Summary

- The energy sector includes the world's biggest and most successful corporations, including oil and gas industry titans.

- STEP Energy Services, a tubing services and hydraulic fracturing solutions provider, reported a net income of CA$ 19.65 million for the three months ended March 31, 2023.

- Pieridae Energy, an explorer of natural gas, produced a net income of CA$ 13.6 million in the March 2023 quarter.

The energy sector includes quite a few of the biggest and most successful corporations across the globe. Some of these energy sector giants are also industry titans, especially those operating in the oil and gas sub-sector.

While these large companies can be a bankable choice for investors, there are other smaller businesses in the sector that have the potential to rise. Here we talk about two such stocks that have a market cap ranging between CA$ 50 million to CA$ 300 million.

These energy stocks have shown inherent financial strength over the previous quarters.

ALSO READ: EQB & X: How have these banking stocks fared?

On that note, here are STEP and PEA, two energy sector stocks that can be examined in July 2023.

STEP Energy Services Ltd. (TSX:STEP)

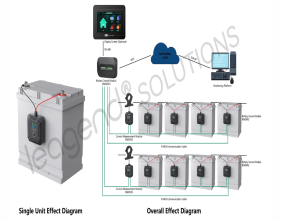

STEP Energy provides coiled tubing services and hydraulic fracturing solutions. The company aims to provide environmentally responsible results to its clients that are cost-effective too.

STEP reported a net income of CA$ 19.65 million for the quarter ended March 31, 2023. The adjusted EBITDA was CA$ 45.35 million for the period, while the consolidated revenue rose 20% from the previous corresponding year to CA$ 263.4 million.

Powered By: TradingView

STEP’s P/E ratio is 2.24x and P/B ratio is 0.76x based on Friday’s closing price of CA$ 3.26. It has a market capitalization of CA$ 233.473 million.

ALSO READ: Can these TSXV-listed biotech stocks potentially shoot up?

Pieridae Energy Ltd. (TSX:PEA)

Pieridae not only extracts and explores natural gas, but also produces LNG, which is sold in Europe and other markets.

The company produced a net income of CA$ 13.6 million in the March 2023 quarter, as against a net income of CA$ 10.7 million in the previous corresponding period. The net operating income for the quarter was reported to be CA$ 50 million.

Powered By: TradingView

Pieridae has a P/E ratio of 0.60x and a P/B ratio of 0.77x, based on its Friday’s closing price of CA$ 0.56. The company’s market capitalization as of July 3, 2023, is CA$ 89.028 million.