Highlights

- The S&P/TSX Capped Real Estate Index rose by 30 per cent this year.

- New condo sales reportedly clocked a new all-time high in Q3, says a new research.

- A stock mentioned here swelled up by about 89 per cent in the past year.

As Canada continues to note a surge in demand for housing, the Greater Toronto Area (GTA) is said to have hit a record high in new condominium sales in the third quarter of 2021.

Market research firm Urbanation recently reported that the GTA saw a record number of 7,773 new condos get were sold in Q3 2021, which was up by 22 per cent year-over-year (YoY).

Some analysts believe that the pandemic-induced work-from-home scenes have shifted buyers’ preference towards better living space, which, in turn, pushed up condo prices.

The real estate sector is likely to enjoy this momentum as inventories further diminish in the third quarter.

That said, with the S&P/TSX Capped Real Estate Index having seen a growth of 30 per cent this year, investors could explore some real estate stocks that could fetch notable returns.

Also read: How Canada’s commercial and housing real estate may look in 2022

1. FirstService Corporation (TSX: FSV)

Canadian property manager FirstService Corporation, which deals in residential and essential outsourced property services, saw its stock drop by 1.228 per cent to C$ 243.81 apiece at market close on Monday, November 1.

FSV stock, however, has jumped up by almost six per cent in the last one month. It also recorded a return of nearly five per cent in the past 90 days and grew about 40 per cent year-to-date (YTD).

Last month, FirstService announced that it saw a year-over-year (YoY) increase of 14 per cent in its consolidated revenues of US$ 849.4 million.

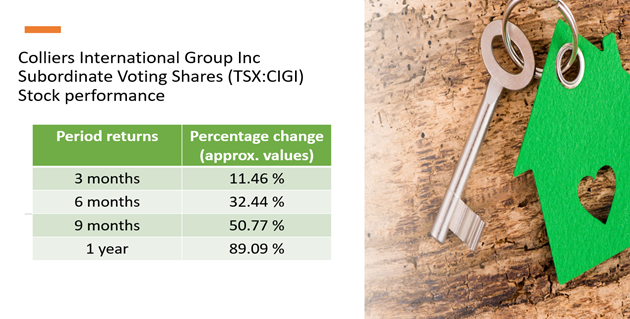

2. Colliers International Group Inc Subordinate Voting Shares (TSX: CIGI)

Colliers International Group Inc, a Canadian real estate service and investment manager, saw its scrip wrap up trade at a value of C$ 178.43 per share, down by 0.618 per cent, on November 1.

CIGI stock clocked its 52-week high of C$ 184.39 on October 27 after the company announced that it has inked an acquisition agreement to hold a controlling interest in affiliation operations, including Colliers Italy.

Image source: © 2021 Kalkine Media Inc

The real estate stock has climbed up by more than eight per cent in the last month and expanded by more than 32 per cent in the previous six months. It also experienced a gain of almost 51 per cent in the past nine months.

Colliers’ stock price swelled up by about 89 per cent on a YoY basis and marked a YTD return of roughly 58 per cent.

Also read: Top 5 Canadian REIT stocks to buy for a recession

Bottom line

The Canadian real estate sector could gain momentum in the future as buyers have shifted their preference to better living spaces. On the other hand, some market experts believe that the country is currently experiencing a “housing bubble”, which could burst as demand eventually wanes.

In either case, investors should bear in mind that it is crucial to assess and evaluate a company, its business, financials and expansion plans to gauge the return capacity of the stock before making any investment.