Summary

- Retail sector revenue may not see any drastic changes but may be susceptible to changes in the tastes and preferences of individuals.

- AutoCanada Inc., an automobile retailer, generated a revenue of CA$1.75 billion in Q2 2023, as against Q2 2023’s CA$1.68 billion.

- Nova Cannabis Inc., a Canadian cannabis retailer, reported an all-time high revenue of CA$64 million in Q2 2023.

Retail sector stocks include a wide variety of companies that produce products that are generally useful to fulfil daily needs. However, the revenue generated by these products is also sensitive to the changes in the taste and preferences of individuals.

Retail stocks with strong financial performance and sales growth can be a good option to add to one’s portfolio. Such retail sector stocks may offer the additional benefit of protection from business cycles.

ALSO READ: WN & SAP: Two consumer staple stocks to watch

Retail companies may not see drastic upswings and downswings in revenue based on the flow of economic conditions. However, investors should carefully examine the financial performance of these stocks before investing in them.

AutoCanada Inc. (TSX: ACQ)

Autocanada is an automobile retailer for brands such as Chrysler, Dodge, Jeep and Kia among others. The company generates the most amount of revenue from new vehicle sales.

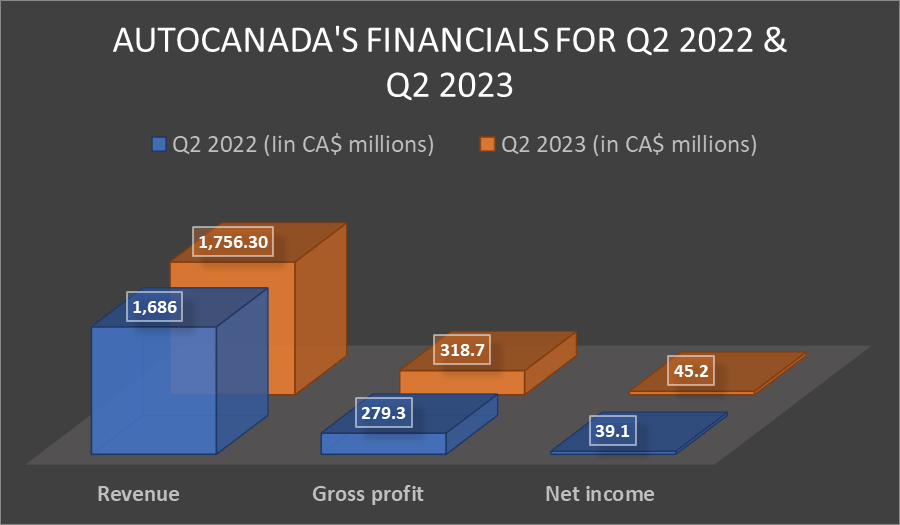

For Q2 2023, AutoCanada’s revenue was CA$1.75 billion, against Q2 2023’s CA$1.68 billion. The company’s total retail vehicles sold amounted to 28,479 units, which was 3.1% higher than previous corresponding period.

Image source: ©2023 Kalkine®; Data source: Company Reports

The company’s net income was CA$45.2 million, as compared to CA$39.1 million in Q2 2022. Meanwhile, the company’s diluted EPS was CA$1.75, which was CA$0.42 higher than Q2 2022.

Based on ACQ’s closing price on Thursday of CA$25.35, ACQ has a P/E ratio of 5.70x. At the close of trade on August 10, 2023, the stock rose 27% monthly and 8.7% YTD. However, the stock price jumped 16.61% intraday on Thursday, August 10, 2023.

ALSO READ: Watch these TSX-listed stocks during this earnings season

Nova Cannabis Inc. (TSX:NOVC)

Nova Cannabis is a retailer of cannabis in Canada, with its brands including Value Buds and Sweet Tree Cannabis Co.

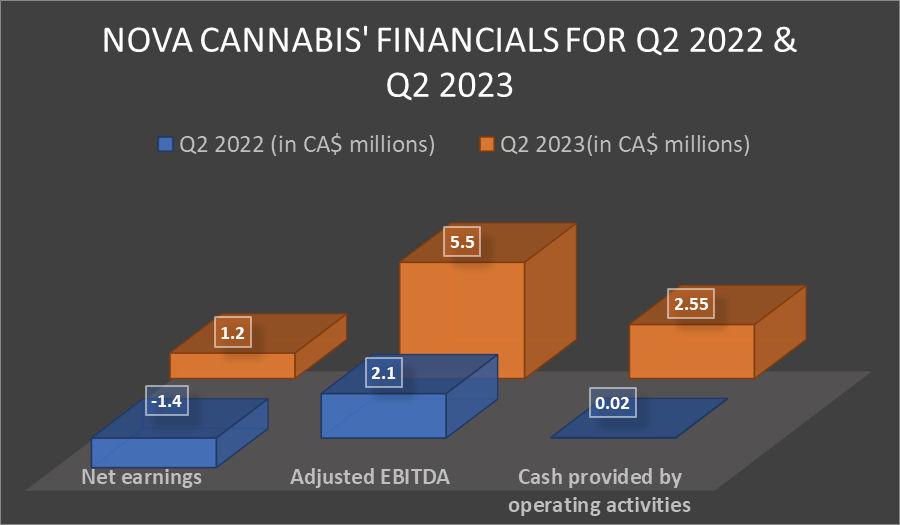

For Q2 2023, Nova Cannabis reported an all-time high revenue of CA$64 million, which was 13.7% higher than previous corresponding period. Additionally, NOVC also reported a 38% uptick on same-store sales from Q2 2022.

Image source: ©2023 Kalkine®; Data source: Company Reports

The net earnings for the quarter were CA$1 million, which represented an EPS of CA$ 0.02. Meanwhile, Nova’s adjusted EBITDA was CA$5.5 million in Q2 2023, as compared to CA$2.1 million in Q2 2022.

NOVC closed at CA$0.53 on August 10, 2023. As at the close of trade on Thursday, the stock saw an intraday incline of 29.27% and a weekly gain of 23.26%.