Highlights

- Alkane Resources is a gold exploration, production and development firm

- In 1HFY24, gold revenue dropped by 5% YoY to AUD 89.06 million

- Gandel (Ian Jeffrey) has maximum interest in the company with a shareholding of ~18.25%

Alkane Resources Limited (ASX:ALK) is an ASX-listed gold explorer and producer. Established in 1969, the company operates its Tomingley Gold Operation and holds multiple highly prospective copper and gold assets.

In the first half of the financial year 2024 (1HFY24), ALK’s gold revenue decreased by 5% YoY to AUD 89.06 million, profit after tax declined by 50% to AUD 12.42 million and gold production decreased by 23% YoY to 29,037ounces .

Profitability during the period was driven by improved cost management and sales prices at Tomingley. However, the 6-months performance was impacted by increased operating expenses arising from higher input costs, increased activities and lower gold grade.

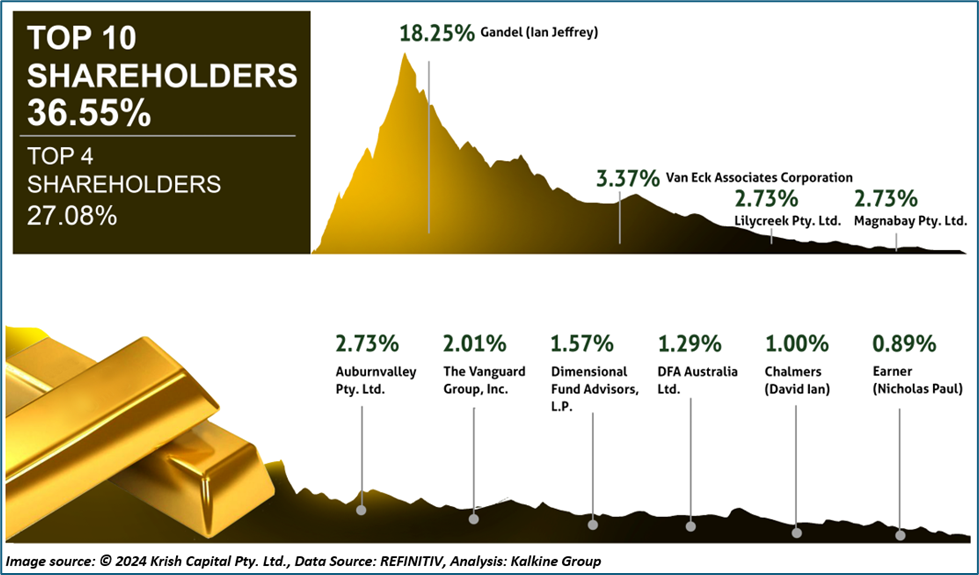

Top 10 shareholders of ALK

The top 10 shareholders of ALK have around 36.55% shareholding in the company, while the top four have nearly 27.08% shareholding. The top two shareholders of ALK are Gandel (Ian Jeffrey) and Van Eck Associates Corporation with a shareholding of ~18.25% and ~3.37%, respectively.

Recent business update

The company has undertaken drilling activities at the Northern Molong Porphyry Project in Central New South Wales and on 15 March 2024, through an ASX update, additional findings were revealed.

Significant high-grade sections were observed from the Kaiser infill drilling campaign, with one intercept reported a gold equivalent of 62g/t within 1m section. Also, the company had discovered a ‘Boda’ style breccia covering more than 70m across two sections, both demonstrating gold equivalent grade exceeding 3 g/t.

In the June 2024 quarter, scoping study is expected to be finalised for mining Kaiser and Boda.

Outlook

In FY24, the expected gold production from Tomingley is 60 – 65koz at an AISC of AUD 1,750 – 2,100 per ounce. The focus is on undertaking drilling at the Tomingley Operation for additional resources within the current underground area with a plan to extend the operational lifespan.

The company is focused on concluding scoping study at the Boda-Kaiser Ag-Cu deposit.

Share performance of ALK

ALK shares closed 0.75% lower at AUD 0.66 apiece on 16 April 2024. With this, ALK’s share price has decreased by almost 25% in the past 12 months and has increased by 7.32% in the last three months.

The 52-week high of ALK is AUD 0.930, recorded on 11 May 2023, while the 52-week low is AUD 0.46, recorded on 22 February 2024.

ALK Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 16 April 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.