Highlights

- In six months ended 30 June 2024, Haranga Resources focused on advancing its Saraya Uranium Project.

- Metallurgical testwork showed over 96% uranium extraction in the initial acid leach test, with follow-up tests achieving 84% extraction.

- Reverse Circulation (RC) drilling began in December 2023; significant anomalism was found at Sanela, with 17m of anomalous intercepts.

- Auger drilling at Sanela confirmed uranium anomalism in 234 of 337 holes.

- Termite mound sampling (TMS) covered 97% of the Saraya permit, identifying 15 target areas.

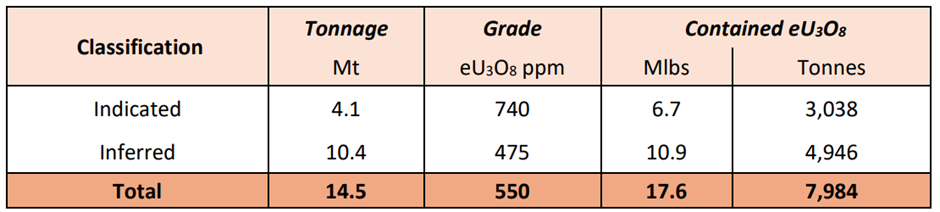

- The Mineral Resource Estimate (MRE) was upgraded to 17.6 Mlbs eU3O8.

- Future exploration will focus on expanding the Saraya deposit and further testing at Sanela.

Haranga Resources Limited (ASX:HAR) has released its interim report detailing operational progress for the period ended 30 June 2024. During this six-month period, the company made notable progress in advancing exploration activities at its flagship Saraya Uranium Project in Senegal.

HAR ended the period with cash reserves of AU$323,188.

Preliminary Metallurgical Testwork Yields Promising Uranium Recoveries

With no prior metallurgical testwork on the project, HAR engaged Independent Metallurgical Operations Pty Ltd (IMO) to conduct preliminary leach tests to determine uranium recoveries from a composite sample. The testwork, conducted at SGS Lakefield in Canada under IMO’s guidance, delivered promising results.

An initial acid leach test achieved over 96% uranium oxide extraction at elevated temperatures with a high sulphuric addition rate of 681 kg/t. Follow-up tests with reduced acid consumption yielded slightly lower extraction rates of 84%, with potential for improvement with extended retention time. In these tests, the acid addition rate was reduced to 224 kg/t.

Further alkaline leach testing also achieved 84% uranium extraction, indicating potential for optimisation through adjustments in reagent use, grind size and leach conditions.

RC Drilling Campaign and Auger Program Reveal Significant Uranium Anomalies

In December 2023, the company began an RC drilling campaign at the Saraya deposit for confirmation data for a planned Mineral Resource Estimate (MRE) upgrade.

Following promising results at the Sanela prospect, HAR initiated a 345-auger-hole program in April 2024 to explore potential extensions of mineralisation. During the June quarter, 161 holes were completed, nearly all indicating uranium anomalism. As of post-June, 337 holes had been drilled with 234 confirming uranium anomalisms at levels 5 to 45 times background levels over a 2km stretch.

Regional and Infill TMS Identifies 15 Target Areas

A regional TMS program was also completed across 97% of the Saraya permit area, identifying 15 target areas for infill TMS.

Resource Estimate Increased to 17.6 Mlbs eU3O8

The classified resource was initially reported at 16.1 Mlbs (7,311 tonnes) of eU3O8, with an average grade of 558 ppm, based on a 250-ppm cut-off, which included an indicated resource of 6.0 Mlbs at 752 ppm eU3O8 grade. The MRE was prepared by A. Gillman of Odessa Resources Pty Ltd, drawing on both historical drilling data and Haranga’s recent validation efforts, including RC drilling and metallurgical testwork.

Following the incorporation of assays from completed RC drilling, Odessa Resources updated the MRE in August 2024. The revised estimate increased the total resource to 17.6 Mlbs eU3O8.

Saraya MRE at 250ppm eU3O8 cutoff, Image source: Company update

Future Exploration Plans

Looking ahead, the company plans to intensify exploration along the 30 km uranium corridor, targeting seven regional prospects where TMS is still pending. Areas with positive results will be further explored through auger, aircore, and potentially RC drilling.

At Saraya, the focus will be on testing possible extensions of the existing uranium deposit, while at Sanela, the company intends to drill further following encouraging previous results. The updated MRE will guide future studies as Haranga moves towards development decisions.

HAR shares traded at AU$0.035 apiece at the time of writing on 12 September 2024.