Penny Stocks includes the stocks whose stock price is less than $1 per share, and with a market capitalization of less than $500 Mn. These stocks are also known as âmicro-capâ or ânano-capâ and are usually preferred by high reward seeking investors with high-risk appetite.

Before investing into any penny stocks, it is important to consider market timings, macro-economic conditions and fundamental analysis (due diligence). Technical analysis usually does not work for such stocks due to limited liquidity. Under fundamental analysis, more weightage should be given on qualitative analysis than on quantitative analysis.

Under Qualitative Analysis, focus on Porterâs five forces could be highly fruitful, which considers:

- Competition in the Industry;

- Potential of new Entrants into the Industry;

- Power of Suppliers;

- Power of Customers;

- Threat of Substitute Products.

Important ratios that can be considered while searching for penny stocks are:

- Liquidity Ratios (Current Ratio, Quick Ratio, Operating Cash flow);

- Leverage Ratios (Debt Ratio and Interest Coverage Ratio);

- Performance Ratios (Gross Profit Margin, Operating Profit Margin, Net Profit Margin, Return on Assets and Return on Equity);

- Valuation Ratios (Price to Earnings Ratio (PE) or Price to Earnings to Growth Ratio (PEG), Price to Sales Ratio and Price to Cash Flow Ratio).

Out of ~1720 companies within market capitalization of $500 Mn, around ~510 companies posted positive returns, ~945 companies posted negative returns and ~57 companies posted no change in last one year. This indicates that most companies rallied with a downward trend in the last one year.

Four important penny stocks are Paladin Energy Ltd (ASX:PDN), Base Resources Limited (ASX:BSE), Karoon Energy Ltd (ASX:KAR) and Livetiles Limited (ASX:LVT)

Paladin Energy Ltd (ASX:PDN) is involved in the development and operation of uranium mines in Africa, together with global exploration and evaluation activities in Africa and Canada.

Recently, the company informed the market that the completion of the first stream of the Pre-Feasibility study (PFS1), has led to re-start of its flagship Langer Heinrich Mine (world class uranium asset) in Namibia. Key targets of the company included achievement of over 5 Mlb per annum at a cost of under US$30/lb AISC (All-In Sustaining Cost) and 12-month lead time on execution.

This study highlights the capability of the asset and lays down a foundation for a confident and effective restart.

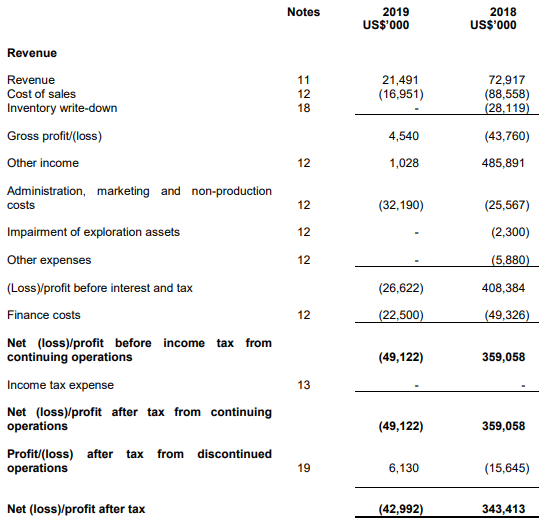

FY19 Key Highlights for the year ended June 30, 2019

Revenue from sales of uranium oxide decreased by 71% to US$21.49 Mn. Loss after tax attributable to members for the period was reported at US$30.35 Mn, as compared to profit of US$367.76 Mn in FY18.

FY19 Income Statement (Source: Company Report)

On the stock information front

On October 15, 2019 at 2:16 PM AEST, the PDN stock was trading at $0.092, down 2.12%, with the market cap of ~$190.62 Mn. Its 52 weeks high and 52 weeks low stand at $0.220 and $0.090, respectively, with an annual average daily volume of 3,501,968. It has generated an absolute return of -47.78% for the last one year, -32.86% for the last six months, and -37.33% for the last three months.

Base Resources Limited (ASX: BSE)

Base Resources Limited (ASX: BSE) is involved in the Kwale Mineral Sands Operation in Kenya and the development of the Toliara project in Madagascar.

Recently, UBS Group AG and its related bodies and Bank of America Corporation and its related bodies, changed their stakes in the industry from 6.88% to 5.61% and 5.49% to 7.38%, effective from October 10, 2019.

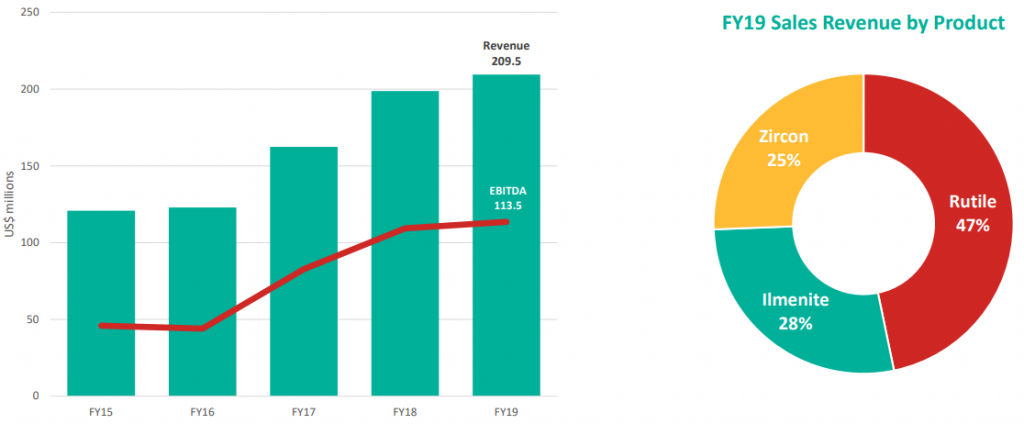

FY9 Key Highlights for the period ended June 30, 2019

Revenue for the period increased by 5% to US$209.5 Mn, mainly due to increase in average price for both rutile and zircon by 22% and 28%, respectively. EBITDA was up by 4% to US$113.5 Mn. NPAT soared by 15% to US$39.2 Mn.

Net cash position at the end of the period was reported at US$19.2 Mn, with no debt. In its outlook, the company expects to produce 64,000 to 70,000 tonnes of Rutile; 315,000 to 350,000 tonnes of Ilmenite; and 25,000 to 28,000 tonnes of Zircon from its Kwale Operation in FY20.

FY19 Key Metrics (Source: Company Report)

On the stock information front

On October 15, 2019 at 2:16 PM AEST, BSE was trading at $0.240 with the market cap of $279.99 Mn with an annual average daily volume of 2,284,627. It has generated an absolute return of -9.43% for the last one year, -15.79% for the last six months, and 4.35% for the last one month.

Karoon Energy Ltd (ASX:KAR)

Karoon Energy Ltd (ASX:KAR) invests in hydrocarbon evaluation and exploration in Peru, Australia and Brazil.

Recently, the company informed that the media speculation regarding equity raising to fund the Baúna acquisition is incorrect. It announced about the final agreement for a US$275 Mn senior term loan facility. It is nearing its oil marketing agreement to ensure the best access to global markets and complement the sale and shipping of oil from Baúna.

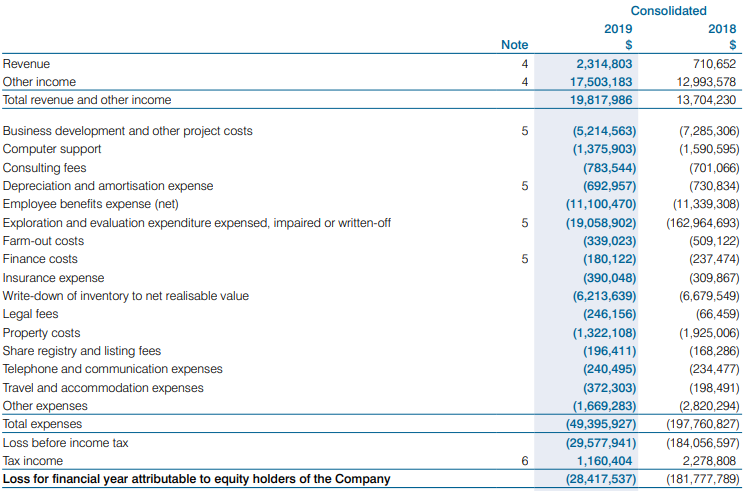

FY19 Key Highlights for the year ended June 30, 2019

The total revenue and other income increased from $13,704,230 in FY18 to $19,817,986 in FY19. Loss for financial year attributable to equity holders of the company decreased from $181,777,789 in FY18 to $28,417,537 in FY19.

FY19 Income Statement (Source: Company Reports)

On the stock information front

On October 15, 2019 at 2:16 PM AEST, KAR was trading at $1.105 with the market cap of ~$277.08 Mn. Its 52 weeks high and 52 weeks low stand at $1.810 and $0.775, respectively, with an annual average daily volume of 1,179,686. It has generated an absolute return of 1.82% for the last one year, 13.71% for the last six months, and -2.61% for the last three months.

Global software company Livetiles Limited (ASX:LVT) empowers its users to create its own intelligent workplace experiences.

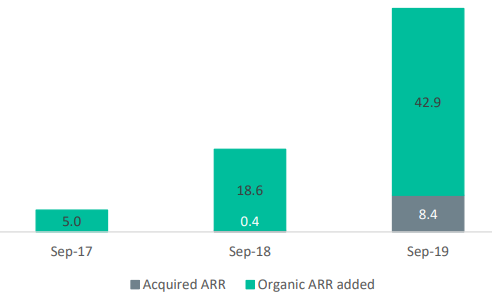

Recently, the company announced that its annualised recurring revenue (ARR) as on September 30, 2019, reached $42.9 Mn, representing year on year growth of 131%. The quarter period witnessed strong Asia-Pacific (APAC) region performance offset by seasonal buying patterns in the US and European regions.

In its outlook, the company highlighted that its key financial objective is to deliver ARR of at least $100 Mn by June 30, 2021.

Annualised recurring revenue growth ($ Mn) (Source: Company Report)

On the stock information front

On October 15, 2019 at 2:45 PM AEST, LVT was trading at $0.320 with the market cap of ~$257.1 Mn. Its 52 weeks high and 52 weeks low stand at $0.610 and $0.275, respectively, with an annual average daily volume of 2,460,636. It has generated an absolute return of -31.91% for the last one year, -45.30% for the last six months, and -20.99% for the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_19_2025_05_49_07_385844.jpg)