Pro Medicus Limited

Pro Medicus Limited (ASX:PME), as known to offer radiology IT software and services to hospitals, imaging centers and health care groups, had signed an AUD $15 million, 7-yearsâ contract through its US subsidiary, Visage Imaging with the U.S. based Mercy health system for Visage 7 Open Archive. Under the contract, PMEâs Visage 7 Open Archive has been indicated to be entrenched across Mercy enterprise. Further, over 25m diagnostic imaging exams are now to be migrated to Visage Archive from Mercyâs archive. This would enable having a leading medical imaging archives in the country. The completion of the project is slated to be in the third quarter of FY19. Meanwhile, the group also made a Visage RIS deal with I-MED radiology across all 200 practices while the transition to Visage RIS has been planned for over the next one year. Accordingly, a further $1.4 million in revenue per year has been indicated to be added through the new sites.

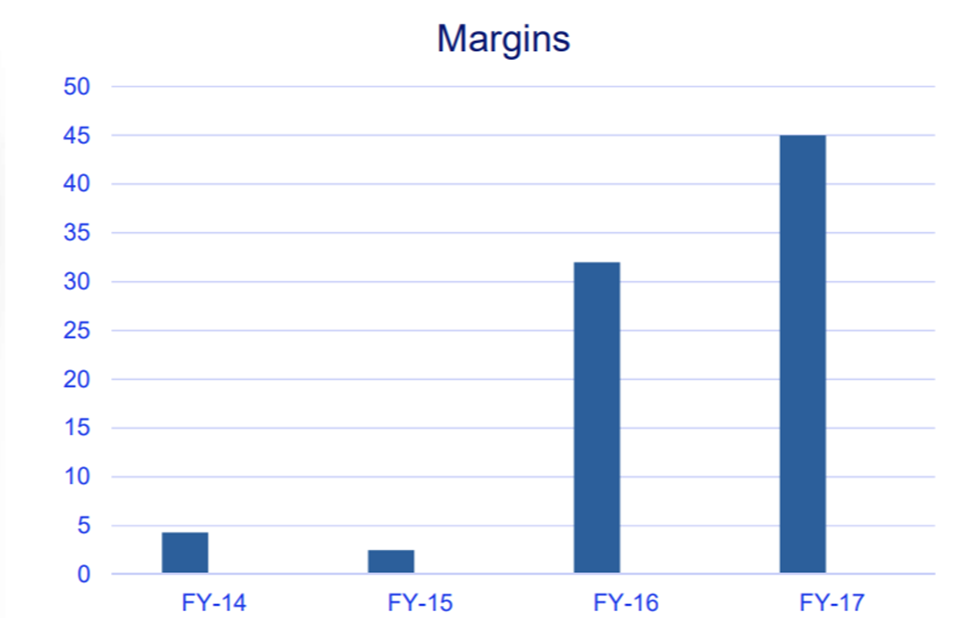

Solid Margins Expansion (Source: Company Reports)

[optin-monster-shortcode id="wxhmli4jjedneglg1trq"]Nanosonics Limited

Nanosonics Limited (ASX:NAN) recently launched its 2nd generation trophon platform device â trophon2 â in North America and Europe post a successful manufacturing and production ramp up. This new software platform would enable them with new functionality to be implemented through firmware upgrades. The group sees trophon2 to continue to drive installed base growth internationally as trophon becomes the new standard of care as well as launch the opportunity for an upgrade market through the current installed base. Nanosonics also got the European CE Mark for trophon 2 post the regulatory approvals in the USA and Canada. They would launch trophon2 in Europe during the first quarter of the 2019. Trophon2 proffers new features that enhance customer usability and were developed basis real-time feedback from European market. Trophon is covered by 14 patent families wherein most are active through to 2025 and in many cases beyond including patents relating to the consumables which go out to 2029. The group has an active program to continue to protect the IP in their technology.

NAN stock delivered an outstanding return of over 30.9% in the last three months (as of August 13, 2018)

Solid target market opportunity (Source: Company reports)

Hansen Technologies Limited

Hansen Technologies Limited (ASX:HSN), an information technology group saw its stock losing over 26.7% in the last three months on lower than expected FY18 outlook. The group forecasts operating revenue to be over $230 million and earnings before interest, tax, depreciation and amortization (EBITDA) of over $58 million, giving an EBITDA margin of around 25%. The earlier estimate of operating revenue in the second half to be slightly below the $118.4 million in 1H18, and the EBITDA margin for the full FY18 to be around the mid-point of target range of 25%-30% now looks a bit different from results expected.

Pressure in EBITDA margin is on the back of the license fee which would have a restructuring charge of over $0.8 million within the Enoro operation â whilst Enoro has exceeded expectations since its acquisition in July 2017. Moreover, for fiscal year of 2019, the total revenue is expected to be slightly below FY18 due to termination of the call center contract within the Solutions business leading to a loss of over $1.8 million of revenue in FY19 against FY18. The total revenue in FY19 is expected to be subdued, while the expense base is expected to remain consistent with FY18 as the group continues to invest in their global platform to support expected future growth. It is to be seen that how the groupâs long-term investments can deliver potential benefits. HSN stock fall placed them at lower levels while the stock has 1.85% dividend yield.

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.