Highlights

- Aspire Mining is developing its 100%-owned Ovoot Coking Coal Project to target steelmakers in Russia and China.

- Coking coal is a key input for steel manufacturing process.

- Ovoot coal has outstanding caking, fluidity and plastic properties across a wide temperature range.

- The Company plans a decision to mine in 2022 once permitting and funding are secured.

Aspire Mining Limited (ASX:AKM) is engaged in the exploration and development of world-class Ovoot Coking Coal Project in Mongolia. The project lies in close vicinity of potential steelmaking markets of China and Russia.

Coking coal, popularly known as metallurgical coal, is used to make coke, which is one of the most important and irreplaceable inputs for steel production.

Coal can be classified into several types based on colours and textures. The caking ability of coking coal is what distinguishes it from other coals. It is the main requirement for making coke suitable for steel production.

Coke is produced by heating coking coal in a reducing environment in a coke oven. The coal becomes plastic as the temperature increases, and fuses together before resolidifying into coke particles. The process is called caking, and the quality of the resultant coke depends on the qualities of coking coal used and the operating conditions of the plant.

Steel companies are always in search of high-quality coking coal to make high-quality coke in order to maximise the productivity of blast furnace operations.

Related Read: Aspire Mining (ASX:AKM) ends March quarter with major strides at Ovoot project

Ovoot coal has world-leading caking and plastic properties

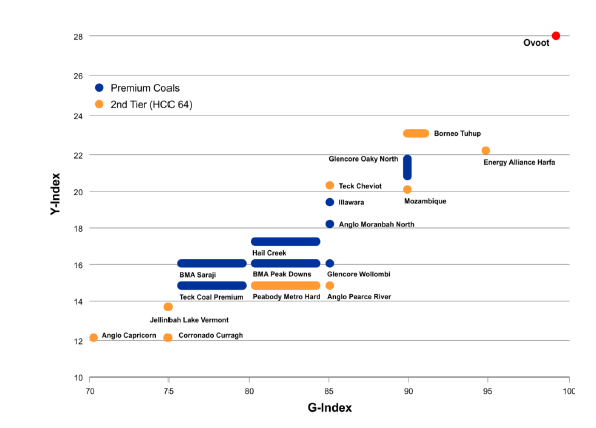

Aspire’s Ovoot fat coking coal comes with properties that boost its significance as an additive to blends, including the wide plastic range. This means it could be used to blend with numerous other types of coal with narrower melting ranges.

Moreover, Ovoot coal has very high fluidity, allowing it to mix well with other coals in the batch.

Image source: AKM presentation, 30 November 2021

Also Read: Aspire Mining (ASX:AKM) completes CHPP infrastructure FEED study for Ovoot coking coal project

Ovoot coal has best-in-class caking and plastic properties. It facilitates superior blending and coking and improves coke oven and blast furnace efficiencies.

Based on the Company’s report, the exceptional plastic properties of Ovoot coal allow it to be used sparingly in blends (5-10%). During pilot testing, Ovoot coal showed that it can ‘carry’ significant amounts of inert materials without affecting the coke strength.

Also, stronger coke with good mechanical properties is required in larger and efficient blast furnaces. It provides an efficient process within the softening area.

It has been observed that the usage of fat coking coal in a batch improves yield and efficiency of the coke oven process with reduced levels of carbon emissions.

Must Read: Aspire Mining’s (ASX:AKM) Ovoot Project gathers steam with recent developments in Mongolia

Ovoot project making headway

Aspire plans to mine coking coal from the Ovoot project and then truck it to nearest railhead at Erdenet. This will involve trucking the coal for 560km by road to the shipping train terminal from where it will be sent to the Chinese market.

Aspire is working on the road and rail line along with the construction of a rail terminal. The Company is advancing various FEED studies along with gaining approvals with the native community.

Working under its ESG program, the Company recently announced to plant 10 million trees in the Khuvsgul province, where it has mining assets.

Know more: Eye on ESG, Aspire Mining (ASX:AKM) vows to plant 10M trees in Mongolia

Aspire’s Ovoot project lies in a high-demand region. The long-term outlook for coking coal remains positive due to the robust demand for steel.

AKM shares were trading at AU$0.086 in the early hours of 1 June 2022.