Summary

- Beach Energy Limited is making its presence in the top five S&P/ASX 200 gainers at the end of the trading session on 17 August 2020.

- The Company has just released its FY2020 figures with a Net Profit After Tax of $500 million, which remains over 13 per cent down against FY2019.

- However, despite that, the stock has gained considerable momentum on ASX in the wake of an optimistic outlook and its ability to sail through turbulent times.

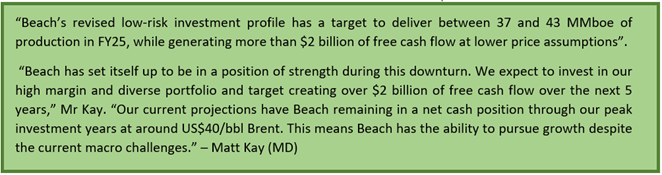

- Matt Kay (MD) – is also reiterating BPT’s ability to sustain the low oil price environment.

- FY2020 highlights and future guidance.

Beach Energy Limited (ASX:BPT) is under a sentiment splash on the exchange with the share price closing the day’s trade ~ 6.9 per cent up against its previous close on ASX at $1.5577 (as on 17 August 2020). It was the best performing stock on the ASX200.

The Company announced its FY2020 financial figures and future outlook on 17 August 2020, which seems to be convincing shareholders concerning future growth.

BPT reported a record Net Profit After Tax (or NPAT) of $501 million for FY2020 with net cash of $50 million, reflecting on its ability to perform in the low oil price environment.

The Managing Director – Matt Kay also reiterated that the robust financials despite COVID-19 pandemic reflects on BPT’s ability to succeed in the lower oil price environment while continuing its actively-controlled growth program.

FY2020 Highlights

- BPT reported an NPAT of $500 million with net cash of $50 million for the financial year 2020.

- Furthermore, the Underlying NPAT for the period reached $461 million, and the Statutory NPAT stood at $501 million.

- The Return on Capital Employed (or ROCE) stood over 19 per cent for the same period due to high-margins from onshore oil along with the diversified gas business.

- The Company witnessed no write downs of producing assets despite reduced commodity prices across the international front during the second half of FY2020.

- The 2P organic reserves replacement ratio reached 214 per cent during FY2020, with 352 million barrels of oil equivalent of 2P reserves.

- BPT drilled 178 wells during the period with a success rate of 81 per cent.

- The Company also declared a final dividend of $1 cents a share.

Performance Time Series Metrics

- BPT produced 26.7 million barrels of oil equivalent during FY2020, down by ~ 9.18 per cent against the previous financial year.

- The Company reported a decline of ~ 14.28 per cent in sales revenue for FY2020 against FY2019 at $1,650 million.

- The NPAT of $501 million remained ~ 13.17 per cent down against the previous financial year.

- The Underlying NPAT took a hit of ~ 17.67 per cent against FY2019.

- Likewise, the underlying earnings per share declined by ~ 17.88 per cent against FY2019.

- The earnings per share for FY2020 stood at 22.0, down by 13.38 per cent against FY2019.

- However, the Company maintained the full-year dividend of $2 cents a share, marking the fourth consecutive year of a constant dividend of $2 cents per share.

On the production counter, the SAWA portfolio performed strongly with a yearly production of 18 million barrels of oil equivalent, up by ~ 11.80 per cent against the previous year.

However, the production across Victoria and New Zealand took a hit of 51 per cent and 11 per cent, respectively against the previous year, leading to a decline of 9 per cent in the overall production against the previous year.

Growth Strategy and Future Guidance

On the growth counter, the final investment decision for the Waitsia Stage-2 is anticipated for December 2020, and gas from the new 250 terajoules per day facility would be processed into LNG at North West Shelf facilities.

- The Company commenced the Waitsia Stage-1 expansion during the year, and the Perth Joint Venture of the Company would be providing 40 terajoules per day of gas to the domestic market in Western Australia in FY2021 while seeking further domestic gas sales opportunities.

- Furthermore, more than six offshore Victoria Otway Basin drilling campaign is underway and planned for March 2020 through a new rig contract inked by the Company with Diamond Offshore.

- Moreover, BPT’s revised low-risk investment profile would now target production of 37 to 43 million barrels of oil equivalent from the existing portfolio in FY2025.

- The current 5-year outlook of the Company is to generate over $2 billion of free cash flow at lower price assumptions.

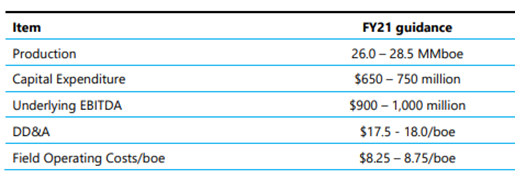

Future Guidance: BPT anticipates the future production to fall in the range of 26.0 to 28.5 million barrels of oil equivalent in FY2021.

- The capital expenditure is projected to fall in the range of $650 to $750 million in FY2021.

- BPT estimates the underlying EBITDA to stand at $900 to $1,000 million.

FY2021 Guidance Snippet (Source: Company’s Report)

The market seems to be rewarding the Company over its decent performance despite several headwinds from the COVID-19 outrage with the stock gaining a strong momentum on the exchange.

Additionally, BPT seems to be optimistic over the future growth, and the Company has kept its production and underlying guidance high for FY2021, which at present, seems to be providing a cushion to the stock.