Highlights

- R3D Resources has secured commitments to raise AU$1,000,000 from the issue of Convertible Notes.

- Funds from the commitment will support the production ramp-up at the company’s Tartana Copper Sulphate plant from early next year.

- The company expects to see strong cash inflows given the copper sulphate production aimed to start early next year and the agreement of a 100% offtake.

Australia-based copper-gold exploration and development company R3D Resources (ASX:R3D) has secured note funding for supporting production ramp-up at its Tartana Copper Sulphate plant. The company has received firm commitments to raise AU$1 million from the issue of Convertible Notes. It is expected to be completed in January 2023.

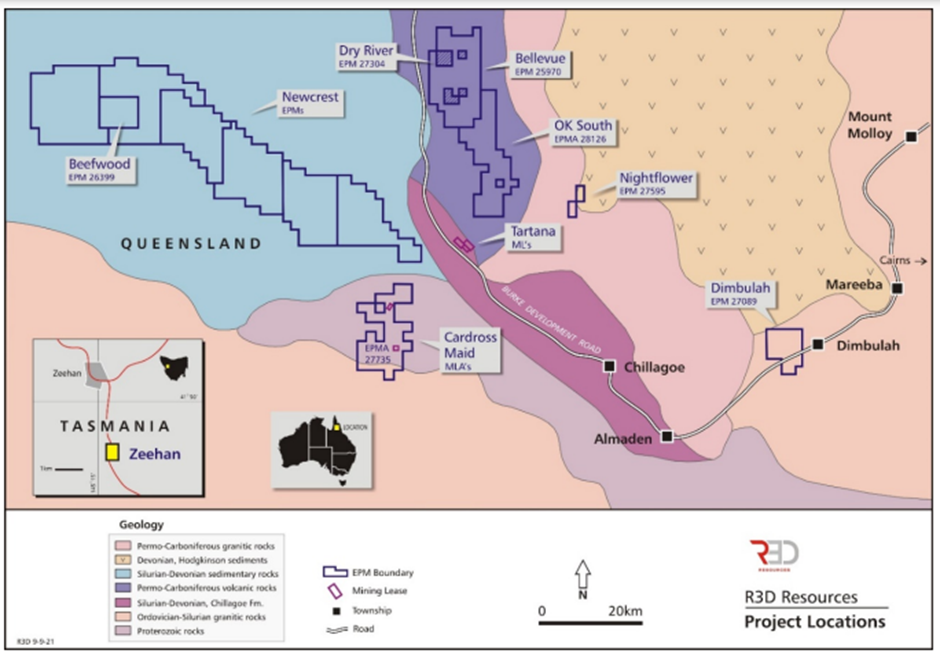

Image source: company update, © 2022 Kalkine Media®

Image description: Project locations of R3D

R3D has multiple projects among which the Tartana mining leases is the most advanced. Recently, the company announced about 300% surge in cash margins on shipments of Zeehan low-grade furnace slag/matte. R3D has been shipping zinc slag to South Korea.

Image source: company update

Image description: Project locations of R3D

Further details on Convertible Notes:

© 2022 Kalkine Media®, Data source: Company update, Image source: © Adonis1969 | Megapixl.com

Earlier this month, R3D announced an increment of cash margin on its Zeehan Zinc slag exports to about AU$15 per tonne. Starting this month, the company expects 20,000 tonne shipments every four to six weeks.

Additionally, it expects to see strong cash inflows given the copper sulphate production aimed to start early next year and the agreement of a 100% offtake. This will bring R3D closer towards becoming a self-funded explorer of its highly prospective project portfolio.

As of 16 December 2022, R3D shares were trading at AU$0.060 each.