Summary

- The demand of online video games and esports apps has grown amid the pandemic.

- This demand has boosted stocks of companies like Score Media Media, Enthusiast Gaming Holdings and Engine Media.

- Canada’s video gaming industry contributed C$4.5 billion to the national GDP in 2019, says a study by Entertainment Software Association of Canada.

Online presence has essentially become a necessity in the wake of the COVID-19 pandemic. People, confined to the insides of their houses, have resorted to the means of teleworking, online shopping and virtual get-togethers in order to function and stay connected. Online video gaming and esports apps has also received a newfound level of demand. With that, the popularity of esports and gaming stocks like Enthusiast Gaming Holdings Inc (TSX:EGLX), Score Media and Gaming Inc (TSX:SCR) and Engine Media (TSXV:GAME) have increased among Canadian investors.

Interactive online video gaming — also referred to as esports — is a growing sector, especially amid the pandemic when contact sports and outdoor recreational activities are discouraged. A report by the Entertainment Software Association of Canada (ESAC) said Canada’s video gaming industry had contributed C$ 4.5 billion to the country’s gross domestic product (GDP) in 2019. While top players of online games have gained much attention on the stock markets, the industry at large is still at a nascent stage. Here’s a closer look at three companies mentioned above that have been doing well on the stock market recently.

Score Media and Gaming Inc (TSX:SCR)

Current Stock Price: C$ 0.82

Score Media and Gaming Inc made headlines this week after it graduated from the Toronto Stock Exchange Venture (TSXV) to the big-league Toronto Stock Exchange (TSX). Share price of Score Media and Gaming has surged over 143 per cent in the last six months. It witnessed an average trading of 1.2 million in the last 10 days.

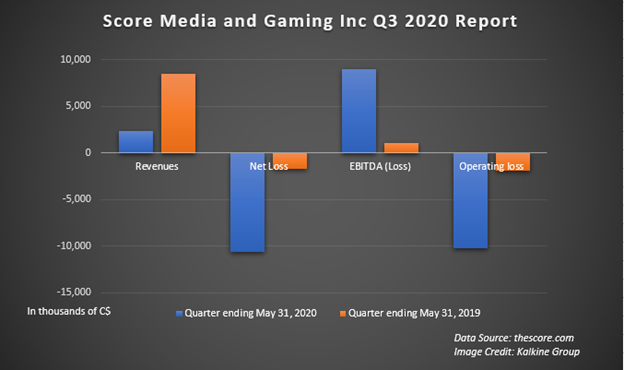

Despite the growth, the impact of the COVID-19 pandemic on Score Media and Gaming reflected in the financial results of its third quarter ending 31 May 2020. The Toronto-based company recorded a total revenue of C$ 2.4 million in Q3 2020, substantially down from C$ 8.5 million in Q3 2019. It also suffered an EBITDA loss of C$ 9 million in the latest quarter, as compared to that of C$ 1.1 million in the third quarter of 2019. The company currently has a market cap of approximately C$ 327 million.

Score Media and Gaming operates digital platforms such as theScore and theScore Bet, catering to a wide range of gaming and esports enthusiasts. The Canadian company recently launched its theScore Bet app in Indiana, expanding its reach to three states in the United States including Colorado and New Jersey.

Company: Engine Media Holdings Inc (TSXV:GAME)

Current Stock Price: C$ 10.50

Engine Media Holdings Inc focuses on immersive esports and interactive online video gaming tournaments. In the last six months, the stock price of Engine Media Holdings has seen a rise of nearly 19 per cent. Although its year-to-date (YTD) share price performance has seen a decline of nearly 39 per cent, Engine Media continues to witness heavy trading activity on the stock market. It is also currently one of the top trending stocks with highest return on equity (RoE) across the TSX and TSXV.

Engine Media Holdings recorded an operating expense of US$ 4.17 million in its quarter ending 28 February 2020, a drop from US$ 4.92 million in its quarter ending 29 November 2019. Its total debt lowered to US$ 13.3 million in the latest quarter.

Headquartered in Toronto, Engine Media Holdings has a market value of C$ 79.6 million. Its return on equity is 565.3 per cent and its price-to-cash flow (P/CF) ratio is 1358, as per data on the TSX.

Engine Media, formerly known as Torque Esports Corp, emerged after a three-way merger of Torque Esports, Frankly Media and WinView Games. The company acquired over 20 per cent interest in mobile gaming company One Up Group, LLC in August.

Company: Enthusiast Gaming Holdings Inc (TSX:EGLX)

Current Stock Price: C$ 1.70

After hitting its lowest point on March 21 amid the coronavirus pandemic-triggered market crash, the share price of Enthusiast Gaming Holdings rose by 36 per cent in nearly six months. In the last three months, its scrips climbed over six per cent in value.

The Canada-based esports company recorded a total revenue of C$ 7 million in its second quarter ending 30 June 2020. Its operating expense was C$ 7.4 million in Q2 2020, up from C$ 1.8 million in Q2 2019. The company also saw a gross profit of C$ 3.2 million and a net loss of C$ 5.3 million in the latest quarter. As of 30 June 2020, Enthusiast Gaming Holdings had a working capital of C$ 6.9 million and cash of C$ 8.4 million.

In August, Enthusiast Gaming announced the acquisition of YouTube gaming platform Omnia Media. The acquisition won Enthusiast Gaming the crown of being the largest platform of gaming communities across North America. The company’s official statement also said that the combined platforms are estimated to reach 300 million gamers in a month, garnering over 4.2 billion views per month.

Enthusiast Gaming Holdings Inc currently has a market valuation of C$ 174.9 million. Its price-to-book (P/B) ratio is 1.14.