Skin Elements Limited (ASX: SKN) is an Australian company with its engagement in the development of natural, organic, health and wellness products focused on the international market. The company sells a variety of products under its two brands, McArthur Skincare and the award winning Solèo Organics, which is 100% natural. With specialisation in science and innovation-driven strategies, the company manufactures organic products from the natural ingredients that are healthy for the users and sustainable for the planet.

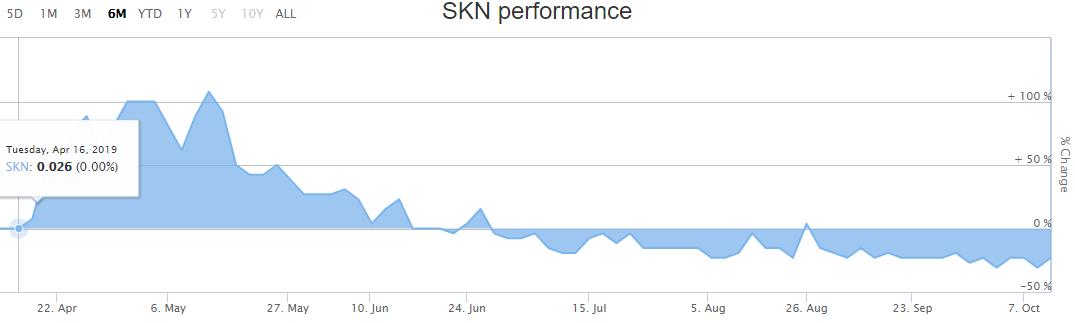

SKNâs stock performance

Figure 1 Six months Performance of SKN (Source: ASX)

Figure 1 Six months Performance of SKN (Source: ASX)

In addition to this, the companyâs sales revenue and research allocation income of $1.48 million for FY19 was up by 15% as compared to the FY18. The companyâs chairman believes that the company has put forward the basis for delivering strong sales growth in the upcoming year, and the achievements of the company in the current year appears to be pleasant.

On 11th October 2019, the company's stock last traded at a price of $0.013, slipping by 18.75 percent from the previous close, with a daily volume of ~492,864 and a market capitalisation of approximately $2.6 million, with an average volume (year) noted at ~302,703. The 52 weeks high price for the stock is $0.063 and 52-week low was noted at $0.009.

According to the companyâs annual report, the company spent an amount of $2.9 million on new product development, which added to the companyâs prior investment of $14 million in developing its skincare technology. Moreover, the company has decreased its overall costs as compared to previous years with the development of the current program and bringing its products into scale manufacturing.

SKNâs capital surplus soared up in FY19

The companyâs net working capital surplus of $532,529 for FY19 increased from net working capital of $109,278 for FY18. The companyâs financial statements reflect decrease in the net loss before income tax expense of $1,852,102 for the FY19, which amounted to $3,178,295 for FY18. Moreover, the company reports show the net cash outflow from operating activities of $1,818,443 for FY19, which amounted to $1,300,027 for the FY18.

The Key Highlights of the companyâs financial performance for the FY19 (period ended 30 June 2019) are as follows:

- The companyâs sales income of $797,710 for the FY19, was generated from current online sales channels and wholesaler and supplier networks across Australia and globally and the first order into China, decreased from $838,292 in FY18;

- The companyâs cash and non-cash expenses of $2,913,558 for the FY19 witnessed a decrease from $3,623,683 for the FY18 due to the cash allocations for acquiring and integrating the MacArthur business accomplishment and the ASX Listing in previous periods.

- The companyâs net loss from continuing operations attributable to shareholders declined to $1,852,102 for FY19 as compared to the net loss of $2,728,114 for FY18.

- The companyâs expenditure on the direct research and development of $899,672 with an R&D Tax rebate of $649,452 receivable on 30th June 2019.

- On 8 August 2018, the company raised $1,075,663 as an additional capital through fully underwritten non renounceable entitlement offer to the current shareholders. Later in the months of October, May and June, through private placements, the company raised an additional $782,975 in working capital.

Adding to the above information, a look at the balance sheet of the company reflects the following:

- The companyâs cash assets reduced by $0.079 million to $0.116 million from $0.195 million in FY18.

- The trade receivables declined by $0.020 million to $0.016 million in the FY19 from $0.036 million in the FY18.

- The trade and other payables reduced by $0.302 million to $0.508 million in the FY19 from $0.810 million in the FY18.

- The R&D Tax receivables appreciated by $0.119 million to $0.649 million in the FY19 from $0.450 million in the FY18.

- The non-current assets of the company diminished by $0.385 million to $8.995 million in the FY19 from $9.380 million in the FY18.

- The company had working capital of $0.085 million for FY19, which reduced from $0.109 million in FY18.

Directorâs Interest Notice & Resignation

On 10 October 2019, SKN notified the market that one of its directors, Luke Martino ceased to be the director if the company effective 9 October 2019.

Further, SKN updated that Mr Martino has resigned from his designation of director (non-executive) of the company.

China Distribution Agreement on hold

During March-end 2019, the company entered into a $20 million order Term Sheet with Henan Huatoa Health Management Limited (HHHM) for a period of subsequent three years and a strategic investment of $2.4 million, which is subject to certain circumstances such as shareholder approval.

In a recent announcement on 9 October 2019, the company reported disagreement among both the parties to reach an agreement over several issues. Even though a major effort by both parties and advisors was initiated in the shape of a convertible loan note deposit of $200,000 and an initial order of $300,000 for the product delivered into China.

Following the discussion between both the parties, the companies decided to dismiss the agreement, as well as not move ahead with the Distribution Agreement and strategic investment. Moreover, the company has been advised that the nominees of the Board of Skin Elements Limited, Mr Zeling Li and Ms Jialin Li, would provide resignation notices.

Product and Brand Extension

Nevertheless, the company is optimistic about the current sales negotiations resulting in significant agreements with international organizations operating especially in UK, USA and Europe. In addition to this, the company has accomplished the development of an extended variety of its Soleo Organics sunscreen products. The company is now releasing three additional new formulae amounting to a total of 18 individual SKUs as compared to one formula and three SKUs earlier.

Figure 2 Products of SKN (Source: Companyâs Report)

Moreover, the papaya-based products acquired from McArthur Health Products have been combined by the company over the last twenty months. Presently, the company is releasing a total of 22 products under two new natural skincare product varieties, namely, PapayaActiv Therapeutic and the Complete Esscience.

Having started the production of the newly expanded variety of the products, the company looks forward to distributing the products through multiple channels of online platforms, as well as distributors across Australia.

Also, the company is of the vision for raising working capital amounting to ~$1 million through a fully underwritten non renounceable rights issue in order to facilitate the manufacturing of stock. However, the decision is still in the pipeline, and the announcement shall be made once the company reaches consensus with the situations.

Issue of Shares

- SKN raised a capital of $1,075,663 on 8th August 2018 through a fully underwritten non renounceable entitlement offer to its current shareholders;

- The company raised an amount of $363,800 by placing the 13,954,717 ordinary fully paid shares on 4th October;

- Skin Elements issued 873,353 ordinary fully paid shares on 4th October 2018 to an external consultant of $29,694;

- The Company issued 425,000 shares to an associate of a director on 7th December 2018 of $8,500;

- SKN was able to raise $140,000 through the placement of 7,000,000 ordinary fully paid shares on 3rd May;

- Skin Elements raised an amount of $311,675 by the placement of 11,131,250 ordinary fully paid shares on 14th

- SKN managed to reduce its cash and non-cash expenses to $3,014,993 in the FY19 from $3,623,683 in FY18. The decrease in the cash and non-cash expenses was achieved due to higher scale manufacturing and distribution of the products under extended brands.

It is noteworthy that the company has made significant operational progress including expansion of product line and increase in the allocation of research grants. However, the companyâs stock is trading near to its 52 weeks low price of $ 0.009. Hence, the investors should keep a close eye on this stock.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.