At the close of trading session on 7th August 2020, the equity market of Australia closed in red. The benchmark index S&P/ASX200 settled at 6004.8, reflecting a fall of 37.4 points or 0.62%. S&P/ASX 200 Health Care (Sector) experienced a fall of 474.2 points to 40,890.1. S&P/ASX 200 Materials (Sector) stood at 14,700.8, indicating a decline of 226.8 points. All Ordinaries ended the session at 6144.9 with a fall of 35.4 points.

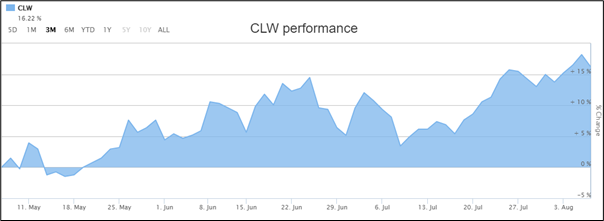

On ASX, the share price of Corporate Travel Management Limited (ASX: CTD) rose by 6.448% to $9.740 per share. The stock of Charter Hall Long WALE REIT (ASX: CLW) ended at $4.970 per share.

Stock Performance (Source: ASX)

At the end of same session, S&P/NZX50 stood at 11,647 with a fall of 1.00%. The share price of Just Life Group Limited (NZX: JLG) soared by 10.13% to NZ$0.435 per share. The stock of Scott Technology Limited (NZX: SCT) rose by 5.88% to NZ$1.800 per share. On the other hand, the share price of Cavalier Corporation Limited (NZX: CAV) plunged by 9.38% to NZ$0.290 per share.

Recently, we have written an article on Cirralto Limited (ASX:CRO), and the readers can view the content by clicking here.

Corporate Travel Management Limited Ended in Green on 7th August 2020.

Corporate Travel Management Limited (ASX:CTD) recently announced that it is in a strong liquidity position and it has reached an agreement with its existing banking group to waive all financial covenants for CY 2020.

As at 7th May 2020, the net cash balance of the company stood at around $30 million. The company has withdrawn its guidance for FY20 due to increased uncertainty surrounding the severity of coronavirus pandemic.

Charter Hall Long WALE REIT Released FY20 Earnings.

Charter Hall Long WALE REIT (ASX:CLW) recently released its results for FY20, wherein, it reported operating earnings amounting to $121.9 million, reflecting a rise of 5.2% over pcp. Statutory profit for the period stood at $122.4 million. During FY20, the company announced new property acquisitions of $1.4 billion.

The total property portfolio of CLW went up by ~$1.52 billion to $3.63 billion. This was driven by net acquisitions and capex of $1.4 billion and property revaluations of $96 million.

For FY20, the company reported a distribution per unit of 28.3 cents with a growth of 5.2%. For FY21, the company expects operating EPS of minimum 29.1 cents per security. The company is also targeting the distribution pay-out ratio of 100% of operating earnings.