Highlights:

- Air Products’ net income in Q4 2022 was US$ 593 million.

- Bloom Energy posted Q3 2022 revenue of US$ 292.3 million.

- Operating income of Air Products in Q4 2022 was US$ 626.5 million.

With growing concern over climate change in the world, the focus is on hydrogen as it is regarded as a great alternative being a potential emissions-free fuel source. So, the discussion would swerve into hydrogen stocks, which form a crucial part of the equity market.

Amid, we look at three US hydrogen stocks and their performances in the latest quarters:

Air Products and Chemicals Inc. (NYSE:APD)

Air Products is an industry leader in supplying industrial gas worldwide with businesses in over 50 nations. Air Products is the largest supplier of hydrogen and helium across the globe.

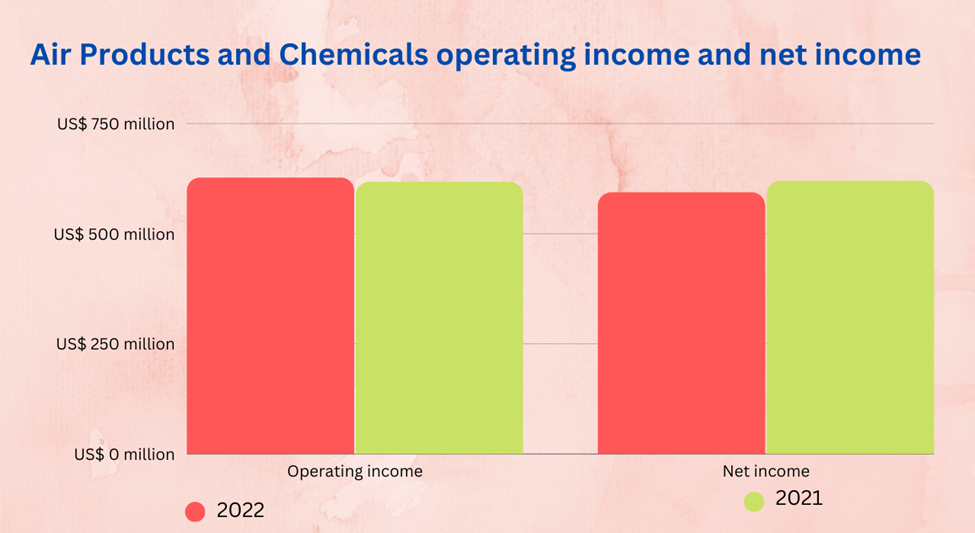

The operating income of Air Products in the fourth quarter of 2022 was US$ 626.5 million compared to US$ 616.7 million in the same quarter in 2021.

The net income of the hydrogen supplier company in Q4 2022 was reported at US$ 593 million versus US$ 618.8 million in the same period a year ago.

Diluted EPS (attributable to Air Products) in the last quarter of 2022 was US$ 2.62, while it was US$ 2.74 in the last quarter of 2021. The APD stock rose 5.68 YoY.

Source: ©2023 Krish Capital Pty. Ltd; © Canva Creative Studio via Canva.com

Source: ©2023 Krish Capital Pty. Ltd; © Canva Creative Studio via Canva.com

Bloom Energy Corporation (NYSE:BE)

Bloom Energy is a manufacturer, designer, and installer of solid-oxide fuel cell systems helping in on-site power generation.

The company recorded Q3 2022 revenue of US$ 292.3 million, up 41.1 per cent YoY.

Meanwhile, Bloom’s net loss was US$ 57.07 million compared to US$ 52.37 million in the same quarter of 2021. The EPS of Bloom energy in Q4 2022 remained unchanged at US$ 0.2 compared to the same quarter in 2021. The BE stock jumped 24.53 YTD.

Ballard Power Systems Inc. (NASDAQ:BLDP)

Ballard’s main business is designing, manufacturing, developing, selling, and service of PEM fuel cell items used in an array of applications.

The company said that its stationary power generation revenues grew nine per cent to US$ 2.1 million in Q3 2022 due to higher sales in North America.

The total revenue of Ballard Power Systems was US$ 21.3 million in Q3 2022, down 15 per cent YoY. The BLDP stock grew 27.77 YTD.

Bottom line

Investors have to go through great uncertainties when the market is volatile and bearish. Every trader is concerned about how to protect their portfolios. Hence, it is important to understand all the risks and research thoroughly before investing in the equities markets.

_01_20_2023_12_43_45_945351.jpg)