Summary

- The ASX top gold gunners Northern Star Resources Limited (ASX:NST) and Saracen Mineral Holdings Limited (ASX:SAR) are looking for a merger, capturing the eye of the global investing community.

- Both the miners have agreed to the merger via a Saracen Scheme of Arrangement under which NST would acquire all of the currently outstanding shares of SAR, unlocking $1.5 to $2.0 billion in synergies.

- NST witnessed a rally of ~ 10.85 per cent against its previous close on ASX while SAR gained ~ 9.49 per cent against its previous closing price on the exchange, post the announcement.

- The proposed scheme would place the merged entity as one of the top ten global gold miners.

The ASX top two beneficiaries of the recent gold rush – Northern Star Resources Limited (ASX:NST) and Saracen Mineral Holdings Limited (ASX:SAR) are on a path to merge, with both miners agreeing on a $16 billion merger, calling it a merger-of-equals.

Both the miners have agreed to the merger via a Saracen Scheme of Arrangement under which NST would acquire all the currently outstanding shares of SAR, unlocking $1.5 to $2.0 billion in synergies.

Image Source: © Kalkine Group 2020

NST and SAR have inked a Merger Implementation Deed (or MID), under which, both the entities would merger via SAR Scheme of Arrangement, creating a Top-10 major gold producer across the globe with high-margin assets in Tier-1 jurisdictions.

Under the scheme, Bill Beament – current Executive Chair of NST would be the Chair of the merged entity and would later transit from Executive to Non-Executive Chair in July 2021. Also, Raleigh Finlayson – Managing Director of SAR would become the MD of the merged group.

Stuart Tonkin would be placed as CEO and Morgan Ball would be placed as CFO at the merged group, and upon the completion of the scheme, the Board of the merged entity would have total nine members with five Directors from NST and four Directors from SAR.

Transaction Highlights and Terms

Under the scheme, each shareholder of SAR would get 0.3763 shares of NST in exchange of each share of SAR (held on the record date), and upon completion of the merger, the merged group would represent 64.0 per cent ownership of NST shareholders and the remaining ownership would be represented by shareholders of SAR.

The Board of SAR unanimously recommends the shareholders favour the wind of the merger and each Director of the Company intends to vote their current ownership in favour of the merger. Furthermore, NST unanimously endorses the current merger scheme in the absence of any superior offer. The implementation is subjective to the approval from shareholders of SAR along with an approval from a court.

Apart from the Board of SAR, an Independent Expert also concludes that the scheme is in the best interest of shareholders.

The Strategic Rationale Behind the Merger

Unrivalled Presence at Goldfields

- The current merger scheme of SAR represents a logical combination of highly complementary assets, which would allow both the miners to combine a portfolio of high-quality assets concentrated in three Tier-1 jurisdictions.

- Furthermore, the merger would mark the presence of unrivalled presence of a company in Goldfields with the transaction consolidating KCGM under single ownership for the first time in over a century.

- Moreover, the common shareholding would exceed 50 per cent consolidated into one company.

Unlocking Sector-Leading Growth Potential

- The current scheme would further fan NST’s trajectory of producing 2 million ounces of gold per annum by FY27, and NST estimates that the production would grow by more than 30 per cent in the next three years with lowest capital intensity in the industry.

- Furthermore, the combined free cash-flow generation along with the balance sheet and asset base would enable the merged entity to optimise the growth options which securing significant exploration opportunities across the portfolio with combined processing infrastructure.

Merger Benefits Will Take Surface Over the Next Ten Years

NST believes that the current merger would unlock $1.5 to $2.0 billion Net Present Value (or NPV) on pre-tax synergies via geographic, operational, and strategic synergies while consolidating ownership at KCGM, which would simplify operations and bring forward expansion opportunities.

Furthermore, the merger would provide both the miners to optimise processing, unlocking a range of previously constrained regional deposits and exploration opportunities.

Boost for the Sales and The Market Profile

- The proposed scheme would place the merged entity as one of the top ten global gold miners, attracting generalist as well as gold-focused global investors and domestic large-cap funds.

- Apart from that, the merged entity would become a long-life gold producer with more than 19 million ounces of Ore Reserves and 49 million ounces of Resources.

- Moreover, the merger would allow the new entity to leverage the combined ESG experience while providing an opportunity to align and scale sustainability initiatives, engagement, and reporting.

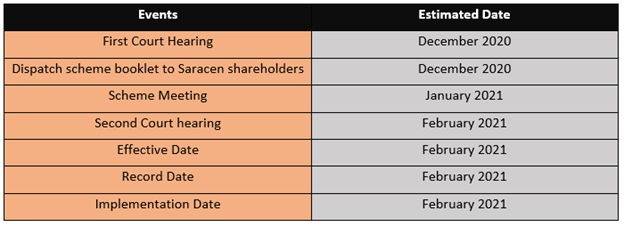

Timeline of the Proposed Scheme

The first court hearing concerning the scheme is in December 2020, post which, SAR would dispatch scheme booklet to its shareholders.

The other important dates are as below:

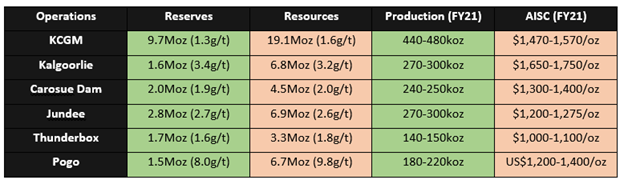

The Merger of Complementary Assets and Tier-1 Locations

The complimentary portfolio of assets includes Kalgoorlie Operations, i.e., KCGM, Kalgoorlie (ex KGCM), Carosue Dam, Yandal Operations, i.e., Jundee & Bronzewing, Thunderbox, and North American Operations, i.e., Pogo.

The reserves, resources, cost, and production profile of tenements of these operations are as below.

Market Reaction and Share Movement

The stock prices of both the companies gained a considerable momentum post disclosing the merger scheme to the general public with NST clinching a day high of $15.320 (as on 6 September 2020 3:10 PM AEST) and SAR inking a day high of $5.720 (as on 6 September 2020 3:10 PM AEST).

NST witnessed a rally of ~ 10.85 per cent against its previous close on ASX while SAR gained ~ 9.49 per cent against its previous closing price on the exchange (3:10 PM AEST).

The market seems to be cherishing the proposed merger with both the miners topping the top gainer of the day list on 6 September 2020 at the end of the trading session.