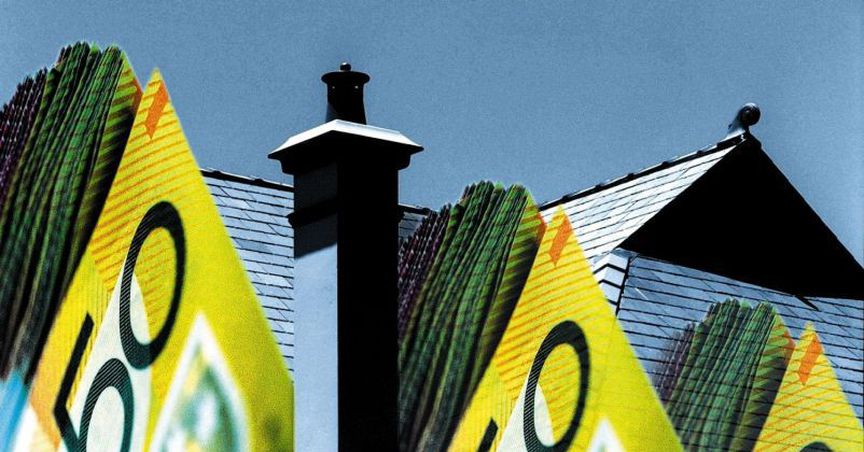

Banking royal commission has laid out the policy recommendation and a lot seem to be riding on the same including the stability of Australian property markets. Consequences which are unintentional are expected from the royal commissionâs recommendations referred here as including a steep fall in house prices on bank lending spurred by a royal commission.

Chief economist Paul Dales of Capital Economics said while house price falls have been small to date, at least in its recent history Australia could be in for a record housing decline. A protracted slowdown in the housing market is forecasted by Mr. Dales because of a crackdown in bank lending standards, rising interest rates and the banking royal commission itself.

It is a different situation in America, where lending was just cut off from one day to the next during the global financial crisis, banks just decided not to lend anymore. Morrison Government was notified by the Treasury and Reserve Bank of Australia privately, with its response in terms of regulatory to the banking commission and fears that the harsh penalties could slow the lending to home businesses and buyers. [optin-monster-shortcode id="wxhmli4jjedneglg1trq"]

The ARPA (the bank regulator) and the Reserve bank will provide private tutorials to understand the full impact of any decision Commissioner Kenneth Hayne makes. The RBA governor Philip Lowe indicated that lending to owner-occupiers remains solid and appears ok with the pace of property price falls so far. To cap growth in investor loans at 10 percent per annum it is demand from investors that is taking a hit following earlier moves from the banking regulator APRA, and later to limit the proportion of interest-only lending which is apparently a favorite loan product for many investors in property.

The most probable outcome from the commission is that some of the bad lending is removed that has been seen. Also, in the next federal election the labor would be sticking to its policies around capital gains taxes to take pressure of the price off the market. However, first home buyers still needed more support which is expected form the possible further independent rate rises and royal commission recommendations from the major banks that could produce as much as 20 per cent from peak to trough in terms of property price declines.

Although a lot of what APRA did is aimed at investors, it is however, getting tougher to fetch a loan as the lending standards are toughened by the banking industry.

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.