Highlights

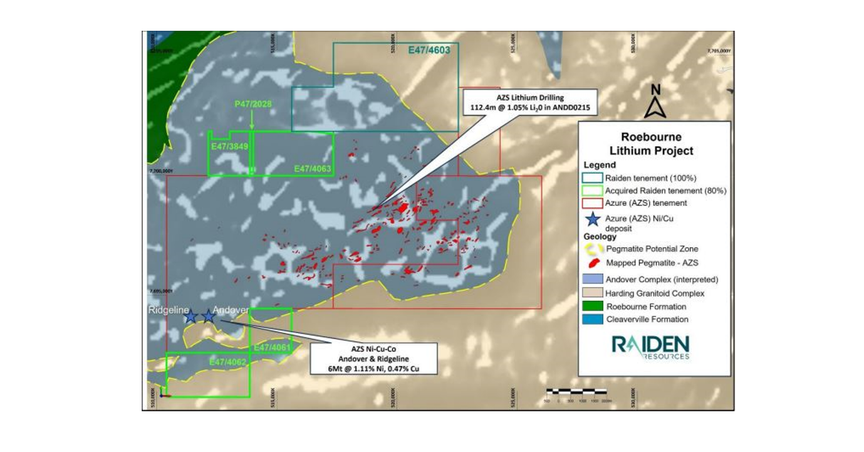

- The five tenements are situated next to ASX-listed Azure Minerals’ Andover lithium discovery (60% Azure)

- The Roebourneproject portfolio cover the Andover Complex rocks, which host Azure’s lithium pegmatite discovery (112.4m @ 1.05% Li2O)

- Project is also prospective for nickel sulphide mineralisation and is adjacent to Azure Minerals Andover-Ridgeline deposit (6Mt @ 1.11% Ni & 0.47% Cu)

- Raiden is planning to undertake project-wide assessment of lithium hosting pegmatite potential, as well as nickel potential in the near term

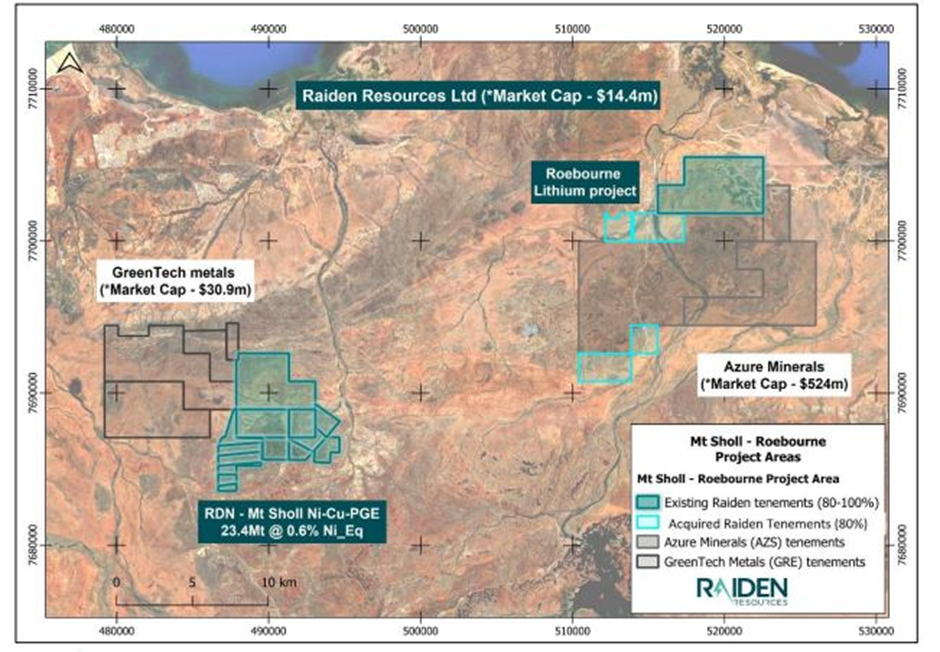

Raiden Resources Limited (ASX: RDN / DAX: YM4) -- which also owns the resource stage Mt Sholl Project (Pilbara, WA) -- has announced the expansion of its lithium (Li) portfolio through the acquisition of an 80% interest in the Pilbara (WA) located tenements of Welcome Exploration Pty Ltd. Notably, these five tenements are adjacent to to ASX-listed Azure Minerals’ Andover lithium discovery and now form part of the company’s Roebourne lithium project.

Raiden;s interprets that the acquired projects are understood to host Andover Complex rocks, which were host to Azure's recent Li discovery and are considered prospective for pegmatite hosted Li mineralisation.

This is what Dusko Ljubojevic, Raiden Managing Director, said among other things:

Source: Company update

RDN shares soar

At the time of writing on 28 June 2023, RDN ASX shares traded over 28.5% higher at AU$0.009.

Transaction Details

ASX-listed Raiden Resources has informed that the company has entered into a transaction for the acquisition of an 80% interest in five tenements that are adjacent to Azure Minerals' Andover Project (Li). For the transaction, the company will make a cash consideration of AUD50,000 and issue ordinary shares valued AUD365,000 (based on VWAP for 20 trading days immediately following the agreement execution). The 20% interest of Welcome Exploration will be free-carried to a final investment decision to mine.

Significant and prospective lithium exploration portfolio

The combined project area for Raiden is nearly 39 km2, while Azure controls / 102km2 in the Andover Complex. RDN asserts this latest acquisition provides the company with a "significant and prospective" Li exploration portfolio in the Complex.

Source: Company update

This acquisition comes off the backdrop of Raiden's assessment of Li prospectivity of its Roebourne project, which helped in defining potential geological setting in the nearby properties. Raiden used magnetic data and concluded that the Andover Complex, which hosts Azure lithium discovery, extends to the five properties that the company is now acquiring. Raiden states the "significant exploration package" represents a brownfield opportunity in relation the Andover Li discovery (112.4m @ 1.05% Li2O).

RDN intends to undertake a project-wide assessment with respect to Li hosting pegmatite potential in the near term.

Raiden further states that similar to its Mt Sholl project, the project area has excellent infrastructure, with exploration support services available in close proximity. The announcement mentions that the acquisition adds potential to the company's Ni-Cu-PGE portfolio in Pilbara, as the properties are also considered prospective for nickel sulphide mineralisation, with 2 of the acquired tenements sitting adjacent to Azures Andover-Ridgeline high-grade deposit (6Mt @ 1.11% Ni & 0.47% Cu).

Mt Sholl & Roebourne Lithium Program

Notably, high-grade Li bearing pegmatites have recently been discovered at the Ruth Well project of ASX-listed GreenTech Metals. The project is located next to RDN's Mt Sholl project, 20km south of Karratha, adding further potential to the lithium portfolio.

In view of this, Raiden plans to commence preliminary mapping and evaluation exercise across all its projects, with a focus on the lithium mineralisation.

The company’s announcement also notes that Raiden's Board plans to implement a new employee incentive plan, which is to be adopted by shareholders, in order to motivate and retain its key professionals.