Portfolio:

The combination of investment products such as stocks, bonds, debenture, mutual funds, cash to generate income in future is known as a portfolio. While constructing a portfolio, an investor allocates a percentage of his investment into various investment products. The construction of the portfolio depends basically on four parameters. It comprises of:

- Investorâs return objective

- Investorâs Budget

- Risk Appetite or the risk bearing capacity

- The holding period.

Portfolio Management:

Portfolio management is an art and science of deciding the investment mix and strategy and actually managing the hard-earned money of individuals/contributions from organisations pooled into a fund by a portfolio manager. The fund/portfolio manager decides on the basis of portfolio construction and designs the portfolio in such a way that the investor is able to realise a better return in future.

Portfolio Construction:

Portfolio construction refers to the process of selecting investment products which could help in achieving maximum return with optimum risk.

There are two ways to construct a portfolio:

- Traditional Approach: In a traditional approach, the portfolio is constructed based on the investorâs requirement. It looks into investorâs return objectives and expectations, the risk appetite of the investor, the time duration for which he wants to make an investment along with the tax considerations.

The approach also requires the formulation of a set of objectives along with a set of restrictions. Next is the selection of the portfolio based on these set objectives in to achieve an optimum investment mix. The approach considers the analysis of risks and returns, followed by portfolio diversification in which a certain weight is assigned to different asset classes within the portfolio.

- Modern Approach: Modern approach is also known as the Markowitz approach under which selection of the securities depends on the analysis of return, standard deviation and coefficient of correlation. In this approach, the investorâs requirement is proposed to be met based on the market returns or total returns of the assets which includes dividend.

Based on investor priorities, along with the thorough analysis of the asset classes, a set of diversified assets are selected, which have the prospects and the potential to generate the required return in future.

Assessment of Risk and Return:

Portfolio risk refers to the measure of the extent the total variation in the value of the portfolio. While finding the risk of the portfolio, both asset risk and asset correlation coefficients are considered.

The portfolio return is the weighted average of the expected return on the securities within the portfolio. These securities have a certain weight which represents the proportion of the total investment that is invested in a particular security. For example: If an investorâs total investment in the portfolio is $100 and in security A, he/she invests $10, then the weight of that security is $10/$100 which is equal to 0.1 or 10%.

So, each security in the portfolio has certain weights.

Portfolio Return formula can be represented as:

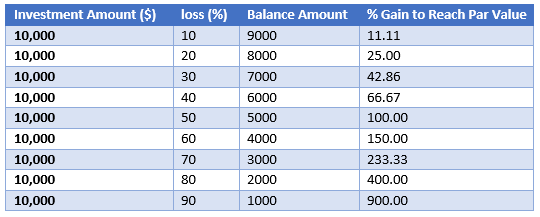

Portfolio construction requires a proper assessment of the possibility of profit or loss. In case the portfolio is not constructed well, and it makes losses then more effort in terms of making a profit is required to reach the original starting value of the portfolio. To explain, let us understand in terms of an example. Suppose an investor invests $10,000 in a portfolio and he makes a loss of 10%. Then in that case, to reach $10,000, he/she needs to make a profit of 11.11% on the reduced value of the portfolio. Imagine a scenario where a portfolio makes a loss of 90%, then the investor needs to make a profit of 900% on the reduced value of the portfolio to reach the original starting value of the portfolio. Letâs understand this through the below table.

In Australia, S&P/ASX 200 Information Technology (Sector) since the beginning of CY2019 has continuously outperformed the benchmark index S&P/ASX 200. S&P/ASX 200 Information Technology (Sector) has given a YTD return of ~ 24.89% whereas S&P/ASX 200 has given a YTD return of 17.49%.

As compared to many sectors, IT sectorâs performance is much better. Thus, investors may have preference to IT stocks in their portfolio.

If the sector is outperforming, it means that the stocks falling under this sector are also performing well. However, not all stocks may perform positively at the same time. So, while constructing the portfolio, we need to figure out those stocks which have the potential to grow faster than the sector as a whole.

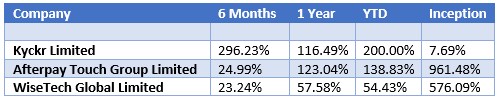

In this article, we will take up three stocks with appreciable returns in the past.

Kyckr Limited (ASX: KYK)

Kyckr Limited (ASX:KYK) is a regulatory technology company which has access to more than 200 official registries, 120 countries, 170+ million legal entities. The company provides its client with the most recent, accurate and legally trustworthy information related to any organisation. It provides the primary source of data.

Stock Performance on 22 October 2019:

By the end of the trading session, the closing price of the shares of KYK was $0.195, down 7.143% as compared to its last closing price. KYK has a market cap of $ 48.16 million and approximately 229.32 million outstanding shares.

Afterpay Touch Group Limited (ASX: APT)

(ASX:APT) is a fintech payment company which focuses on making the purchasing feel of its end users awesome. Through APT, the retailers can offer their customers an option to buy now and then pay later.

Stock Performance on 22 October 2019:

By the end of the trading session, the closing price of the shares of APT was $29.210, up 1.919% as compared to its last closing price. APT has a market cap of $7.24 billion and ~ 252.73 million outstanding shares.

WiseTech Global Limited (ASX: WTC)

WiseTech Global Limited (ASX:WTC) is the provider of the software solution to logistics industries around the world.

Stock Performance on 22 October 2019:

There was no trading in the stock on October 22, 2019. By the end of the trading session on 21st October 2019, the closing price of the shares of WTC was $26.300. WTC has a market cap of $8.37 billion and ~ 318.19 million outstanding shares.

Past performances of KYK, APT and WTC

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.