Highlights

- Calima Energy has spudded Gemini #8, the first well under its four-well drilling campaign at Brooks.

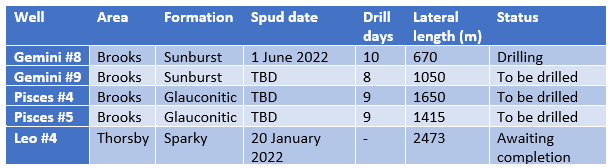

- The company plans to spud the other three development wells by early July.

- Calima has completed coil tubing clean-out operations successfully on Leo #1 and #2 wells in Thorsby.

- The credit facility of C$27 million has been renewed by the National Bank of Canada post the semi-annual review.

In a significant development, Calima Energy Limited (ASX:CE1|OTCQB:CLMEF) has spudded the first well under its four-well drilling program at Brooks.

As oil prices continue to be on the boil, the addition of more wells in its production portfolio is expected to provide significant leverage to Calima in the booming oil market.

Calima is currently drilling ahead at Gemini #8, which is a follow-up to the highly successful Gemini #5 vertical stratigraphic test well.

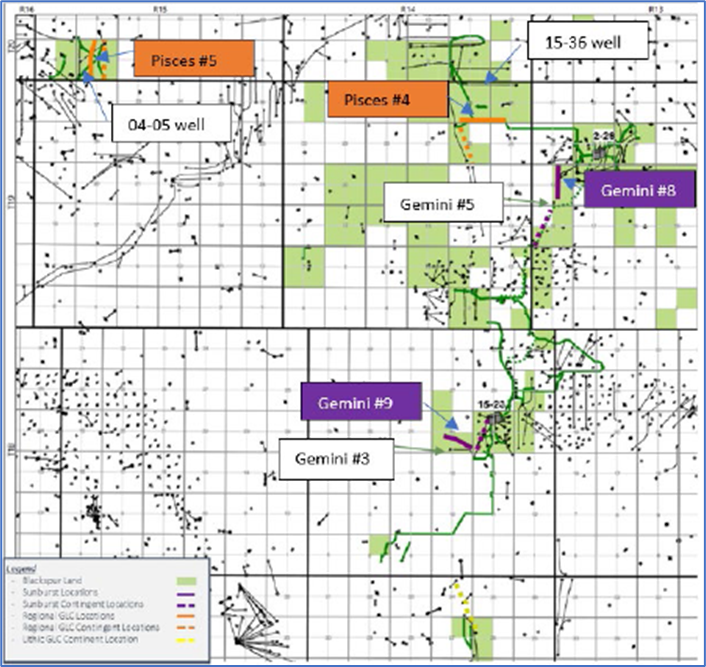

The Gemini series wells are being drilled on the Sunburst formation in the Brooks area. In mid-June, Gemini #9 will be drilled from the same pad as Gemini #3 horizontal well.

The other two wells of the ongoing drilling program, Pisces #4 and #5, will be drilled to target the Glauconitic formation at Brooks. These two wells are expected to spud in late June/early July.

Data source: Company update, 10 June 2022

Related read: Calima Energy (ASX:CE1) keeps eyes on the prize as oil remains on the boil

Overview of four-well drilling program

Gemini #8 is a follow-up well to the highly successful Gemini #5, a vertical test well drilled in the first quarter of 2022. It was Gemini #5 that confirmed the presence of the Sunburst formation in the target area and proved its prospectivity. Gemini #8 is a development well, drilled to target undrained reserves of the Sunburst pool.

Gemini #9, as reported by the Company, will be a follow-up well to the Gemini #3 horizontal well drilled last year in July. Gemini #3 has so far produced 74,000 bbl of oil and 118 mmcf of gas.

Both the wells, Gemini #8 and #9, will be horizontal wells drilled to target the known pools of the Sunburst formation and are designed to extend the previously identified pool boundaries.

Pisces #4 on the Glauconitic formation is a follow-up well to 15-36 well, drilled by the erstwhile operator Blackspur. The 15-36 well has produced 133,000 bbls of oil to date.

Pisces #5 will be a follow-up to Glauconitic 04-05 well, a 1st generation well drilled by Blackspur back in 2014. The well has produced 86,000 bbls of oil since then.

Pisces #4 and #5 are expected to have an average IP90 rate of 115bbl/d of oil.

Drilling program on Sunburst and Glauconitic formations (Image source: Company update, 10 June 2022)

Updates on Thorsby wells

The Leo #4 well drilled on the Sparky Formation will be fractured stimulated in the third week of June. The well was drilled in January this year to a measured depth of 4,088m and outfitted with a 52 stage frac liner. Soon after the fracture operation, a production test will follow and if everything goes according to the plan, the well will be soon tied into gas sales, while the oil will be trucked to the company’s oil processing facilities at Thorsby.

Calima undertook a well intervention operation on Leo #1 and #2. The Company used coiled tubing clean-outs on these wells, a standard procedure in the oil industry to maintain the production levels of the wells.

Due to the clean-outs, Calima’s production fell by ~425 boe/d during the last two weeks of May and the first week of June.

Q3 2022 drilling campaign summary (Data source: Company update, 10 June 2022)

Related read: Calima Energy (ASX:CE1) on high-growth path amid robust crude oil market

Annual Review of credit facility by bank

The National Bank of Canada concluded its semi-annual review of the revolving credit facility and has reaffirmed the Company`s CA$27 million revolving line of credit. The credit score facility offers the Company with a low-cost capital (~4%) that may be used to fund its working capital requirements and long-term funding programs.

The bank amended the credit facility to allow Calima to distribute AU$2.5 million to shareholders in the September quarter. The amended terms suggest that the value of any cash distribution will reduce the Company’s available credit capacity under the facility.

Share price: CE1 shares were trading at AU$0.205 around mid-day on 10 June 2022 with a market cap of AU$132.25 million.