Source: Shutterstock

With US President Joe Biden coming to power in the White House, markets are waiting with bated breath to see the gradual shift from traditional energy to renewable power. And as the concept of clean energy becomes more popular, the electric vehicle (EV) industry is also expected to capture a wider customer base.

At the same time, stocks surrounding the EV sector are also stirring interest among investors as green energy and emission numbers become rising trend topics. With that in mind, let’s check out 17 EV stocks from North American markets that you should know about.

1. Magna International Inc (TSX:MG)

Canadian automotive industry supplier Magna International announced on February 19 that it will be venturing into the electric vehicle sector in collaborations with EV startup Fisker Inc (NYSE:FSR) and battery maker LG Chem.

One-year stock performance chart of Magna International (Source: Refinitiv/Thomson Reuters)

The C$ 32.9-billion market cap* company saw its stocks expand by about 65 per cent in the last one year. Since collapsing amid the pandemic-triggered March lows, the scrips have approximately gained 193 per cent in the last 11 months.

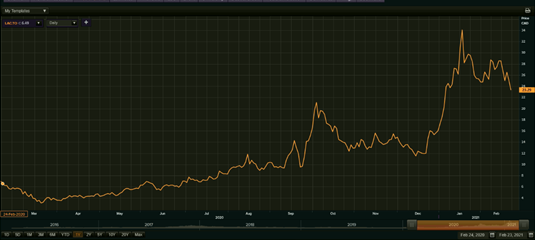

2. Lithium Americas Corp (TSX:LAC)

Lithium is one of the essential ingredients required in the making of an electric vehicle. As the EV industry continues to expand, lithium exploration firms are coming into the limelight as well. Vancouver-based resource company Lithium Americas, for example, saw its stocks surge by roughly 260 per cent in the past year.

One-year stock performance chart of Lithium Americas (Source: Refinitiv/Thomson Reuters)

The C$ 2.9-billion market cap* company recorded a share price growth of about 150 per cent in the last six months and of nearly 57 per cent year-to-date (YTD).

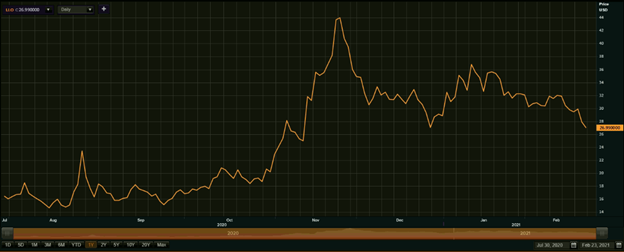

3. GreenPower Motor Company Inc (TSXV:GPV)

GreenPower Motor, which distributes all-electric charter, school and city buses, is one of the emerging companies on the Toronto Stock Exchange Venture. The Vancouver-based enterprise currently holds a market cap* of C$ 638.9 million.

GreenPower stocks grew by about 1294 per cent in the last one year.

One-year stock performance chart of GreenPower Motors (Source: Refinitiv/Thomson Reuters)

4. Facedrive Inc (TSXV:FD)

Canadian ridesharing service provider Facedrive, which provides customers the option to choose an EV for their ride, launched an electric vehicle subscription service in Toronto earlier in February. Facedrive said that it acquired Steer, an American technology-driven monthly subscription service, in September last year.

One-year stock performance chart of Facedrive (Source: Refinitiv/Thomson Reuters)

Facedrive stock rose by about 37 per cent over the last six months and by over 187 per cent YTD. It is also one of the top performing TSXV stocks in terms of its price growth.

5. NFI Group Inc (TSX:NFI)

NFI Group, which presently has 7,300 transit buses in service that are fueled by electric motors and battery propulsion, pays a quarterly dividend of C$ 0.212 per share. The payout, as per the TMX data, reflects a dividend yield of 2.982 per cent at the moment.

One-year stock performance chart of NFI Group (Source: Refinitiv/Thomson Reuters)

The Canadian automobile manufacturer, with a market cap* of C$ 1.78 billion, saw its stocks skyrocket to a 52-week high of C$ 32.7 in January. So far into 2021, NFI stocks have jumped by 18 per cent YTD.

6. Li Auto Inc (NASDAQ:LI, LI:US)

Beijing-headquartered electric vehicle manufacturer Li Auto announced in its latest strategy, released on February 22, that it aims to be the top smart EV producer in China by 2025. The company currently holds a market cap of US$ 24.99 billion, as per Nasdaq.

One-year stock performance chart of Li Auto (Source: Refinitiv/Thomson Reuters)

Li Auto’s stocks debuted on the Nasdaq exchange in July last year and have since surged by over 69 per cent in a span of about seven months.

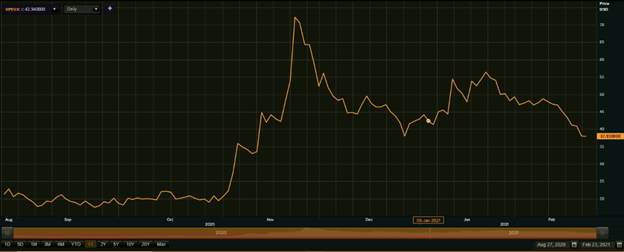

7. Lucid Motors Inc

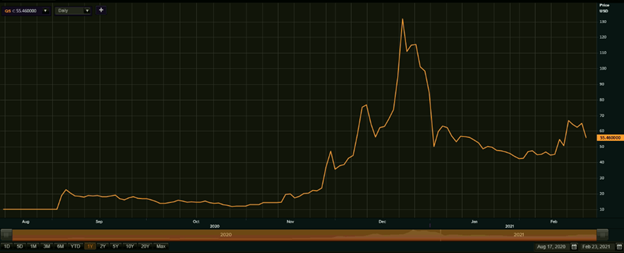

Lucid Motors became the talk of the town in January after rumors cropped up around its potential merger with blank check company Churchill Capital IV. The special purpose acquisition company (SPAC) saw its stocks surge over the next few weeks, hitting an all-time high of US$ 58.05 last week (February 18). Its stocks are currently up 473 per cent YTD.

Lucid Motors confirmed the merger rumors on Monday, making it official that the EV maker is heading for a public listing soon.

One-year stock performance chart of Churchill Capital IV (Source: Refinitiv/Thomson Reuters)

8. Nio Inc (NYSE:NIO, NIO:US)

Shanghai-based Nio Inc saw its American depositary shares (ADS) balloon by nearly 370 per cent since they debuted on the New York Stock Exchange (NYSE) in September 2018. More recently, the Chinese EV stock gained over 229 per cent in the period of the last six months.

One-year stock performance chart of Nio (Source: Refinitiv/Thomson Reuters)

Holding a market cap of US$ 78.08 billion, Nio is poised to reveal the annual and fourth quarter financials for 2020 next Monday, on March 1.

9. Xpeng Inc (NYSE:XPEV, XPEV:US)

XPeng recently reported that its electric vehicles being used for a cumulative 17.267 million kilometers in China during their New Year holiday week (February 11-17) led to a 1,086 tons reduction in carbon emissions.

One-year stock performance chart of Xpeng (Source: Refinitiv/Thomson Reuters)

Its NYSE-listed ADS have been trading down in February so far, but have recorded a growth of about 68 per cent in the last six months since their public debut.

10. Siemens Energy AG (ETR:SIE)

Engineering technology company Siemens Energy AG was picked by oil producer TC Energy Corp recently to develop a waste heat-to-power pilot plant in Alberta. Known worldwide automation pursuits, the German conglomerate deals in the electric vehicle industry via its wing, Siemens eMobility.

Siemens stocks expanded by about 22 per cent in the last three months.

One-year stock performance chart of Siemens Energy (Source: Refinitiv/Thomson Reuters)

11. Tesla Inc (NASDAQ:TSLA, TSLA:US)

Tesla stocks have been white hot on the equity markets for roughly the past year, helping its founder Elon Musk snatch the golden title of ‘World’s Richest Person’ from Amazon head Jeff Bezos. The EV stock skyrocketed by about 280 in the last one year, and currently records a six-month growth of 67 per cent.

One-year stock performance chart of Tesla (Source: Refinitiv/Thomson Reuters)

Tesla saw its stocks slip by about nine per cent on Monday as, days after its US$ 1.5 billion investment in Bitcoin, the cryptocurrency’s price also dipped by about nine per cent.

- Westport Fuel Systems Inc (TSX:WPRT)

Vancouver-based Westport Fuel Systems recently entered a deal to supply more than 1,000 truck engines to Amazon Inc. Following the announcement earlier this month, Westport stocks had catapulted by roughly 40 per cent on February 8.

One-year stock performance chart of Westport Fuel Systems (Source: Refinitiv/Thomson Reuters)

A low-emission engine manufacturer and supplier, Westport’s market cap* stands at C$ 1.5 billion at the moment. Its trending TSX stocks, meanwhile, record a YTD growth of over 129 per cent.

13. Atlantica Sustainable Infrastructure Plc (NASDAQ:AY, AY:US)

Infrastructure company Atlantica Sustainable owns a diverse portfolio of assets across North and South America, including conventional as well as renewable energy. Its stocks climbed 11 per cent in the last one year.

One-year stock performance chart of Atlantica Sustainable (Source: Refinitiv/Thomson Reuters)

Atlantica, recently recognized as one of the top 100 sustainable companies in the world, currently has a market cap of US$ 3.8 billion.

14. Fisker Inc (NYSE:FSR, FSR:US)

Fisker went public in October 2020 in a reverse merger with special purpose acquisition company (SPAC) Spartan Energy Acquisition, getting more than US$ 1 billion in cash. Since then, its stocks have climbed by about 66 per cent in the last four months.

One-year stock performance chart of Fisker (Source: Refinitiv/Thomson Reuters)

Fisker is one of the many companies that went public last year via the SPAC route.

15. SolarEdge Technologies (NASDAQ:SEDG, SEDG:US)

Stocks of solar energy supplier SolarEdge Technologies (NASDAQ:SEDG, SEDG:US) rose by roughly 101 per cent in the last one year.

One-year stock performance chart of SolarEdge (Source: Refinitiv/Thomson Reuters)

SolarEdge recently extended its supply contract with fellow solar energy company Sunrun. It currently holds a market cap of US$ 14.65 billion.

16. Sunrun Inc (NASDAQ:RUN, RUN:US)

San Francisco-headquartered Sunrun Inc, which primarily provides residential solar panels and home batteries, also deals in the business of powering electric vehicles.

One-year stock performance chart of Sunrun (Source: Refinitiv/Thomson Reuters)

The US$ 14.7-billion market cap company records a stock price growth of 179 per cent for the past one year.

17. QuantumScape Corporation (NYSE:QS, QS:US)

QuantumScape, a San Jose-based lithium metal EV battery manufacturer, is known for having major investors like Microsoft co-founder Bill Gates and Volkswagen. The company recently announced a “breakthrough” development of producing multilayer battery cells, which saw its stock price fly last week (February 17).

One-year stock performance chart of QuantumScape (Source: Refinitiv/Thomson Reuters)

Since debuting on the stock markets in August last year, QuantumScape stocks have surged by about 459 per cent in the span of six months.

*as per the data on TMX.