The Australian share market ended the first trading session of the new financial year by gaining 0.62 per cent, with the benchmark index closing at 5934.4 as compared to yesterday's closure of 5897.9.

The US market on Tuesday ended in the green zone with Dow Industrials up by 0.85 per cent, S&P 500 surged up by 1.54 per cent, and NASDAQ composite up by 1.87 per cent.

What's interesting is, though it was a rough quarter for the US economy due to virus-fueled recession, the US stocks surged to the best quarter since 1998 on the final day.

The US government's top infectious diseases expert said that the surge in cases could be more than double if Americans fail to take steps to curb the infection.

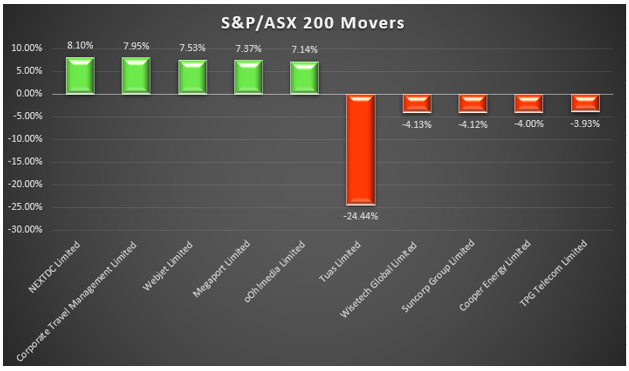

The top-performing stocks for today's market are:

- NEXTDC Limited (ASX:NXT) was up by 8.097 per cent when traded at AUD 10.680, and

- Corporate Travel Management Limited (ASX:CTD), which was up by 7.946 per cent when traded at AUD 10.460.

The worst-performing stocks for today's market are:

- Tuas Limited (ASX:TUA), which traded at AUD 0.510, down by 24.444 per cent, and

- Wisetech Global Limited (ASX:WTC), which traded at AUD 18.550, down by 4.134 per cent.

Let's see the graph below to view the top five best and worst-performing stocks today: