Highlights

- The Canadian benchmark index fell by more than two per cent on Friday, November 26, as the new COVID variant, Omicron, made headlines.

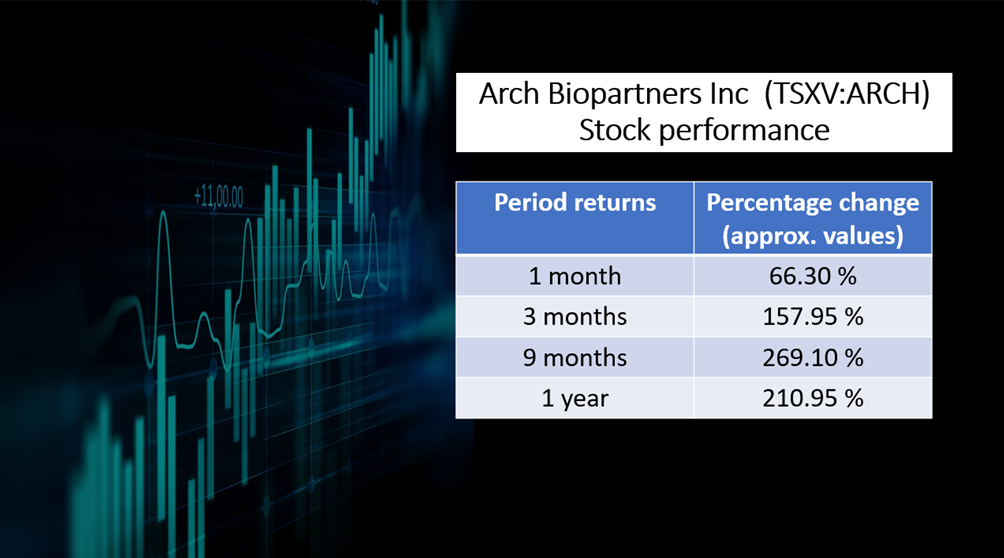

- A biotech stock in Canada zoomed by more than 269 per cent in the last nine months.

- A Canadian healthcare company its revenue surge by 22 per cent YoY to C$ 4.6 million in Q1 FY2022.

The Canadian benchmark index fell by more than two per cent on Friday, November 26, as the new COVID variant, Omicron, made headlines.

Investors seem to have been spooked by the threat of a new COVID variant and prompted a selloff in the Canadian markets, leading to some stocks declining in value.

However, on the other hand, some pharmaceutical companies having been noting a rise in their stock performance in the wake of Omicron’s emergence, especially companies that are working on solutions to combat COVID-19.

So, let us discuss three Canadian stocks that can see substantial growth amid the new COVID variant’s emergence.

Also read: Cyber Monday 2021: 3 TSX stocks to buy ahead of time

1. Arch Biopartners Inc (TSXV: ARCH)

Arch Biopartners Inc is a Toronto-based biotechnology company that engages in the development of new drug candidates for inflammation treatment in the lungs, liver and kidneys through dipeptidase-1 (DPEP-1) pathway.

On May 4 this year, Arch Biopartners completed the enrollment for the Phase II Trial of its treatment, Metablok, which is an LSALT Peptide study. It is targeted at patients severely affected by COVID-19’s the delta variant and have suffered acute lung and kidney injury due to inflammation.

The study reflected that acute respiratory distress syndrome is a major cause of death among COVID patients, while 35 per cent of hospitalized COVID patients suffered and often died due to acute kidney injury.

The company also mentioned that the study’s Phase III program would be based on these results, which will include a greater number of patients to assess the efficiency and safety of hospitalized patients with risk of organ inflammation.

ARCH stock grew by more than 66 per cent in the last one month and expanded by nearly 158 per cent in the past three months. It also zoomed by more than 269 per cent in the last nine months.

On Friday, November 26, the biotech stock closed at C$ 4.54 apiece, down by roughly two per cent.

Image source: © 2021 Kalkine Media Inc

2. SQI Diagnostics Inc (TSXV: SQD)

SQI Diagnostics Inc, also known as SQI, is a Canadian healthcare provider that operates in the medical diagnostic and research industry. SQI is primarily engaged in the development and commercialization of proprietary tech solutions for multiplexing diagnostics.

SQI’s RALI-Dx™ IL-6 Severity Triage Test is said to help in identifying patients who are suffering severely from inflammation due to COVID-19 and other causes. This test got an FDA approval under non-EUA regulatory framework earlier this year in July.

The Toronto-headquartered company reported sales of C$ 0.3 million in the third quarter of fiscal 2021. Its research and development expense amounted to C$ 2 million in Q3 FY2021, as compared to C$ 0.8 million in the same quarter a year ago. Its net loss was C$ 0.7 million in the latest quarter, down from C$ 1.5 million a year ago.

As of its stock performance, SQD closed at C$ 0.18 apiece on November 26, up by about nine per cent.

3. Immunoprecise Antibodies Ltd (TSXV: IPA)

Immunoprecise Antibodies Ltd is a biotechnology firm that supports the research and industrial community by providing custom antibodies and related service solutions.

The company is said to have developed a four-monoclonal antibody cocktail named TATX-03 that is claims has the potential to prevent and treat the delta variant.

In Q1 FY2022, Immunoprecise saw its revenue surge by 22 per cent year-over-year (YoY) to C$ 4.6 million. Its research and development costs stood at C$ 1.1 million and its net loss amounted to C$ 3.2 million in the latest quarter.

As for its stock performance, IPA jumped by more than 18 per cent week-to-date. Its stock closed at C$ 8.47 apiece on November 26, up by roughly 14 per cent.

Also read: Can DiDi's IPO debacle end on with its exit from US markets?

Bottom line

Pharmaceutical companies can see a boost in their operations and play a significant role in fighting the new COVID-19 variant.

However, investors are advised to look at their operations and financials in detail before drawing any conclusion.