Highlights

- RPS Energy Canada Ltd ("RPS") published a competent person's report ("CPR") for PEDL 183.

- CPR confirms Reabold’s (RBD) West Newton is potentially one of the largest hydrocarbon fields discovered onshore UK

- The CRP key highlights covered West Newton’s three major parameters: Resource Potential, Economics, and social impact.

- As per the CPR, West Newton can ease the domestic gas shortfall and reduce the UK's dependence on imported gas.

Reabold Resources PLC (LON:RBD), a UK-based firm with a portfolio of upstream oil and gas projects, recently updated the market about the competent person's report ("CPR") published by RPS Energy Canada Ltd ("RPS").

The CPR is published for Reabold’s UK onshore licence, PEDL183 (containing the West Newton discovery), in which Reabold holds a total economic interest of ~56% via its 59% stake in Rathlin, the operator of PEDL183, in addition to a direct 17% holding in the license.

Source: © 2022 Kalkine Media®, Data Source: Company’s update

Source: © 2022 Kalkine Media®, Data Source: Company’s update

For more about the company strategy, click here.

CPR key highlights provid insights into West Newton’s on three major parameters

- Resource Potential:

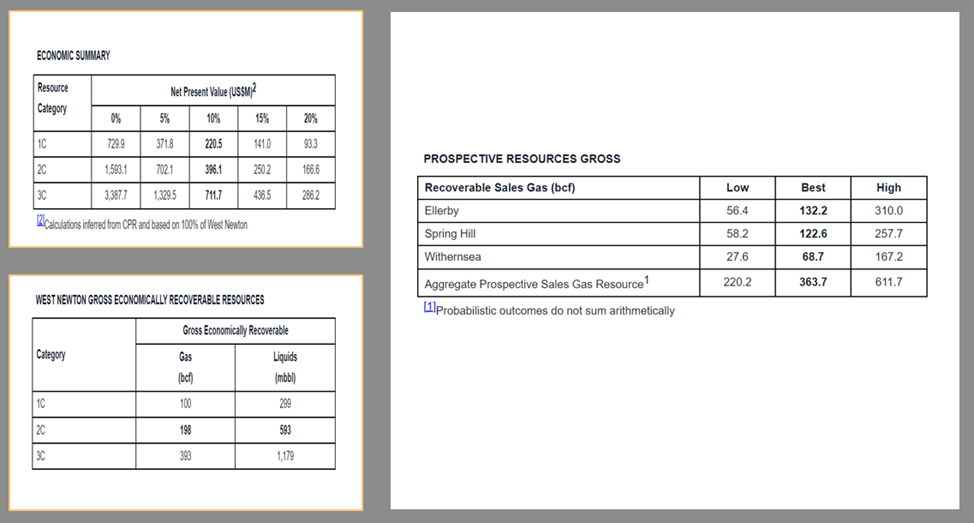

CPR confirms the potential of the West Newton as one of the largest onshore hydrocarbon fields discovered in the UK. CPR reported the gross 2C unrisked technically recoverable resource of 197.6 billion cubic feet (bcf) of sales gas. Additionally, the CPR attaches a 86% geological chance of its success to West Newton.

CPR also estimated the prospective resource potential from Spring Hill, Withernsea and Ellerby, at 363.7 bcf of sales gas value of the combined gross 2U unrisked recoverable resource. The geological chance of success stood at 43% for all. However, the chance of success will increase for any of the two prospects if the remaining third prospect produces a successful well.

- Economics:

As per the RPS's risked forecasts, the economic modelling calculates an NPV10 of US$396 million on a 100% basis for West Newton, which translates to US$222 million based on Reabold's ~56% economic interest (56% of US$396 = US$222). It also supports the joint venture partners' conceptual development plan results.

- Social:

Based on the CPR, West Newton has the potential meet gas demand for approximately 380,000 homes in the UK for several years. Therefore, it can ease the domestic gas shortfall and reduce the UK's dependence on imported gas once it goes into production in 2026.

CPR’s key data is summarised in the infographic below

Source: © 2022 Kalkine Media®, Data Source: Company’s update