A derivative is an instrument whose value is derived from the value/price of one or more underlying asset. A derivative is a contract between two or more parties which derives its price from the fluctuation in the underlying asset. In case, the price of the underlying asset increases, it will tend to increase the price of the derivative as well and vice versa.

To explain the concept of the derivative, let us consider crude oil. We know that petrol or diesel is obtained/derived from crude oil. In case the price of crude oil increases, then it would impact the price of petrol and diesel as well.

These underlying assets include stocks, commodities, bonds, interest rates, currencies, and market indexes.

Derivatives are traded over the counter (OTC) as well as exchange. In the OTC transaction, two parties can directly enter into the transaction without involving any exchange or any intermediary. OTC derivatives involve a huge counterparty risk as there is a possibility that the other counterparty may default.

On the other hand, those derivates that are exchange-traded are standardised, and it eliminates the risk that exists in the OTC derivatives.

Why investor opts for derivative?

- Most of the derivatives are used for hedging a position or increase the leverage.

- Speculating on the price variation in the underlying asset.

- Derivatives assist in protecting the risk linked with the underlying asset.

Types of Derivatives Contract:

Forward Contracts:

A forward contract is an agreement between the buyer and the seller to buy or sell any particular asset at a pre-defined future date and a pre-defined future date. These contracts can be personalised to amount, commodity, and delivery time. These contracts are OTC contracts.

Futures Contracts:

Forward and futures contracts are both similar in terms of buying and selling of an asset at a particular date and time. However, the only difference is that futures contracts are exchange traded while forward contracts are traded over the counter.

Options Contracts:

An option contract is an agreement between the buyers and sellers under which the buyer in the contract has the right to buy or sell any particular asset at an agreed price at a later date. Options contract come into the picture with respect to transaction related to securities, commodities, etc.

There are two types of options:

- Call option: Call options are the financial contracts that provide the buyer of the contract the right but not obligation to purchase the underlying asset.

Call option, at the time of the option purchased from the seller (known as the writer) itâs position is in the open state. In this transaction, the seller is being given a premium to undertake the obligation of selling shares at the strike price (the price at which the buyer would buy the underlying asset at the expiration date).

In case the seller of the call option holds the shares to be sold, then that position is known as a covered call.

- Put option: Put options are financial contracts that give the owner of the contract (the buyer of the put option) with the right but not the obligation to sell the underlying asset at a pre-determined price within a particular time. Here, the pre-determined price is known as the strike price, the rate at which the underlying asset would be sold.

Swaps Contracts:

A swap is a derivative contract under which 2 participants involved in the deal switch their liabilities from different financial instruments. Precisely, through swap contracts, if party A of the contract is paying a fixed rate of interest, may swap with party B paying a floating interest rate.

Swaps comprise of:

- Interest rate swap

- Currency swaps

- Credit swaps

- Commodity swaps

- Equity swaps

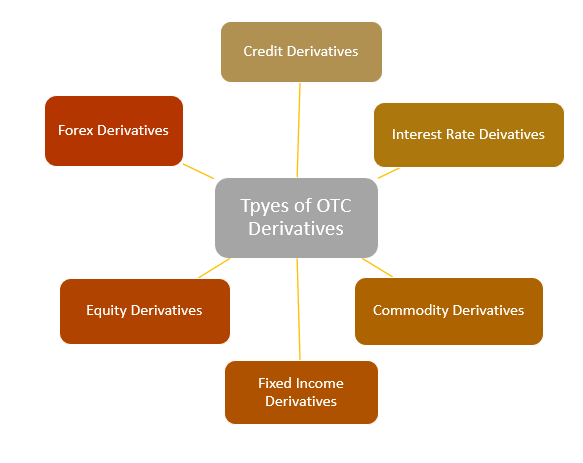

Types of OTC Derivatives:

Letâs understand each of these OTC derivatives one by one:

Interest Rate Derivatives:

Interest rate derivative is a contract between two parties who agree to exchange a notional amount of money at a certain interest rate. In an interest rate derivative, the value of the financial instrument fluctuates based on the interest rate movement.

Interest rate derivatives are used by institutional investors, banks, companies, and individuals to hedge against the changes in the interest rate. It can also be used for increasing or refining the risk profile of the holder.

Example of such derivatives is interest rate swaps.

Commodity Derivatives:

In commodity derivatives, the underlying asset is a commodity like gold, silver, copper, oil, spices, wheat etc. Commodity derivatives are investment tools which let investors gain without actually owning the commodity.

The buyer of the commodity derivative buys the right to exchange the commodity at a future date for a specific price. The buyer is only required to pay the margin amount to the seller. On contract, the seller of the commodity gives the buyer the rights of the commodity at a future date along with the actual delivery of the commodity.

Profit or loss of the buyer depends on the spot price of that commodity.

Fixed Income Derivatives:

In fixed income derivatives, the underlying assets are fixed income securities. These derivatives help in reducing transaction cost and improves trading efficiency. Examples of fixed income derivatives are options, futures, forwards and credit default swaps.

Equity Derivatives:

In the equity derivative, the underlying asset is equity securities. The value of the financial instrument depends on the equity price movement of the underlying asset. An example of equity derivative is a stock option whose value depends on the price movement of that particular stock.

Using equity derivatives, the investor can hedge the risk related to a particular stock by taking a long or short position in the stock. Equity derivatives also assist in speculating on the price fluctuations of the underlying asset.

Forex Derivatives:

In forex derivatives, the underlying asset is the fluctuations in the foreign exchange. The payoffs of these contracts rely on the foreign exchange rate of two or more than two currencies. Examples of these derivatives are foreign currency forward contracts, foreign currency futures, foreign currency swaps, currency options, and foreign exchange binary options.

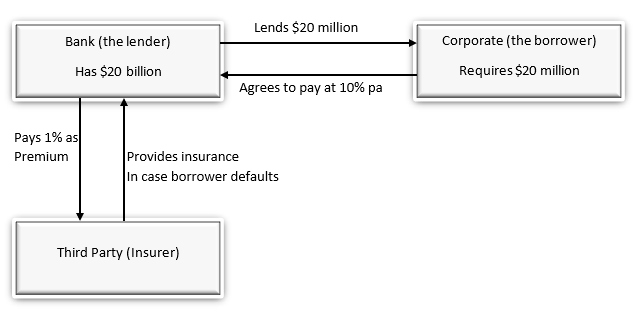

Credit Derivatives:

These are a financial asset that enable the participants involved to manage their risk exposure. Through these derivatives, the credit risk gets shifted from one party to another with no transfer of the underlying asset.

The banks, as well as other lenders, use this derivative to eliminate the risk of non-payment completely from the loan portfolio against an upfront fee also known as premium.

An illustration of this derivative is CDS.

Exchange-Traded Derivatives:

These derivatives are financial instrument that transact on the stock exchange and its value is derived from the value of underlying asset. As compared to the OTC derivatives, exchange-traded derivatives have standardisation, liquidity and eliminate the chances of default risk. Examples of exchange traded derivatives are futures and options.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.