Highlights

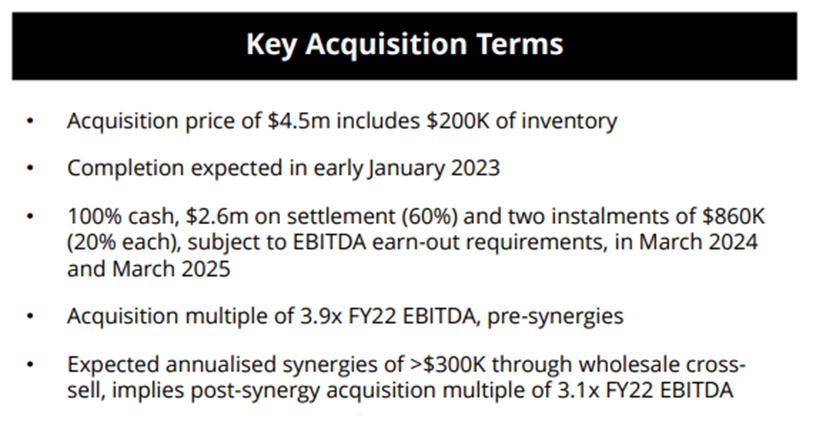

- RPM Group has signed a binding agreement to acquire Metro Tyre Services for AU$4.5 million.

- The successful acquisition of Metro will expand RPM’s retail operations in NSW, with 40 points of presence in Australia.

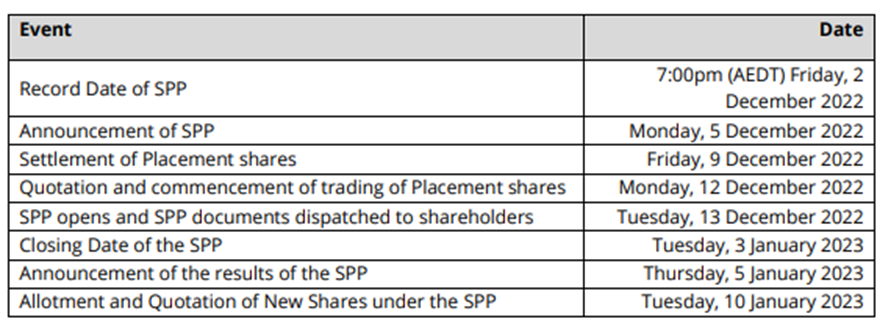

- The Equity raising comprises an Institutional placement to raise AU$2.0 million at AU$0.165 per ordinary share, and an underwritten share purchase plan to raise AU$1.0m via SPP, which is fully underwritten by Collins St Value Fund.

- RPM Group will be issuing 12,121,212 new fully paid ordinary shares at AU$0.165 per share, under the Placement.

RPM Automotive Group Limited (ASX:RPM), a leading player in the Australian automotive aftermarket sector, has successfully completed a AU$2 million placement. Also, the Company has signed a binding agreement for acquisition of the inventory and assets of Metro Tyre Services, a full-service tyre dealer in NSW.

Penrith-based Metro offers round-the-clock onsite mobile tyre fitting repairs and servicing. It has expertise in earthmoving, forklift and commercial tyre sales, fitting, service, and repairs. Metro clocked revenue of AU$10 million with EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortisation) of AU$1.15 million in fiscal year 2022.

Details of the acquisition

With the successful acquisition of Metro, RPM Automotive Group will be able to expand its geographic footprint in NSW. This move will increase RPM Group’s points of presence from 38 to 40 across the country.

The strategic acquisition will widen RPM’s retail service offerings with added varieties in the product portfolio. This will also increase pull through from the company’s new wholesale warehouse in Prestons, Sydney.

RPM expects the acquisition to deliver a better customer value proposition with more competitive pricing, improved supply chain efficiencies, and greater national service capabilities for fleet operators.

The Metro acquisition falls in line with RPM Group’s M&A strategy. The acquisition will refine the vertically integrated business model of the company and enable further margin expansion.

Post the acquisition, the company expects the annualised revenue to go up by AU$10 million and EBITDA by AU$1.15m, with identified annualised EBITDA synergies of over AU$300,000 to be realized.

Source: RPM ASX release, 5 December 2022, figures in AU$

An overview of the placement

RPM Group will be issuing 12,121,212 new fully paid ordinary shares at AU$0.165 per share. The offer price of the Placement marks a discount of about 13.2% to the last-close price of AU$0.190 (as on 01 December 2022). The settlement of the placement is scheduled to take place on 09 December 2022.

The funds generated from the equity will be directed for fulfilling acquisition, integration costs, as well as costs of the offer.

Directors and executives of RPM have subscribed for AU$0.5 million, subject to approval from shareholders which will be considered at an extraordinary general meeting in early 2023.

Canaccord Genuity (Australia) Limited acted as Lead Manager to the equity raising and Aitken Mount Capital Partners Pty Ltd acted as Co-Manager to the Offer.

SPP offering

RPM Group also announced an underwritten SPP for eligible existing shareholders on the same terms as under the Placement. Eligible shareholders can apply to subscribe for up to AU$30,000 of shares.

Source: RPM ASX release, 5 December 2022

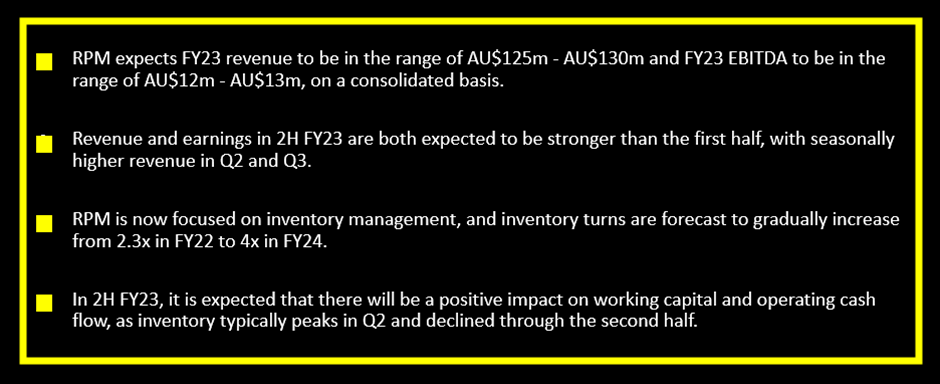

Refinance and restructure of banking facilities

RPM will utilise its new bank facility of AU$26 million with CBA for the deferred acquisition payments which are scheduled for the second half of the FY23. The company has restructured the trade finance facility to brace up the broadening operations and scale up company’s working capital.

RPM expects that the new facility will provide sufficient funding for working capital requirements and organic growth. The new facility will be available for drawdown before the end of 2022.

Management commentary

Data source: RPM ASX release, 5 December 2022

Data source: RPM ASX release, 5 December 2022

What’s in for FY23?

Data source: RPM ASX release, 5 December 2022

RPM shares were trading at AU$0.160 apiece (as on 14 December 2022).