Highlights

- Company has received firm commitments to raise a total of approximately AU$5 million (equity and convertible loan)

- RRR intends to use the proceeds for diamond drilling and other works at its copper exploration projects

- Drilling of first targets at Osprey and Dianne (both related to copper) is expected to start in June this year

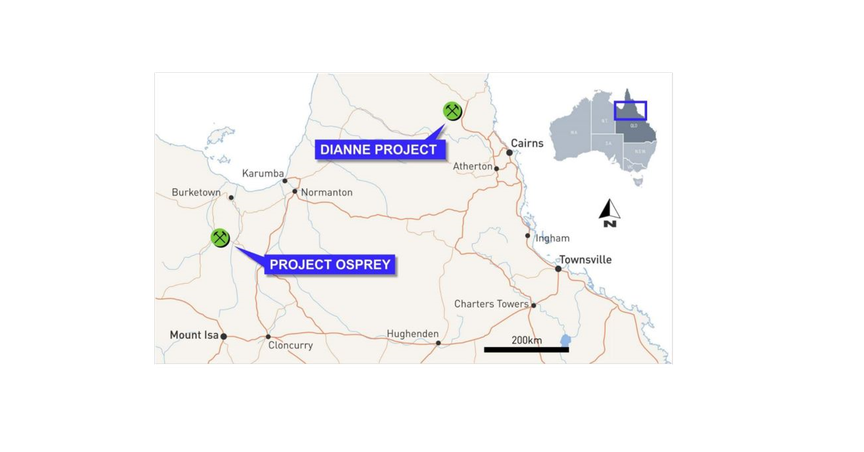

Natural resources focused public company Revolver Resources (ASX: RRR) -- with near term focus on copper (Dianne Project, and Osprey Project) -- has announced that the capital raising event for AU$5 million has been successful, with robust demand from Revolver’s new and existing institutional and sophisticated investors. RRR received a cornerstone commitment of AU$650,000 from its Board members and other related parties.

Revolver Resources has stated that it would use the proceeds for diamond drilling and other activities at the Osprey Project, Heli-gravity survey and diamond drilling at the Dianne Project, besides other working capital expenses. RRR shares last traded at AU$0.165 on 2 May 2023.

Source: RRR ASX announcement dated 2 May 2023

More details

Both the equity placement part and the convertible loan facility part of the total AU$5 million fund raising by Revolver Resources have been successful. As part of the equity placement, the company raised ~AU$2 million (before costs) with issue of ~15.69 million new shares (fully paid) at the issue price of AU$0.13 apiece.

The Placement saw (where subscribers also receive one unlisted option for every two new shares with a term of 36 months and strike price AU$0.20 per share) strong response, with RRR's Board members and related parties making a cornerstone commitment of AU$650,000. The first tranche of Placement (AU$1.39 million) is expected to settle on 4 May 2023, with issuance and start of trading on 5 May 2023.

The second tranche (AU$0.65 million) relates to subscription by RRR Directors and related parties, and shareholder approval is planned to be sought by Revolver at its General Meeting in June this year.

With respect to the convertible loan facility, a binding term sheet is executed with Kamjoh Pty Ltd, an existing shareholder but not a related party. The facility is unsecured and has a term of three years, with money drawable in tranches of AU$500,000. The arrangement with Kamjoh comes with a 7.5% interest rate p.a. (only on the drawn balance, with interest capitalising). Revolver also solely holds the conversion right at an agreedprice of AU$0.20 per share.

Statement from Mr Pat Williams

The Managing Director of Revolver has acknowledged the strong response and welcomed new sophisticated investors. He commented that new funding provides immediate liquidity to Revolver to accelerate its drilling activity plans at Osprey and Dianne copper projects. Mr Williams also informed that the focus of company’s drilling campaign would be on high-priority, high-potential targets.