Highlights

- Revolver Resources has shared initial heap leach process testwork results for the Dianne Copper Mine project.

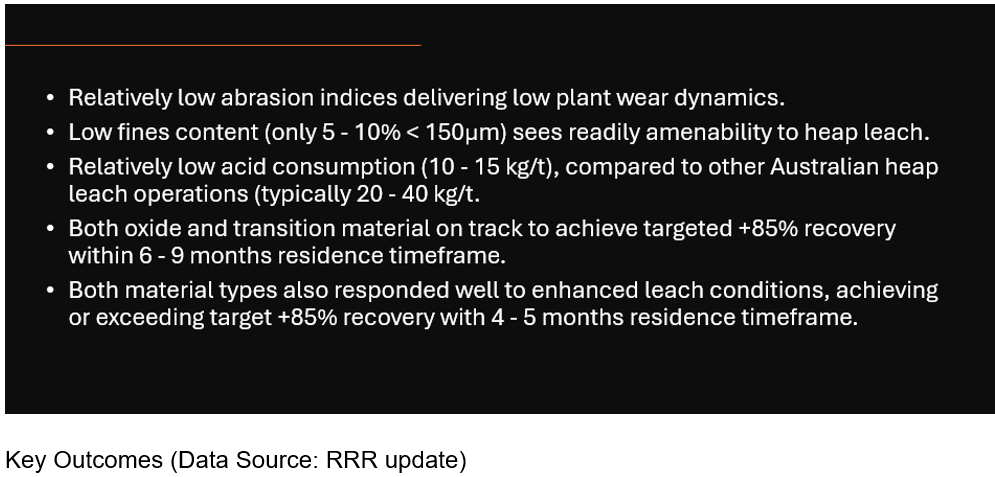

- The testwork indicated low abrasion indices, minimal fines content and reduced acid consumption.

- Both oxide and transition materials are on track to achieve targeted +85% recovery within a 6-9 month residence time.

- Column leach testwork is expected to be completed by 4Q 2024, with final results anticipated in 1Q 2025.

Revolver Resources Holdings Limited (ASX:RRR) has reported encouraging initial results from six-month continuous 4m column leach testwork conducted on its Dianne Copper Mine Project in north-west Queensland. The test was performed on both discrete and composite samples of oxide and transition material from Dianne Deposit Mineral Resource.

The company expects to complete the column leach testwork by Q4 2024, with final laboratory data and analytical results scheduled for release in Q1 2025.

Background of leaching testwork

In the June quarter, the company started a comprehensive laboratory testing program to assess the processing characteristics of material from the deposit. The material at the Diane Copper deposit is classified as oxide material (Ox), which includes minerals such as malachite, cuprite, and tenorite. Additionally, it contains high-grade zones of transition material, (Spotty Chalcocite (SCL)), containing chalcocite and tenorite.

Initial tests focusing on mineralogy, acid consumption, particle size distribution, and abrasion index were undertaken to get data and design criteria for the Front-End Engineering Design (FEED) and laid the groundwork for the subsequent leaching testwork.

The leach testing involved four columns, each measuring 150 mm in diameter and 4m in height. Two columns were loaded exclusively with oxide material and then leached using a conventional sulfuric acid solution. The other two columns contained a blend of oxide and transition materials.

Detailed results of leaching testwork

Visual microscopy analysis of the oxide and transition materials revealed that oxide material includes copper minerals, malachite, cuprite, and tenorite, while the transition material includes chalcocite and tenorite.

Analysis of the acid consumption of the Dianne material demonstrated rates ranging from 10–15 kg/t.

Particle size distribution analysis was conducted for both Ox and SCL by using a stack of sieves with dry and wet screening. Both materials produced 5–10% of fines smaller than 150 µm, confirming their suitability for heap leaching.

For Ox, an abrasion index of approximately 0.04 was reported and for SCL, the index of approximately 0.06 was obtained. The results suggest relatively low abrasion, minimising wear costs in the crushing and material handling stages of the heap leach process plant.

Positive Leach Test Results at Dianne

Four columns were established to evaluate leaching performance under various conditions:

- Column 1: Oxide material only with standard leach parameters.

- Column 2: Oxide material only with enhanced leach parameters.

- Column 3: Blend of oxide and transition material with standard leach parameters.

- Column 4: Blend of oxide and transition material with enhanced leach parameters.

The results indicated that enhanced conditions for columns 2 and 4 achieved high copper recovery over a period of 4-5 months. Additionally, it was observed that the material was responsive to elevated application rates and reagent (acid and iron) addition.

An economic recovery target of 85% Cu was set for all four columns at the outset of testing, and it was expected that Ox columns will take 3-6 months, while SCL will take 6-9 months to achieve the target. The results showed that the continuing upward trend in columns 1 and 3 shows the potential to attain economic terminal recovery in the expected timeframes.

The columns 2 and 4 achieved or exceeded 85% recovery within approximately 4 months.

The results highlight the amenability of Dianne Deposit materials to conventional leaching using sulfuric acid and iron as reagents.

RRR shares traded at AU$0.035 at the time of writing on 2 December 2024.