Summary

- The June 2020 earnings season is finally kicking in with the exchange now flooded with quarterly performance announcements from several listed companies.

- While the ongoing global turmoil has posed strong headwinds for some companies, some have clearly weathered the storm, and the June 2020 quarter seems to be a mixed bag so far.

- Quarterly updates of Champion Iron Limited (ASX:CIA) and IGO Limited (ASX:IGO).

The June 2020 quarter has been a quarter of recovery of the domestic market with a ~ 40 per cent recovery in the S&P/ASX 200, leading to a sentiment boost in many listed stocks.

The June 2020 earnings season along with the diminishing market volatility or the market fear concerning the COVID-19 outbreak provided a cushion to the equity market.

In the wake of a recovery in the major equity index along with external factors, iron ore, gold, and base metals stocks have emerged among top performers of the year so far.

To Know More, Do Read: Commodity Stocks Making Their Way To The Top

While some of the mining companies have disclosed healthy performance for the June 2020 quarter, especially gold and iron ore miners, many now are now disclosing the June 2020 quarterly results with some even completing their financial year 2020, which in general, should now decide the future direction of the equity market

Champion Iron Limited (ASX:CIA)

CIA recently announced the June 2020 quarterly results, which marked the first quarter for its 2021 financial year (FY2021).

- On the financial counter, CIA reported revenue of $244.6 million for the period, which was ~ 11.98 per cent down against the previous corresponding period (or pcp).

- The EBITDA came in at $127.7 million, translating to an EBITDA margin of 52 per cent as compared to the EBITDA and EBITDA margin of $166.9 million and 60 per cent, respectively, in the previous corresponding period.

- The net income came in at $75.6 million to mark a margin increase of ~ 1.88 per cent against pcp.

- However, the net cash flow for the quarter slipped by ~ 18.06 per cent against pcp to stand at 75.3 million.

- Reported an EPS of $0.16, down by ~ 23.80 per cent against pcp.

- The cash on hand at the end of the period surged by ~ 16.33 per cent against pcp to stand at $347.5 million.

CIA suggested that during the three-month period to 30 June 2020, the Company shipped 1,758,800 tonnes of high-grade iron ore concentrate at a CFR gross realised price of USD 107.8 per dry metric tonne, prior for the adjustment to provisional sales and shipping costs.

- The gross realised price during the period represented a premium of 15.5 per cent against the benchmark of P62, and the premium of 15.5 per cent during the period remained higher against the premium of 6 per cent witnessed by the Company on the same benchmark in the previous quarter.

Furthermore, during the three-month to 30 June 2020, a final price was established for 851,000 tonnes, which remained in transit at the end of the March 2020 quarter.

- In addition, CIA shipped 80,000 tonnes prior to the March 2020 quarter, which remains subject to pricing evaluation during the recently completed quarter, leading to a decline in the reported revenue for the quarter.

- Accordingly, the revenue associated with the shipment of 931,000 tonnes, which the Company accounted for FY2020, was up by USD 16,424,000 during the three-month to 30 June 2020.

- Apart from a shipment tenure variation and revenue recognition guidelines, a lower production for the three-month ended 30 June 2020 took a toll on the quarterly revenue.

- CIA produced 1,798,800 wet metric tonnes of 66.5 per cent Fe for the three-month to 30 June 2020, which remained ~ 40.69 per cent down against pcp.

- On the processing counter, the recovery rate of 82.3 per cent during the period remained in line with pcp.

The stock of the Company last traded at $2.765 (as on 31 July 2020 2:16 PM AEST), down by 2.3 per cent against its previous close on the exchange.

IGO Limited (ASX:IGO)

IGO Limited (ASX:IGO) recently announced the June 2020 quarter performance, with which, the Company marked the end of the 2020 financial year (FY2020).

The Company stated that the production from Nova exceeded the guidance for all metals, while the gold production from Tropicana operations remained within the guidance.

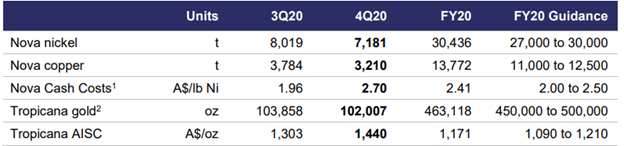

- The nickel production from Nova for the June 2020 quarter fell by ~ 10.45 per cent against the previous quarter to stand at 7,181 tonnes; however, with the July addition, the yearly production reached 30,436 tonnes, surpassing the upper range of FY2020 guidance of 27,000 to 30,000 tonnes by ~ 1.4 per cent.

- Likewise, the copper production from Nova slipped by ~ 15.16 per cent during the same period; however, the quarterly addition of 3,210 tonnes, took the yearly production to 13,772 tonnes, exceeding the upper range by ~ 10.17 per cent of the FY2020 guidance of 11,000 to 12,500 tonnes.

- The gold production for the quarter from Tropicana took a slight hit of ~ 1.78 per cent to stand at 102,007 ounces.

- However, the yearly production meets the FY2020 guidance of 450,000 to 500,000 ounces to stand at 463,118 ounces.

- Tropicana operations witnessed an increase in the all-in sustaining cost with the AISC increasing by ~10.51 per cent for the June 2020 quarter at $1,440 per ounce.

Nova and Tropicana Production Summary (Source: Company’s Report)

Nova and Tropicana June 2020 Quarterly Performance

Nova Operations

- On the production and processing counter, Nova plant milled 381,000 tonnes of ore, which remained unchanged as compared to the previous quarter, at an average nickel and copper grade of 2.17 per cent and 0.90 per cent, respectively.

- The recovery rate for nickel also remained largely unchanged against the previous quarter at 86.9 per cent despite the lower head grade while the copper recovery rate witnessed a slight decline against the previous quarter at 88.0 per cent.

- On the development counter, the underground development advance totalled 620m for the period, taking the total development for FY2020 to 2,951m.

- IGO mined a total of 393,000 tonnes of ore during the quarter, which remained up by ~ 8.26 per cent against the previous quarter.

On the financial performance front, Nova’s quarterly revenue surged by ~ 37.04 per cent at $159.8 million, driven by higher volumes sold and higher assumed quotational period metal prices.

- Payable volumes for nickel, copper, and cobalt surged by 13 per cent, 35 per cent, and 38 per cent, respectively.

- The average nickel price from Nova for the quarter surged by 3.93 per cent at $18,984 a tonne, resulting in a 4.4 million favourable price variance.

- The higher realised price for other metals along with nickel and higher sales volume further translated into strong financial performance with the underlying EBITDA surging by 34 per cent at $82.8 million, representing an EBITDA margin of 52 per cent.

Tropicana Operations

- On the production and processing front, IGO milled 2.1 million tonnes of ore during the period at an average grade of 1.66g/t of gold.

- The recovery rate for metallurgical gold stood at 90.6 per cent to mark a quarterly production of 102,007 ounces on a 100 per cent basis.

- On the mining front, the total open-pit material mined during the quarter declined slightly against the previous quarter at 7.9M bank cubic meters.

The fall in production further resulted in a decline in financial numbers for the quarter, with the total revenue from Tropicana taking a hit of ~ 5.58 per cent at $65.9 million.

The decline in the revenue was primarily driven by a lower ounces sold for the quarter at 30,617 ounces; however, a higher average realised price on gold partially offset the impact of the fall in the production.

The stock of the Company last traded at $4.630 (as on 31 July 2020 2:36 PM AEST), down by 1 per cent against its previous close on ASX.