On the global front, investors have been eyeing the recently released alarming figures of the US Manufacturing Index; however, on the domestic front, the following announcements have garnered the investors? attention:

- GDP Growth Rate in June 2019 Quarter

- Country?s Balance of Payments and International Investment Position in June 2019 Quarter

- Retail Trade Outcome for July 2019

Amidst the aggravating trade tensions between the two largest economies of the world, the US Manufacturing PMI (Purchasing Managers' Index) has fallen substantially to 49.1 per cent in August, the lowest such level recorded since January 2016. The slid in the August?s US ISM Manufacturing PMI has raised speculations of another rate cut by the US Federal Reserve to promote economic growth. The weaker data induced the fall in US stock market on Tuesday, where the Dow Jones Industrial Average?closed 1.08 per cent lower at 26,118 and S&P 500 stock index ended 0.69 per cent down at 2,906.

Although the escalating dispute between the US and China has weakened the global growth outlook, the Australian economy has flowed against the tide, delivering a seasonally adjusted economic growth of 0.5 per cent in the June 2019 quarter.

The country has also recorded a significant current account surplus of $5.9 billion in the quarter, the first surplus since the June quarter 1975. In contrast, the country's retail turnover has declined by 0.1 per cent in July 2019 despite the existence of lower interest rates in the economy.

Considering the current state of the Australian economy, the Reserve Bank of Australia?s Governor has kept the official interest rate steady at 1 per cent in its September 2019 board meeting.

Let us take a deep dive into the recently released statistics of current account surplus and retail turnover in Australia:

Current Account Surplus Statistics

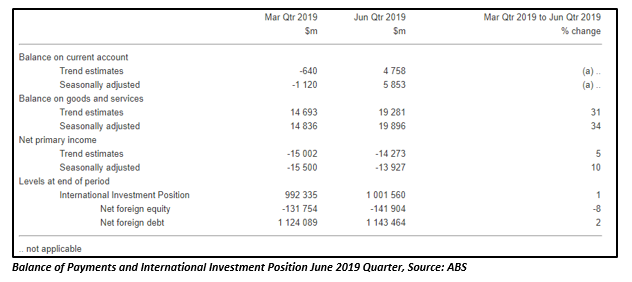

As per the Australian Bureau of Statistics (ABS) recently reported figures, Australia has experienced its first current account surplus in 44 years in June 2019 quarter, driven by export earnings. This means that the country has been facing a current account deficit since 1975, with its imports overriding its exports to the rest of the world. Breaking the trend, the country posted a current account surplus of $5.9 billion in the quarter, driven by a narrowing net income deficit to $13.9 billion and the largest quarterly balance on goods and services surplus on record at $19.9 billion.

As indicated in the above figure, it was a turnaround quarter for the Australian economy as it had experienced a deficit of $1,120 million in the previous quarter (March 2019 quarter). Let us take a look at the major contributors of this current account surplus:

- Balance on goods and services: The balance on goods and services surplus rose substantially from a surplus of $3,637 million in the March quarter to a surplus of $6,387 million in the June quarter. In the release, ABS stated that the rise in the surplus is likely to contribute 0.6 per cent points to the June quarter 2019 economic growth. In line with the ABS projection, the net exports contributed 0.6 percentage points to the June quarter?s GDP growth in seasonally adjusted chain volume terms.

- Net primary income: The net primary income deficit fell $1,573 million to $13,927 million in the June 2019 quarter, stimulating the current account surplus.

- Terms of trade: In seasonally adjusted terms, the terms of trade on net goods and services improved by 1.4 per cent in the June 2019 quarter to 111.6.

- Intermediate and other merchandise goods: There was a fall in the imports of intermediate and other merchandise goods by $48 million during the quarter to $32,538 million. The decline in imports of iron and steel (13% down), primary industrial supplies (24% down) and processed industrial supplies (1% down) contributed majorly to the reduction.

Retail Turnover Statistics

On the one hand, the country recorded robust current account surplus while on the other hand, its retail turnover dropped by 0.1 per cent in July 2019 against the rise of 0.4 per cent witnessed in June 2019 in seasonally adjusted terms.

Four out of the six industries and six out of the eight states saw a fall in retail turnover in July 2019. The four industries that faced a decline were Cafes, restaurants and takeaway services (0.6 per cent down), Other retailing (0.4 per cent down), Department stores (0.2 per cent down) and Clothing, footwear and personal accessory retailing (0.1 per cent down). Only Food Retailing and Household Goods Retailing observed a rise, of 0.3 per cent and 0.1 per cent, respectively.

Though retail turnover fell in July 2019, it witnessed a rise of 0.2 per cent in June 2019 quarter against a fall of 0.1 per cent observed in the March 2019 quarter. The quarterly rise in volumes was majorly driven by a rise in Department stores (1.4%), Clothing, footwear and personal accessory retailing (0.7%), Cafes, restaurants and takeaway food services (0.5%), Other retailing (0.4%), and Household goods retailing (0.1%). Among all the six industries, only Food Retailing fell by 0.4 per cent in seasonally adjusted terms.

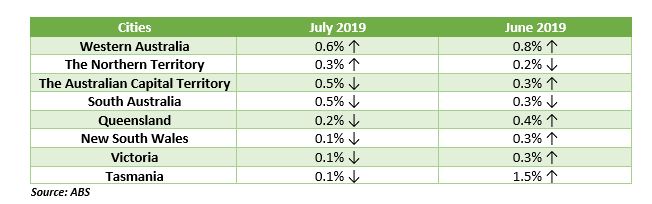

The below table shows the percentage fall or rise in retail turnover in the eight Australian cities in June and July 2019:

It can be seen from the above table that the country reported a far better retail turnover figures in June 2019, with only two cities facing a fall while the others experiencing a surge. Western Australia is the only such city that has followed a rising trend in July, although improving by a lower percentage. The Northern Territory saw a reversal from a fall of 0.2 per cent in June 2019 to a rise of 0.3 per cent in July 2019.

RBA Keeps Interest Rates Steady

Despite a fall in retail sales in July 2019, the RBA has recently kept the interest rates unchanged at 0.1 per cent. The market analysts were expecting a further decline in interest rates from the existing 1 per cent level due to the persistence of high unemployment and subdued inflation in Australia. Also, the RBA?s Governor Mr Phillip Lowe signalled for further rate cuts while addressing the Anika Foundation Luncheon in July this year.

While keeping the interest rates on hold at 1 per cent, Mr Lowe mentioned that the central bank will ease monetary policy further if required to uplift sustainable growth. He is also repeatedly mentioning in his speeches that Australia is likely to see an extended period of low interest rates to make progress in achieving inflation target and reducing unemployment. He also believes that the country?s growth will increase gradually to be around trend over the next couple of years.

Mr Lowe emphasized that the recent tax cuts, signs of stabilisation in some established housing markets, low level of interest rates, a brighter outlook for the resources sector and the ongoing spending on infrastructure will support this gradual growth.

Although the country saw a fall in its retail turnover figures in July, the outstanding current account surplus delivered by the country is likely to regain the investors? confidence in the prospects of the Australian economy. The market analysts are still expecting a further reduction in interest rates in the near term, but whether the RBA will ease monetary policy further or not is still uncertain.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.