Highlights

- It is forecasted that global spending on healthcare would grow rapidly in the future.

- Health spending in developed countries is expected to reach 10.2% of GDP by 2030, compared with 8.8% in 2015.

- Telehealth started gaining momentum since the COVID-19 pandemic.

Global spending on healthcare is forecasted to grow faster in the coming years. The increasing number of people and changing demographics will lead to the rising demand for healthcare.

As per the Organisation for Economic Co-operation and Development (OECD), health spending in developed countries is expected to reach 10.2% of gross domestic product (GDP) by 2030, compared with 8.8% in 2015.

Along with the growth in the overall sector, trends within the industry are also changing. Earlier, patients used to visit doctors for health assessments and checkups. This trend is now slowly being replaced by digital health solutions. Known as ‘telehealth’, the use of video conferencing for online health consultation has started gaining momentum since the COVID-19 pandemic.

Nowadays, it is possible to have real-time remote monitoring of patients through internet based medical devices. It saves a lot of time and effort of travelling to hospitals, leading to more timely interventions. Patient health records have also been started getting stored in digital form making patient history and information quickly available at times of need.

During the earlier days of COVID-19 pandemic, there was limited physical access to doctors and healthcare professionals. This led to the rise in need of telehealth services. However, the use of telehealth services has continued to rise even now when the pandemic has lessened.

On this note, we at Kalkine Media® will discuss some of the telehealth stocks from ASX and their recent updates.

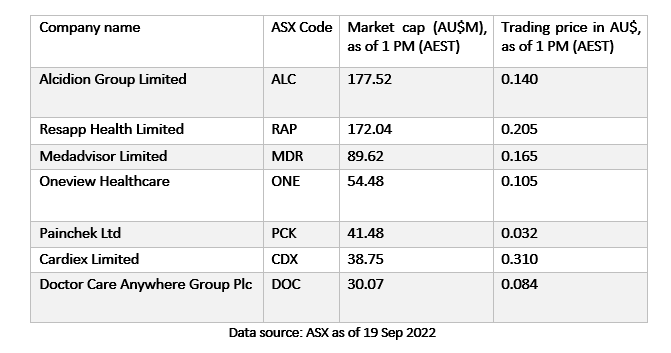

Alcidion Group Limited (ASX:ALC)

Alcidion offers a complementary set of software products in the global healthcare market. The company’s flagship product is Miya Precision. It has more than 20 years of experience in healthcare, with operations in Australia, New Zealand, and the UK.

Following are the FY22 financial highlights of Alcidion

- 33% surge in revenue

- 8% gross margin

- 29% increment in gross profit to AU$29.5 million

- 310% rise in Earnings before Interests and Tax (EBIT)

Resapp Health Limited (ASX:RAP)

Resapp offers point-of-care diagnostic solutions for telehealth. The company is developing digital healthcare solutions related to respiratory diseases. It includes acute disease diagnosis, chronic disease management, and sleep apnoea.

During FY22, the company’s revenue from ordinary activities went up by 3503%. However, it incurred a loss of around 5%. Operational review of the company are as follows:

- Jan 2022 - signed a binding letter of intent (LOI) with the Philippines-based telehealth start-up, Homify. Homify intends to launch ResAppDx on its platform.

- Feb 2022 - Signed a two-year non-exclusive agreement with Health Teams. Based in Australia, Health Teams plans to use ResAppDx on its telehealth platform and in-room patient consultations.

- April 2022 - Signed a one-year agreement with the Dartford and Gravesham National Health Service (NHS) Trust to pilot ResAppDx across its four hospitals.

Medadvisor Limited (ASX:MDR)

During FY22, the company expanded its digital reach by signing new contracts in the US and Australia. It launched the US Medicare Advantage program and made its entry into the New Zealand market. The company reported strong financials with a 10.5% increment in US revenue. Similarly, its revenue in NewZealand went up by 44%.

Oneview Healthcare (ASX:ONE)

Oneview Healthcare is a digital patient engagement company. Following are the H122 highlights of Oneview:

- 26% growth in contracted beds

- 15% surge in recurring revenue

- 23% improvement in gross margin

- 11% rise in operating EBITDA

- 15% decline in net loss after tax

2022/23 Financial outlook – 2022 revenue guidance in the range of 9 million euros to 9.5 million euros. The company is anticipating procurement decisions from nearly 5000 beds in the coming weeks/ months.

Painchek Limited (ASX:PCK)

Painchek develops and commercialises pain assessment tools through mobile applications. The company’s PainChek® App is the first clinically proven digital pain assessment tool in the world. It works by using Artificial Intelligence, facial recognition, and smartphone technology. In FY21, the company’s PainChek® Infant App received Australian TGA, CE Mark (Europe), UK, New Zealand, Singapore, and Canada regulatory clearances.

For the financial year ended 30 June 2022, Painchek bolstered its footing in the residential aged care sector with important steps in market expansion. Further, the company saw several developments in the UK market.

Cardiex Limited (ASX:CDX)

For the financial year ending 30 June 2022, Cardiex Limited reported a 19% decline in revenue. Similarly, its net loss went down by 105% to AU$11.38 million.

Doctor Care Anywhere Group Plc (ASX:DOC)

DOC is a telehealth company offering a digital healthcare system. It has a Quick Consult app for fast access to medication and advice. It also has a My Health platform with a range of resources for supporting mental well-being.

Below are the highlights of DOC from the interim report for the six months ended 30 June 2022

- 5% growth in revenue. The company attributes the revenue growth to a surge in volume of consultations provided to the company’s increasing base of Activated Lives

- Loss of £11.6 million – Net loss includes one-off restructuring costs summing up to £1.6 million