Highlights

- Dollarama Inc. (TSX:DOL) is set to release its financial results for the second quarter of fiscal 2022 on Thursday, September 9.

- Dollarama is ranked among the top return on equity (ROE) performers on the Toronto Stock Exchange.

- Dollarama plans to increase its store count to 2,000 by 2031.

Canadian discount retailer Dollarama Inc. (TSX:DOL) is all set to release its financial results for the second quarter of fiscal 2022 on Thursday, September 9. This appears to be drawing investors' attention as the stock's historical gains have been impressive.

Some analysts believe that Dollarama's Q2 2022 results could outperform its earnings in the second quarter of fiscal 2021, as economic activity has picked up since amid increasing vaccinations and fewer public health restrictions.

Let's further explore Dollarama’s stock performance to see if you should consider keeping it in your investment portfolio.

Also Read: Canopy Growth (TSX:WEED) is rising. Is the pot stock a safe bet?

Dollarama (TSX:DOL)

Dollarama has previously discussed its vision to expand its presence, keeping growth plans in place. In March 2021, Dollarama President and CEO Neil Rossy had announced that the Canadian retailer was planning to increase its store count to 2,000 by 2031 in the country.

The announcement came after Mr Rossy decided to increase the previous target of expanding the store count to 1,700 stores by 2027. As of May 2021, Dollarama had 1,368 stores in Canada.

As the company has plans to expand this network, the retailer could see a surge in its revenues, which, in turn, could impact its stock performance in future.

Another factor that could boost Dollarama's growth prospect is that it offers a wide variety of products at discounted rates. The COVID-19 pandemic has affected the economy negatively and impacted the purchasing power of people. Hence, the company could attract customers looking for affordable products.

© 2021 Kalkine Media Inc.

Dollarama stock & financial performance

In Q1 2022, Dollarama’s sales increased by 13 per cent year-over-year (YoY) to C$ 954.2 million. In addition, its operating income expanded to C$ 176.8 million, reflecting an increase of 18.1 per cent YoY.

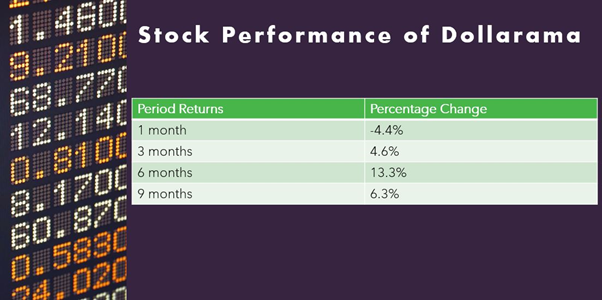

Dollarama shares declined by four per cent in the last 30 days. On the other hand, the discount retailer's stock surged by 9.4 per cent year-to-date (YTD) to outpace the Toronto Stock Exchange 300 Composite Index, which has declined by 8.3 per cent in the same comparable period.

Dollarama is ranked among the top return on equity (ROE) performers on the Toronto Stock Exchange (TSX), with that of 791.26 per cent.

On the dividend front, Dollarama pays a quarterly dividend of C$ 0.05 per unit to its shareholders.

Also Read: 5 best Canadian mid-cap stocks to buy this September

Bottom line

With a wide range of retail stocks available in the Canadian stock markets, investors are open to many options. As for Dollarama stock, it could yield higher long-term gains as the company continues to focus on further expanding its presence.