Australia is witnessing rapid growth in the technology industry, which is majorly focused on meeting customer demand. In this article, we are discussing two IT sector players, which are also registering robust growth in terms of new customer wins and revenue generation.

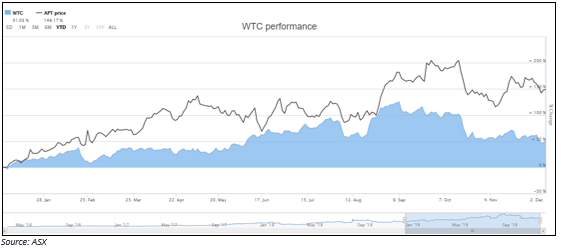

Letâs have a look on the recent business updates of Afterpay Limited and WiseTech Global Limited, which have delivered returns of 149.17% and 51.03% on a year to date (YTD) basis, as of 9 December 2019, respectively.

Afterpay Limited (ASX : APT)

Afterpay Limited is an IT based company, which operates in the payment segment and offers services like âbuy now, receive now and pay laterâ.

The stock of APT climbed ~9.66% during the last one month (November 2019), on account of strong business growth in the recent past, in addition to positive results from the Independent Auditor concerning the AUSTRAC notice. The external independent auditor, in its final report, has confirmed that the companyâs current program is aligned with the AML/CTF Act. The auditor further notified that APT is a low risk business, concerning its exposure to the use of money laundering or terrorist financing.

Meanwhile, the company reiterated that it did not recognise any activities related to money laundering or terrorism through its systems.

November 2019 - Highest Ever Monthly Performance

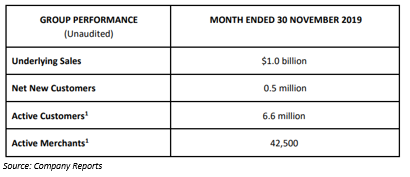

Afterpay Limited released its monthly numbers for November 2019, wherein the company reported $1.0 billion of underlying sales, the highest monthly performance since the inception of APT. The company registered total underlying sales of $3.7 billion during the first five months of FY2020.

Active customer base stood at over 6.6 million at the end of the reported month, up ~0.5 million from October 2019. The company reported addition of more than 22,000 new customers to the Afterpay platform on a daily basis in November 2019.

From the US segment, the company derived more than 3 billion of customers, which is equivalent to the combined market of Australia and New Zealand after approximately 19 months since launch. The company reported more than 500,000 active customers, after approx. 7 months from the launch of Afterpay across the UK.

APT also reported strong growth in new and repeat customers across Australia and New Zealand. As per the merchant portfolio is concerned, the company reported ~42,500 active merchants engaged in offering Afterpay to their customers.

Other Operating Highlights

- On Black Friday (29 November 2019) and Cyber Monday (02 December 2019), the business reported underlying sales of more than $160 million in two days, up more than 160% on the equivalent BFCM days in 2018.

- The company reported new customer growth of more than 140,000 in two days, representing more than 160% on the equivalent BFCM period in 2018.

Private Placement Completion

At the end of November 2019, the company announced the successful completion of the private placement to US based technology investor Coatue Management. The placement involved 7,017,544 shares of APT at a price consideration of $28.50 per ordinary share.

These shares rank equally in all respects with the existing fully paid ordinary shares in the company from their date of issue. The company would direct the proceeds towards targeting global platform expansion opportunities beyond mid-term plan deliverables.

Stock Update

The stock of APT was trading at $29.795 on 9 December 2019, down 0.351% from the previous close, with a market capitalisation of $7.77 billion. The stock has generated stellar returns of 27.51% and 130.71% in the last six months and one year, respectively. The stock is trading at the upper band of its 52-week trading range of $11.360 to $37.410

WiseTech Global Limited (ASX : WTC)

WiseTech Global Limited is an IT based company, which provides services to the clients primarily in the logistics sector. Recently, the company informed regarding the issue of 2,260 fully paid ordinary shares at a price consideration of $27.42 per share.

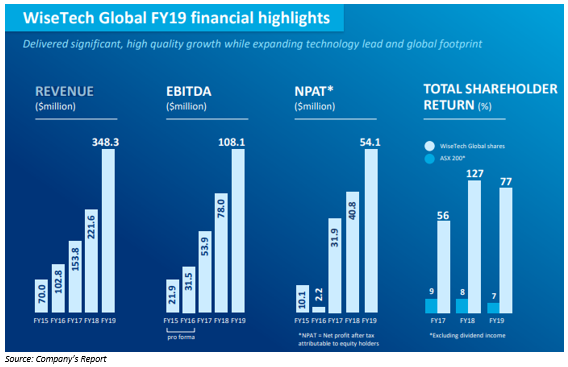

The company held the annual general meeting of shareholders on 19 November 2019, during which the WTC performance during FY19 ended 30 June 2019 was discussed. During the year, business continued to experience strong growth, with focus on innovation.

FY19 Operating Highlights

WTC reported revenue of $348.266 million in FY19, compared with $221.598 million in FY18. The company reported higher expense from product design and development at $84.170 million as compared to $53.372 million in FY18. Net profit for the period stood at $54.089 million, up 33% from $40.794 million in the previous financial year. The business reported more than 12,000 customers across the globe followed by more than 50 billion annual data transactions in CargoWise category.

Other Business Highlights in FY19

- The company invested more than $113 million in FY19 with more than 830 product upgrades and enhancements.

- WTC accelerated development capability across more than 35 development centres.

- Existing customersâ revenue grew $46.8 million in FY19 and provided 86% of organic revenue growth in FY19.

- Top 10 customers contributed 22% of revenue in FY19 as compared to 29% in FY18.

- The company reported building ecosystems for cargo chain and border compliance during FY19.

- The company is focusing on machine learning, natural language processing, automations, master data management, etc.

- WTC reported new customer wins including some prestigious clients like French logistics conglomerate Bolloré, Asia Shipping, China International Freight and Bon Voyage Logistics.

- During FY19, the company added 25 WiseService partner organisations, 16 global independent freight forwarding and industry trade networks.

Stock Update:

The stock of WTC was trading at $25.660 on 9 December 2019, down 0.233% from its previous close, with a market capitalisation of ~$8.18 billion. The stock is available at price to earnings multiple of 145.31x on trailing twelve months basis, with an annual dividend yield of 0.13%. The last one-year return of the stock stands at 43.69%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.