Following a speech in Canberra, the Reserve Bank of Australia?s Deputy Governor, Mr Guy Debelle stated that the interest rates could fall between zero and 0.5 per cent. While addressing the Economic Society of Australia in Canberra, Mr Debelle focussed on Australia's current account balance and its external position. He mentioned that Australia?s current account deficit and trade surplus has now reached multi-decade milestones.

Let us try to understand the dynamics of the Australian economy from Mr Debelle?s perspective below:

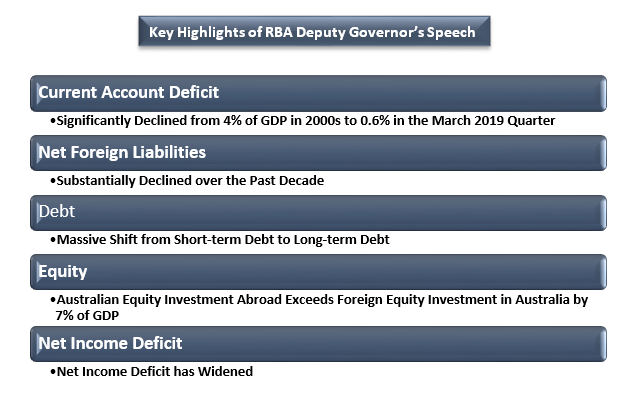

Current Account Deficit: As per Mr Debelle, Australia has significantly reduced its current account deficit (CAD) that was around 4 per cent of GDP through the 1980s, 1990s and 2000s, to around 1 per cent of GDP since 2015. The country experienced the narrowest CAD of 0.6 per cent in the March quarter, lowest since the December quarter 1979.

The contraction of the CAD reflected a significant shift in Australia's trade balance that has witnessed the largest surplus (3 per cent of GDP) since 1973 in the March quarter. The surplus in the trade balance was driven by high revenue from resource exports and a decline in import of investment goods.

Net Foreign Liabilities: Mr Debelle notified that Australia's Net Foreign Liabilities (NFL) have substantially declined over the past decade, driven by some significant changes in gross foreign assets and gross foreign liabilities. The fall in the stock of Australia's NFL was driven by reduced levels of the CAD and net capital inflows.

Debt: Australia has seen a massive shift from short-term debt to long-term debt, with its long-term debt liabilities being larger than its total net foreign liabilities. Mr Debelle informed that the share of short-term debt has fallen from 20 per cent in the early 2000s to under 5 per cent of GDP now, while the share of long-term debt has risen from 25 per cent to 52 per cent of GDP over the same period.

Equity: The net equity position of Australia has witnessed a dramatic shift, with the Australian equity investment in foreign countries surpassing foreign equity investment in Australia by 7 per cent of GDP. The country observed a transition from net equity liability position with an average of 10% of GDP between 1990 and 2010 to a net foreign equity asset position.

Net Income Deficit: Mr Dowelle cited that the net income deficit of Australia has broadened a little, due to the average yield that the country pays on its net foreign liabilities, which has climbed by more than the yield it obtains on net foreign assets.

Mr Dowelle stated that these noteworthy developments have often been overlooked. He appreciated the country?s rules-based global trading system that has delivered sizeable benefits for welfare and global growth.

Recently, RBA?s Deputy Governor presented the August Minutes of the Monetary Policy Meeting of the RBA?s Board along with other key members of the monetary authority, including Philip Lowe (Governor and Chair). The members provided Australia?s economic scenario from a broader view. Let us discuss the overall economic scenario from the RBA?s board members perspective below:

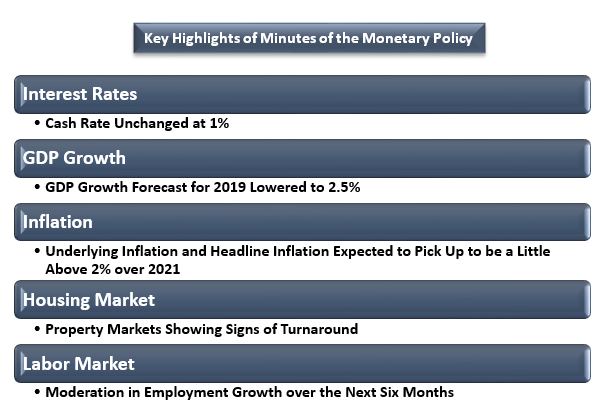

Interest Rates: Keeping the cash rate steady at 1 per cent, the RBA expected a 25 basis points reduction by November 2019 and a further 25 basis points reduction in 2020. The bank highlighted that the low level of bond yields indicate that the interest rate will remain very low for several years. Not to forget, RBA?s Governor reduced the cash rate by 25 basis points both in June and July this year, to provide greater confidence that inflation will reach the medium-term target and? support employment growth.

The bank also notified that it may think of a further easing of monetary policy if there will be a need to aid sustainable growth in the economy and attain inflation target over time.

GDP Growth: The RBA expects the June quarter GDP growth to remain stronger after three weak quarters, owing to a recovery in resource exports and less implication of mining investment on the growth. The members noted that the resource exports improved during the June quarter because of an increase in LNG production and resolution of supply disruptions to iron ore. The bank anticipates a subsequent growth in service and manufacturing exports, supported by the recent depreciation of the Australian dollar. The bank also expected a positive medium-term outlook for mining investment with the completion of numerous projects in the near-term.

Due to weaker growth in consumption over the recent quarters, the bank lowered its GDP growth forecast for 2019 to 2.5 per cent. However, it expects a pick-up in growth to 2.75 per cent over 2020 and to about 3 per cent over 2021. The promising forecast was driven by multiple factors, including the lower exchange rate, lower interest rates, the infrastructure pipeline, signs of stabilisation in some established housing markets sooner than expected, tax measures and increase in the mining sector activities.

Inflation: The RBA mentioned that the CPI in June Quarter was in line with the bank?s expectation. The headline inflation stood at 1.7 per cent in the June quarter in seasonally adjusted terms, partially due to an increase of 10 per cent in fuel prices. The bank noted that there had been few signs of emerging inflationary pressures in the June quarter CPI numbers. The RBA expects the persistence of small inflation in new dwelling rents and costs in the near term.

The bank informed that the Underlying inflation and headline inflation are likely to increase gradually to a little under 2% over 2020 and a little above 2% over 2021.

Housing Market: As per the RBA, the July performance of the housing market suggested that the conditions are demonstrating signs of a turnaround. The housing prices witnessed a rise in Sydney and Melbourne, with other cities showing tentative signs of improvement. The bank mentioned that the housing turnover looked to have reached a trough in Sydney and Melbourne, where auction clearance rates?had also risen. The members observed that the stabilisation of conditions in the settled housing market will take some time to convert into an increase in construction activity.

Labor Market: The bank mentioned that the June unemployment rate of 5.2 per cent was higher than it had been anticipated in May. The RBA also noted that the growth in employment had stronger than May?s forecast in the June 2019 quarter, surpassing the growth in the working-age population. The central bank also considered a prominent increase in the participation rates of workers aged 65 years and over, and women aged between 25 and 54 years.

The RBA expects moderation in employment growth over the next six months. The bank revised the unemployment rate forecast to stay at 5.25 per cent for some time before falling to around 5 per cent over the following couple of years.

Understanding these individual characteristics of Australian economy help us infer that though the country has been struggling with subdued inflation and high unemployment rate, it has observed several remarkable achievements in the recent years. Australia also carries an excellent record of attracting foreign investment that makes it a global investment hot spot. It would be interesting to keep a watch on RBA?s further steps to sustain the country?s economic growth. ?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.