The economy of Australia is counted amongst one of the most resilient economies across the world that performed strongly during the global financial crisis. However, the country?s economy is currently in a challenging state with record low interest rates, subdued inflation and high unemployment.

As per recent data announced by the Australian Bureau of Statistics (ABS), retail sales experienced an unexpected fall of 0.1 per cent in the September quarter against expectations of a 0.2 per cent rise in retail turnover. In addition, the retail sales increased in September by 0.2 per cent, which was lower than August?s rise of 0.4 per cent.

Though the retail sales data was quite disappointing, the Reserve Bank of Australia (RBA) kept the official cash rate on hold at 0.75 per cent in November to judge the economic impact of government tax handouts and low borrowing costs. The decision was taken on the back of strengthening property market in the economy.

The RBA?s decision was widely anticipated by the market experts who pegged down the expectations of a rate cut to around 6 per cent for November before the announcement. The central bank kept the cash rate steady but did not rule out the expectations of a further rate cut moving forward. Consequently, market experts are predicting further rate cuts in the coming months.

However, some of the recent developments have raised fresh hopes of a revival in the country?s economy, which include the following:

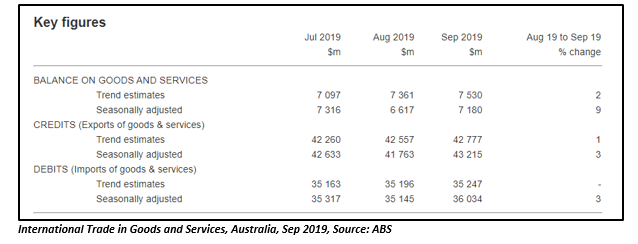

Record High Trade Surplus Observed in September

A recently announced ABS data showed that Australia attained a record high trade surplus of $7.5 billion in September in trend terms, observing a rise of $169 million on the prior month?s surplus.

Moreover, the country?s trade surplus was recorded at ~$7.2 billion in September in seasonally adjusted terms, marking an increase of $563 million on the surplus reported in August 2019. The trade surplus was well ahead of economists? forecast of $5.1 billion.

In quarterly terms, the trade surplus was $21.1 billion in the September quarter, $2.5 billion higher than the seasonally adjusted balances for the three months to June 2019.

In seasonally adjusted terms, exports increased 3 per cent or $1.45 billion to $43.2 billion in September, along with an increase of 3 per cent or $889 million in imports of goods and services.

As per the market experts, the September data indicated that the US-China trade war is having a minimal impact on the Australian economy. The global issues, including Brexit, US-china trade differences, a slowdown in the Chinese economy, etc. were not reflected in the country?s trade balance.

Improvement in Property Prices in October

The property prices have begun to improve in Australia, indicated the recently released CoreLogic?s home value index for October. The data demonstrated a rise of 1.2 per cent in house prices in October, marking the largest increase since May 2015 and fourth straight monthly increase since July 2019.

The house prices increased substantially in Sydney and Melbourne by 1.7 per cent and 2.3 per cent, respectively, while the prices declined by 0.4 per cent in Perth. The 2.3 per cent rise in Melbourne was the largest month-on-month increase seen in the city since November 2009.

The figures suggest a rebound in the country?s property market, driven by a reduction in the cash rate by RBA and Australian Prudential Regulation Authority?s (APRA) modified mortgage serviceability rules.

Few market experts are of the opinion that if the property prices continue to grow at the same pace as they are increasing now, the country might see the house prices breaking their all-time high levels by early 2020.

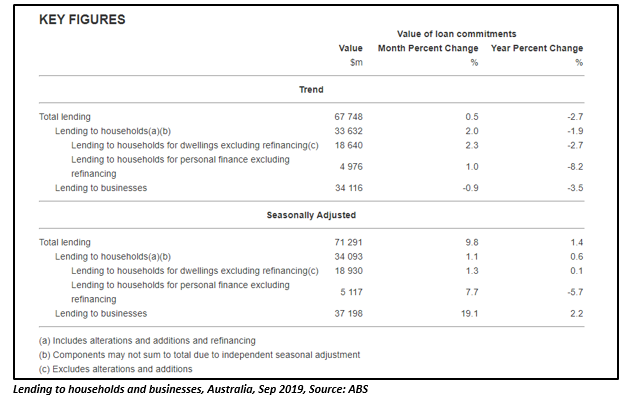

New lending Commitments to Households Rise in September

A recent ABS release has also shown a rise in new lending to households by 1.1 per cent in September, following an increase of 3.8 per cent in August. This was the fourth straight month increase in new lending commitments, which was spurred by an improvement of 3.2 per cent in new commitments for owner occupier dwellings in September.

All states and territories of Australia apart from the Australian Capital Territory contributed to an increase in lending for owner occupier commitments during the month. Also, new lending commitments for investment dwellings declined by 4 per cent in September, driven by a 6.5 per cent fall in Victoria and a 7 per cent drop in Queensland.

September?s data on lending commitments to the households indicated an improvement in the country?s property market that has been under pressure for the last few months.

As per the RBA, the turnaround in the housing market came sooner than expected with an improvement in auction clearance rates, housing prices and housing loan approvals.

Key Highlights of RBA?s Monetary Policy Statement

Recently, the central bank has also released its Statement on Monetary Policy for November 2019, wherein the bank has revised its forecasts on different macro-economic indicators as discussed below:

Economic Growth

Though the country?s economy observed a lower than expected growth of 1.4 per cent over the year to the June quarter, the bank expects the domestic growth to strengthen in the coming quarters.

The central bank expects the economy to grow by 2.25 per cent over 2019, driven by moderate growth in September and December quarters. The bank has also anticipated an increase in the forecast of year-ended growth to 2.75 per cent over 2020, inching up to 3 per cent over 2021.

The bank notified that the economic growth will be driven by the recent tax cuts, low level of interest rates, the upswing in housing prices in few cities, ongoing spending on infrastructure and a brighter outlook for the resources sector.

Consumption Growth

The bank also expects a gradual recovery in consumption that has been significantly weaker than expected over the past year. The consumption growth has been estimated at 1.5 per cent for 2019, increasing steadily over subsequent quarters, resulting in a growth of 2.5 per cent over 2020 and 2.75 per cent over 2021.

The consumption growth is likely to be driven by a recovery in housing markets and an expected increase in growth in household disposable income. In addition, the growth in household disposable income is expected to be driven by the recent rate cuts easing household interest payments, growth in labour demand and the low-and middle-income tax offset reducing tax payments.

Dwelling Investment

As per the central bank, the dwelling investment will continue to fall over the coming year, with a certain chance of trough in late 2020 before a revival in residential construction gets started through 2021. The bank noted that there is little sign of a pick-up in residential development activity in the early stages despite a stronger-than-expected upturn in established housing markets.

However, the bank has revised expectations of a revival in dwelling investment over 2021 upwards, partly indicating the greater-than-expected rise in established housing prices.

Unemployment

The bank anticipates persistence of positive labour market conditions over the next six months, with job vacancies staying at a high level and hiring intentions of firms remaining above average. Australia observed a fall of 0.1 per cent in the unemployment rate to 5.2 per cent in September 2019 in seasonally adjusted terms, with an increase of 14,700 people in total employment.

RBA expects the unemployment rate to stay above the rate consistent with full employment for the next couple of years (central estimate at 4.5 per cent). However, the bank mentioned that there is huge uncertainty around the amount of spare capacity currently is (and will be) in the country?s labour market. RBA anticipates a decline in the unemployment rate to 4.9 per cent by the end of 2021.

Inflation

The central bank expects an increase in trimmed mean inflation to around 1.75 per cent over 2020, surging to 2 per cent over 2021. The bank has estimated an increase of 0.2 percentage points in inflation during the December quarter, driven by an increase in fuel prices.

Though largely unchanged from August?s forecasts, the RBA?s economic outlook seems quite optimistic, especially around residential construction cycle which is likely to drive much-needed improvement in dwelling investment.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.