On 28th November 2019 (AEST 12:45 PM), the benchmark index S&P/ASX200 was trading in green. With a rise of 26.2 points, the index was trading at 6,876.8. In the below article, we would be discussing four diversified ASX-listed companies. Of these companies, Collins Foods Limited updated the market with first half performance, Telstra released Investor Day Presentation, Bravura shared Chairmanâs address at the AGM and BHP Group announced change in directorâs interest and substantial holding.

Let us discuss these developments in detail.

Collins Foods Limited

Collins Foods Limited (ASX: CKF) is involved in the operation, management and administration of restaurants in Australia, Europe and Asia.

Decent Numbers in 1H FY20

- The company through a release dated 27th November 2019 updated the market with the operational and financial results for the half year ended 13th October 2019, wherein, CKF mentioned that this half year has been another period of strong earnings growth.

- The key personnel of the company stated that its KFC Australia network has delivered enhanced same store sales growth that, with new restaurant openings, fueled strong growth in revenue.

- Together with the focus of management on maintaining strong cost control, earnings margin of KFC Australia witnessed a growth over the past 6 months.

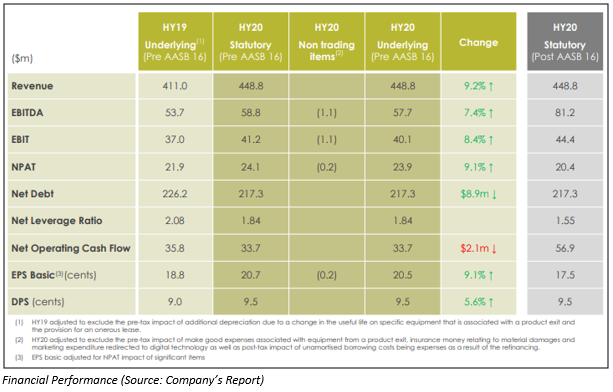

- The company reported revenue amounting to $448.8 million, reflecting a rise of 9.2% as compared to 1H FY19. The statutory EBITDA stood at $58.8 million with a rise of 9.7%, and Underlying EBITDA was increased by 7.4% and the figure stood at $57.7 million.

- CKF experienced a fall in net debt to $217.3 million and net Leverage Ratio was also down to 1.84x.

- The Board of the company declared an interim dividend of 9.5 cents per share, fully franked, reflecting a rise of 5.6% on HY19. It implies the healthy operating cash flows of the business and its growth outlook. The interim dividend will be having a record date of 6th December 2019 and payment date of 17th December 2019.

Also Read: Inclusion of Collins Foods Limited into S&P/ASX All Australian 200 Index.

The stock of CKF was trading at a price of $10.310 per share, reflecting a decline of 0.483% as on 28th November 2019 (AEST 12:47 PM). In the span of last three months and six months, the stock of CKF has delivered returns of 20.05% and 34.55%, respectively.

BHP Group Limited

BHP Group Limited (ASX: BHP) is a producer of major commodities, such as copper, metallurgical coal and iron ore.

Change in Directorâs Interest and Substantial Holding

- The company recently announced that Andrew Mackenzie has made a change to his holdings in the company via acquiring 271,348 Performance Shares under the long-term Incentive Plan and 25,845 Deferred shares under the short-term Incentive Plan on 20th November 2019.

- In another update, BHP announced that BlackRock Inc. and subsidiaries has made a change to their holdings in the company on 18th November 2019.

Petroleum Update

- Key personnel of BHPâs Petroleum operations through a release dated 11th November 2019, stated that Petroleum segment is on the verge to report strong returns as well as to contribute significant value for BHP through the 2020s and beyond, built on a foundation of quality assets, and attractive growth options as well.

- The key personnel of the company also stated that BHPâs capabilities in safety, exploration as well as deepwater operations, in combination with a high-performance culture provides the company a confidence that it can deliver on its plans into the future.

Also Read: How company expects value in oil & gas?

The stock of BHP was trading at a price of $38.550 per share, with a rise of 0.522% as on 28th November 2019 (AEST 12:51 PM). In the span of last three months and six months, the stock of BHP has delivered returns of 9.73% and 1.08%, respectively.

Telstra Corporation Limited

Telstra Corporation Limited (ASX: TLS) provides telecommunications as well as information services, which include mobiles, internet and pay television.

Investor Day Presentation

- The company recently published a presentation primarily containing update on key market dynamics in the Enterprise and Consumer & Small Business segments. The presentation also includes the transformation of those businesses under T22.

- It was mentioned that T22 is pursuing multiple jobs, which include delivering cost reductions and simplifying the business of the company. It is also, importantly, about delivering revenue as well as profit margin benefits.

- When it comes fixed cost productivity, the aim of the company is to reduce underlying fixed costs by a cumulative $2.5 billion by FY22, when compared to FY16.

- TLS also made very significant progress in decreasing its underlying fixed costs. In last three years to FY19, TLS has achieved a reduction of $1.17 billion, and the trajectory remains on track.

- During the time period of FY17 to FY19, while TLS was making additional strategic investments, the capex to sales ratio was around 18%. In the four years prior to that, the ratio was circa 15%. The target is to reduce this to 14%.

- With respect to focus and guidance for FY20, the company anticipates that ARPU would continue to decrease in FY20 because of continuing migration to in-market price points, and an increasing mix of Belong in its customer base.

Also Read: How TLS is working towards the progress of T22 strategy?

The stock of TLS was trading at a price of $3.830 per share, with a rise of 3.235% as on 28th November 2019 (AEST 12:52 PM). In the span of last six months, the stock of TLS has delivered a return of 5.95%, respectively.

Bravura Solutions Limited

Bravura Solutions Limited (ASX: BVS) provides services and software products to clients. These clients operate in fund administration and wealth management industries.

Chairmanâs Speech on AGM

- On 26th November 2019, the company completed its Annual General Meeting for financial year 2019, wherein, the Chairman of the company while addressing to shareholders stated that post successful listing in November 2016, the company has now reported four years of excellent full year results.

- On the financial front, the Chairman stated that the business of the company reported revenue amounting to A$257.7 million in FY 19, with a rise of 16% when compared to FY18.

- As at 30th June 2019, net cash balance of the company stood at A$194.8 million, which reflected companyâs strong financial position and puts the business in an excellent place for taking benefit of a pipeline of compelling investment opportunities, organic as well as acquisitive.

- The Board of the company declared a final dividend amounting to 4.8 cents per share, unfranked. During the earlier part of the year, the company declared the interim dividend of 5.3 cents per share. BVS reported full-year dividend payout ratio of 70% of FY19 NPAT.

Also Read: Equity Raising plan of Bravura for investing in growth opportunities.

The stock of BVS was trading at a price of $4.895 per share, with a decline of 1.707% as on 28th November 2019 (AEST 12:53 PM). In the span of last three months and six months, the stock of BVS has delivered returns of 3.75% and -16.02%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.