Highlights

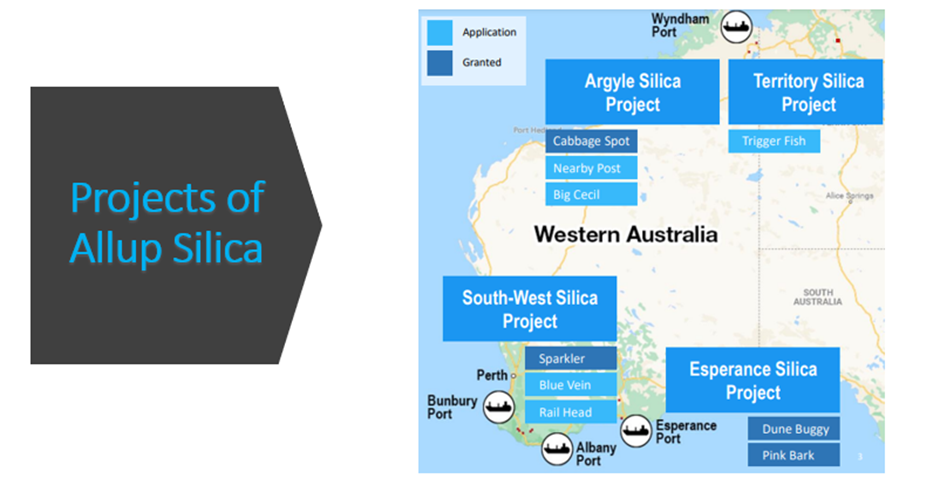

- Allup Silica is focused on the future development of its silica sand tenements in Western Australia.

- Allup’s projects are 100% owned, placed at multiple locations with a major focus on logistics and connectivity with potential export capacity.

- Silica prices are rising due to higher production costs and strong demand for electric vehicles and solar panels.

High-grade silica sand is a key raw material in many industries, including specialised glass and photovoltaic panels. Silica use is gaining traction in the renewable space as it is the main component for building solar panels.

Eyeing this opportunity, ASX-listed silica exploration firm Allup Silica (ASX:APS) is going full steam ahead to advance its silica sand tenements across several exploration projects in Western Australia.

How big is the opportunity?

High-purity silica sand is essential for some of the most used equipment, such as electronics, computer processors, and solar panels. Demand is growing across the globe for critical minerals including silica.

This year, the Australian government added silicon to the list of critical minerals. Silicon has already been listed as a critical mineral in the EU.

Allup referring to data from Evolution Capital Advisors suggests that the global silica sand market would grow from US$7 billion in 2018 to US$20 billion in 2024. Moreover, the company states that the Asia-Pacific region, supported by the dominant Chinese market, is likely to remain the largest regional consumer of industrial sand through 2025.

There are supply constraints in the global silica sand market and restrictions due to environmental and social awareness impacting silica sand mining. Over the last two decades, the global rate of sand use has increased by three folds, and it far exceeds the natural rate at which environmental factors are replenishing sand.

Further, silica prices are also rising due to higher production costs and surging demand for electric vehicles and solar panels.

How Allup is tapping this opportunity

© 2022 Kalkine Media®, Image source: company update

Allup Silica is uniquely advancing in the silica market with its multiple project locations for high-purity silica sand. All the company's projects are 100% owned and have access to logistics and connectivity through road, rail, and port with potential export capacity.

- Sparkler Silica Sand Exploration Project

The Sparkler Project has three granted exploration licences - E70/5447, E70/5527 and E70/5920. The company has completed stage 1 exploration and analysis program for this project.

Sparkler project has approved Provision of Work (POW) for further exploration drilling on Sparkler A, B and C.

Moreover, latest metallurgical tests based on improvements in the company’s process circuit design have produced a consistent high-grade <100 ppm Fe₂O₃ silica sands product from samples taken from the project. The company highlights that this purity grade is considered suitable for the photovoltaic (solar panel) industry.

- Dune Buggy (Esperance Sands)

Dune Buggy is one of the tenements of the Esperance project, located about 20km from the Esperance port. The company has already submitted POW with exploration planned for early 2023.

The project has a very different type of raw silica sand, which is a ratio of silica and calcium carbonate. The company plans to separate the two - silica and calcium carbonate - into two viable streams. This would enable calcium carbonate to be sold into agriculture as a high-grade calcium carbonate used as a soil conditioner.

- Pink Bark Project

Pink Bark is also one of the tenements of the Esperance project with an estimated strike length of 6km and a potential deposit of SiO2 of nearly 29sqkm.

Results from the surface sampling program have indicated the presence of high-grade silica within the identified target area.

Its POW has received approval for further exploration drilling, scheduled for late this year or early next year.

- Cabbage Spot (Argyle)

Cabbage Spot is part of the Argyle project located in the Kimberley region of Western Australia. It has good connectivity, 90km from the Wyndham Port and proximity to main roads rated for Quad trailer transport. It is also closer to Asia-Pacific customers.

Allup has received approval for stage 1 and stage 2 exploration. It has also submitted a heritage notice.

The company plans to start scoping studies in 2023-2024.

Image source: Company update

Allup is committed to the exploration of its multiple projects and is targeting progressive step-by-step processes and approvals needed as it develops each project towards a commercialisation outcome.

APS shares were trading at AU$0.075 midday on 15 December 2022.