to take the price advantage whilst supporting the new output.

Image Source: © Kalkine Group 2020

For example, Savannah mine of Panoramic Resources Limited (ASX:PAN), closed in April 2020 would come back online during the first-half of the year 2021, as inferred from the recently updated mine plan.

Also, Poseidon Nickel Limited’s (ASX:POS) Black Swan mine is being prepared for a restart. It was closed since 2009.

Apart from that some existing operations across the continent are anticipated to come either online or expand further. For example, Kambalda operations of Mincor Resources NL (ASX:MCR) is planned for production in 2021. Likewise, BHP Group Limited’s (ASX:BHP) Nickel West operations likely to continue its expansion.