Coronavirus outbreak has become a top risk factor for every economy and has dwarfed all the other risks to the global economy. Supply chain disruptions, falling profits and trade halts have shattered all the hopes for businesses and have left them deeply concerned about their survival in the long-term.

Coronavirus, which originated in the Wuhan city of China, has killed more than 40,000 people and has spread in 205 countries till date.

National Australia Bank Limited (ASX:NAB) conducts a quarterly business survey based on a sample of firms between a certain time period to detect prevailing business conditions and sentiment. NAB surveyed 950 firms between mid-February and early-March- before the significant lockdown. At the same time, the second half of the sample was collected from mid-March when significant lockdowns were announced, and uncertainty rose.

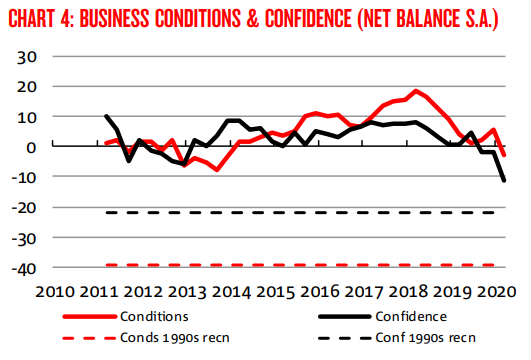

Dip in business conditions and confidence

As per the Quarterly NAB Business survey for Q1 2020 released on 2 April 2020, business conditions plunged 9 points reaching to -3 index points. New South Wales and Western Australia accounted for the significant fall in the business conditions amongst all regions with index points at -4 for both from 6 and 5 index points respectively in the previous quarter.

Finance, business & property and manufacturing saw largest declines in business conditions. Conditions were bleak across all industries except retail and wholesale industry. However, the impact on the business revenue was around just 3% with the largest effect on Transport & utilities and wholesale.

Source: NAB quarterly business survey 2020 Q1

While, the business confidence fell to -11 in Q1 2020 compared to -2 in the previous quarter due to plunge in demand, falling margins and bleak global outlook. The confidence fell the most in New South Wales and Victoria reaching to -12 and -15 index points from -1 and -4 respectively in the previous quarter.

Alan Oster, NAB Chief Economist, stated, “While the survey was done before containment measures were implemented, the coronavirus outbreak and international developments has impacted confidence. The decline in confidence was majorly in labour-intensive industries like personal and recreational services and retail.”

ALSO READ: Staying Positive while ABS Talks About COVID-19 Driven Impact on Businesses

Containment measures have been tightened, and more significant impacts across the business sector are apparent after the survey. However, a critical positive has been steadfast support by the government to business and households to help them sustain in the recovery phase.

Softened Economic indicators in Q1

Leading indicators softened during the quarter. Business conditions in the next 3 months are expected to fall to -4 from -3 in the current quarter. Expectations for capex and employment also deteriorated for the near-term and the medium-term. While the capacity utilisation rate remained unchanged at 81.5, forward orders saw a sharp drop to -6 index points in this quarter from 0.

The forward indicators reflect the current weakness prevailing in the business sector. It was clear that increased lockdowns and escalation of social distancing measures were bound to impact the economic activity despite uncertainty at the time the survey was conducted.

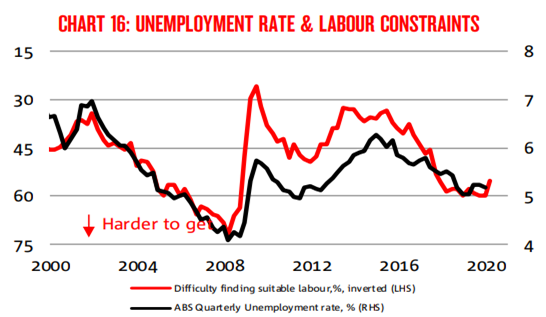

Labour indicators were weak during the quarter. The employment index declined to 0 index points with lower expected employment in next 3-month and 12-months. While labour costs edged lower, difficulty finding suitable labour eased driven by smaller firms reporting significant shortages.

Source: NAB quarterly business survey 2020 Q1

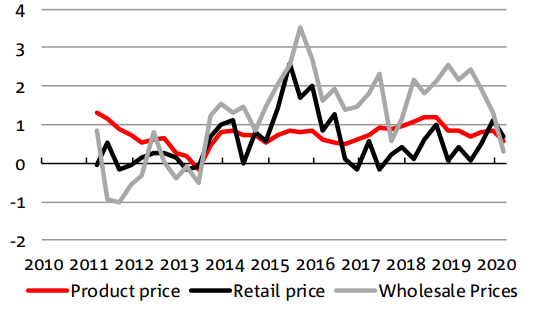

Inflationary pressures remained weak. While the final product prices fell to 0.1 index point from 0.2, labour costs growth softened, and purchase costs growth ticked up by 0.1 index point to 0.5 index point. The margins continue to fall as input costs rise faster than the output prices. Profitability fell by 11 index points and went negative to -7 index points from 4 in the previous quarter.

Inflation pressures, Source: NAB quarterly business survey 2020 Q1

Margins could fall further as supply-side disruptions push input prices higher amid softened demand.

The construction industry sub-sectors experienced a decline in residential and engineering. Construction services and non-residential construction has remained flat.

Financial Market Expectations

Exchange rate expectations were similar to Q4 result at US67.8 cents. The exchange rate has been volatile over the past few months but has mostly remained around these levels during the time of the survey. Since then, the exchange rate has depreciated, notably.

The survey was conducted when RBA cut the cash rate by 25 bps to 0.5% but before the emergency meeting of 18 March, where it reduced interest rates to 0.25%. Businesses priced in a further 75% chance of 25bp cut to the short-term rates over the next 12 months period. Since the time of the survey, RBA has maintained its 0.25% rate while also stating a target yield of 0.25% for 3-year government bond yields.

NAB has forecasted rates to hold for at least the next 2 years with a looming recession and a rapid return to growth, but slow recovery to the level of GDP and the unemployment rate.

Strong policy response from Government and RBA are rightly targeted to support the sinking business. The enormous impact on the cash flow has the potential to destroy the business sector majorly small companies. The immediate effect of the policy measures is uncertain, but they will surely benefit and provide support in the recovery phase.